Deep Dive - Lotus Bakeries

Discovering the fortune cookie - a prime example of reliable compounding

Part I. Introduction

Chances are you’re already familiar with the world’s third best-selling cookie (only behind Chips Ahoy! and Oreo). It’s called Biscoff.

Exhibit I

Following several successful partnerships with for instance airlines and large multinational confectionary companies (e.g. Cadbury, Côte d’Or), brand awareness has continued to grow.

Surprisingly, few people know the manufacturer behind Biscoff is a publicly-listed Belgian company: the family-controlled Lotus Bakeries (or in short, referred to as LOTB (its ticker)). We’re a very frequent consumer of its products (perfect excuse after an intense daily workout): the traditional cookies, the Biscoff spread, the Biscoff ice, the healthy Nakd snacks…

As a shareholder, you can take home Lotus products at the Annual General Meeting. It's a great opportunity to invest in a company whose products you enjoy as a loyal customer.

For those who’re already familiar with this name, it goes without saying that Lotus Bakeries’ stock return has shot out the lights over the past years and decades. It’s achieved the 100-bagger status as this company has been run by a management team that’s not focused on perfecting next quarter’s profitability or providing short-term guidance, but driving long-term value creation instead.

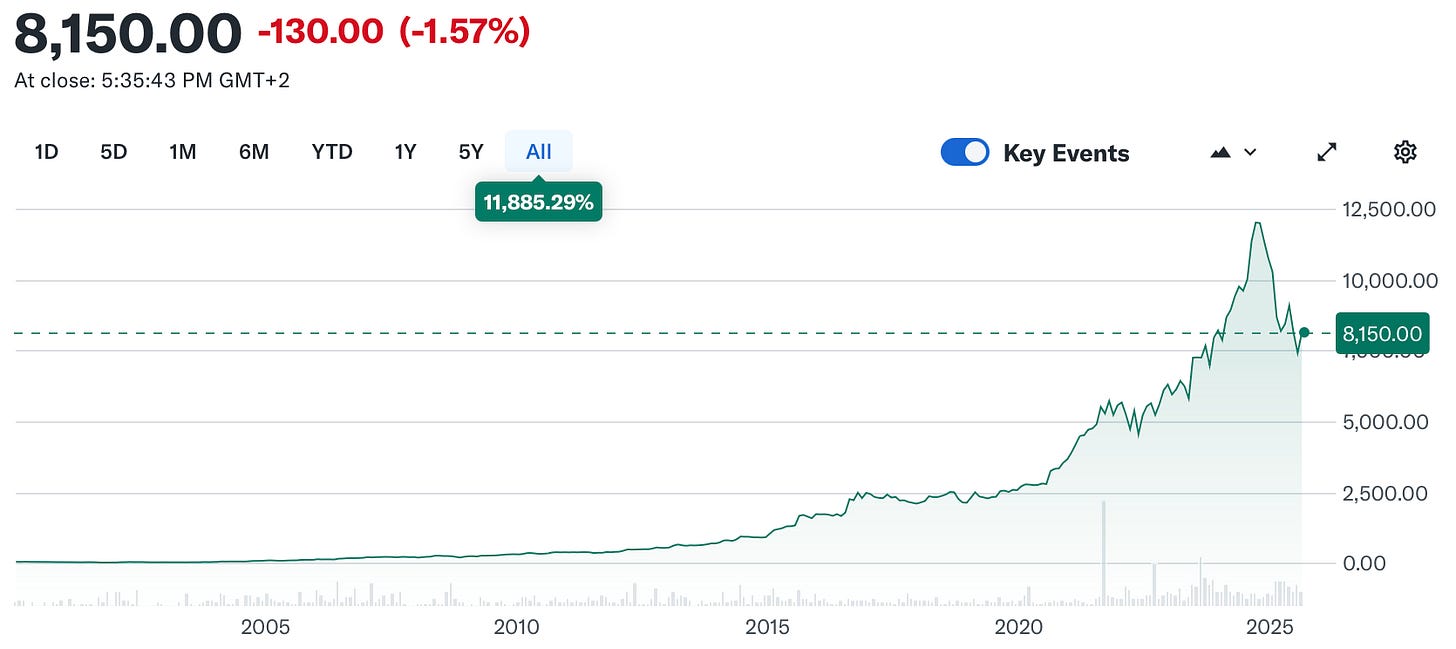

Exhibit II - Yahoo Finance

While many would sign up for that 25% total CAGR since September 2001, earning that kind of return required significant time and patience. We used to own Lotus in the past for a relatively short period of time as well, but we sold it in 2015 after a quick gain. What a mistake that was!

The reason why it was an error? Historically, it’s rarely (not always) been a good idea to sell truly winning companies that operate a tangible business model. Most multi-baggers have been fairly boring, and thus easier to spot.

Think of your consumer goods, industrial, medical equipment and devices companies; these sectors have been great places to fish for attractive stock returns. Solid returns on capital, attractive and secular growth, unique products/brands that customers/clients stick to, a long-lasting reinvestment opportunity, and strong balance sheets (high return companies don’t need leverage to grow, and that’s enormously convenient). When they’re run by a management team that’s incentivized to do the things right, you should be served well as a shareholder.

If you’ve got high returns on capital and solid profitability - and you’ve been achieving them for a long time (not by accident) - you’re able to spend more on new exciting products, marketing & sales, and sharing that success with your customers (known as being priced right for the value you provide). A perfect example would be reinvesting your productivity gains into new product development or supporting your sales teams to enter new geographies.

Yet, even with the benefit of hindsight, it’s not easy to hold onto a boring multi-bagger for so long, as addressed in a previous blog.

While many skeptics have pointed out that Lotus Bakeries’ share price has enjoyed a notable rerating (multiple expansion), the reality is that solid organic revenue growth, selective acquisitions, margin expansion, and attractive returns on capital with low maintenance CAPEX have been far more relevant (as it should be) and provided a structural platform to create shareholder value.

We’re not suggesting here that the valuation isn’t important, but the limit as ti how much you can pay up for really good businesses is a lot higher than what people realize.

Until very recently, Lotus Bakeries’ share price trajectory was very smooth with some blips that were being bought instantaneously. However, as we stated previously: we’re talking about businesses here and not sheets of paper.

At any given moment, the share price reflects investor expectations, which should be based on factual information (although it’s not always true from a short- to medium-term perspective). Zooming out, despite continuous sales and profit growth, drawdowns of 15% ore more have been quite frequent.

Exhibit III - Lotus Bakeries drawdowns - Finchat

Late October 2024, we estimate that the stock was trading at a forward 10-year CAGR of about 2% (nominal and based on a 20x steady-state NOPAT multiple). It’s also true that Lotus shares have commanded a premium valuation over the past years, but it had never been that excessive. Even if you’d taken a 25x multiple, it was barely exciting.

However, the pace at which the multiple has since derated is quite unprecedented for a household name such as Lotus, revealing that 1) nothing is certain, and 2) a low free float amplifies drawdowns. When you look back at several compounders, they’ve all had massive drawdowns or dead-money periods which makes you wonder: could I’ve held onto them for several years?

In this new in-depth write-up, we’ll break down Lotus Bakeries’ long-term success, past and future capital allocation priorities, and specifically its return on incremental invested capital and the moving pieces around its growth CAPEX. Finally, we’ll go over our valuation model, and other factors to take home as there’s a great deal to learn from this steady compounder. Unsurprisingly, it’s got many parallels with some of our portfolio companies.

Part II. Executive Summary

Someone once said that the best ideas are the ones that stuck out to you right away, and that the thickness of the research file didn’t add up with the quality of the investment idea. So, below you can find a very brief summary of the key pillars of the Lotus Bakeries investment case.