Executive summary

As we speak, there’s a lot of noise surrounding the outlook for luxury companies, as we’ve now fully lapped the post-COVID tailwinds. We reiterate our long-term stance: investors should make a clear distinction between “aspirational luxury” and “true luxury”.

One of the most attractive areas for getting exposure to long-lasting luxury is the high-end yachting segment. The Italy-based Sanlorenzo (SL), the world’s leading monobrand luxury yacht manufacturer, has clearly delivered on - or better: far exceeded - its 2019 IPO promises.

Since December 2019, it’s delivered a 25.9% total shareholder CAGR, leading to a market cap of close to 1.5 billion EUR. Nonetheless, SL’s valuation multiple has derated notably over the last two and a half years, despite ever-increasing margins, ROIC, and net financial position.

Exhibit I (source: The Compounding Tortoise)

Its strategy is built to last and encompasses the following four key pillars:

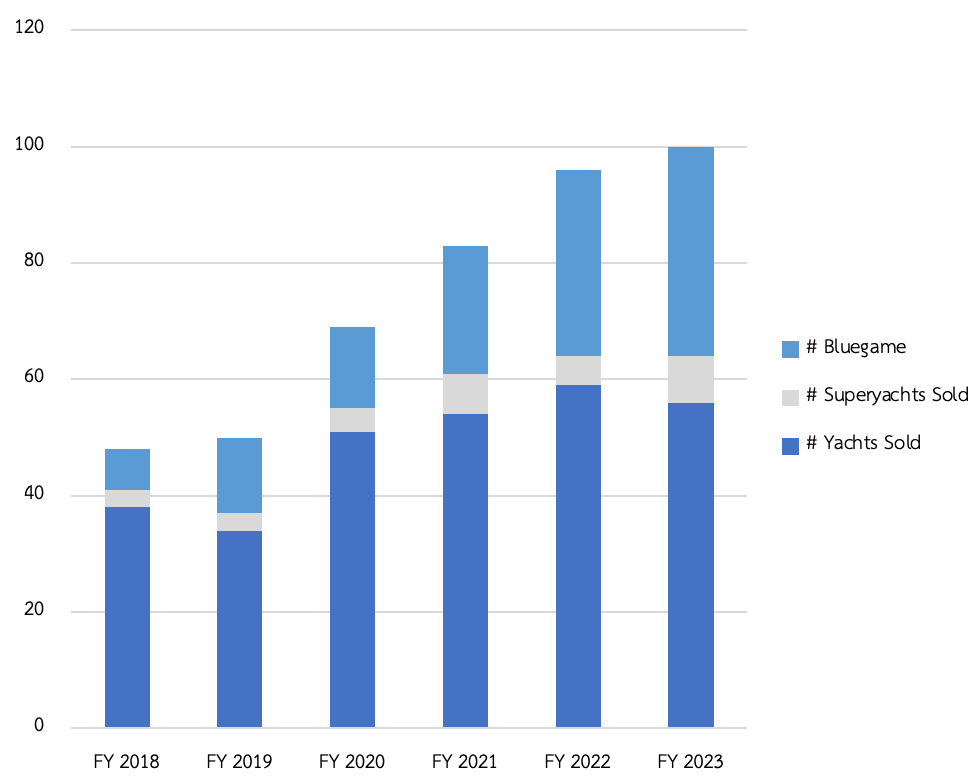

Exclusivity, with a limited number of yachts produced each year and for each segment. SL is laser-focused on profitability, not on mass-production that could dilute its brand equity. SL currently serves its customers through Bluegame (13-23 meter, manufactured in the Ameglia shipyard), Yacht (24-40 meter, constructed in Ameglia, Viareggio, and Massa), and Superyacht (40-73 meter with production in La Spezia). Exhibit II breaks down the number of units sold in each division.

Exhibit II (source: The Compounding Tortoise)

Keeping made-to-measure tradition intact. SL’s high level of customization of interior and exterior accessories and technology, not only for yachts over 40m, but also for yachts between 24m and 40m, sets it apart from the rest of the luxury sailing world. Even for its smaller sport utility models, the backlog visibility remains unparalled, highlighting the strong appeal to a variety of customers.

Expanding into adjacent areas, while sticking to its monobrand strategy for the core “Yacht” and “Superyacht” segment. In 2018, it acquired Bluegame, thereby entering the composite sport utility yacht segment. Last year, it signed a memorandum of understanding with Nautor Swan, which is positioned at the high-end of sailing yachting. Searching for unique satellite brands to tap more potential clients will broaden the income streams.

Being at the forefront of sustainability. In fact, just recently, SL presented the 50Steel, which is the world's first Superyacht to be accommodated with the modular Reformer - Fuel Cell system, developed in collaboration with Siemens Energy. This piece of innovation will transform green methanol into hydrogen and then into electrical energy to support the yacht’s hotel systems (without the need of storing hydrogen on board).

Exhibit III (source: Lengers)

As we summarize the investment case for SL, the expected return potential will be driven by:

high single-digit CAGR for “Shipbuilding” revenues, i.e. net revenue new yachts (NRNY);

progressive increase of profitability, albeit at a slower pace than over the past years due to a mix shift towards larger yachts that typically boast lower margins than SL’s legacy “Yachts”;

capital-light business model with negative working capital, and the untapped capacity that stems from previously executed growth CAPEX yet to be fully utilized;

flexible cost structure with roughly 20% of total costs being fixed;

optionality to enter “Refit” which is characterized by larger upfront CAPEX but with above-average margins (both in terms of EBITDA as well as underlying/recurring maintenance-based NOPAT);

strong net financial position that is yielding higher interest income. Quite ironically, that income alone could easily cover some M&A to further vertically integrate its suppliers;

rigorous dividend policy, given that in a steady-state, SL is flush with cash (>140m EUR annual FCF generation by FY27);

current >55% ROIC and >30% ROIIC, which demonstrate the intrinsic CAPEX efficiency and elevated economic profit generation (even when accounting for the portion of outsourcing (e.g. naval carpentry services, turnkey furnishings, typically 33% of total NRNY));

prudent capital allocation, under the stewardship of CEO and majority shareholder Massimo Perotti (now owning >60% of total float);

a potential re-rating towards the multiples it traded at in December 2019 (IPO)

We’ll cover the following topics:

Track record - a rich corporate history

Recent financial performance

Backlog post-COVID-19

Industry backdrop and SL’s positioning

Cash flow performance and capital allocation

Recent cash performance

Base valuation model

Risks and uncertainties

Without further ado, let’s weigh anchor!

Track record - a rich corporate history

SL’s roots can be traced back to 1958, when Italian yacht builder Giovanni Jannetti established the Cantiere Navali San Lorenzo shipyard in Viareggio. Over the course of 50 years, the company has built a strong reputation for top-notch quality, dependability, and enduring sophistication.

The shipyard debuted the SL57 model in 1985, which was its first fiberglass yacht. Larger composite models were introduced in the ensuing years, until Sanlorenzo made its debut in the superyacht market in 1995 with the introduction of the first 30-meter SL100.

In 2005, Sanlorenzo reached a significant milestone when Massimo Perotti (the current CEO and chairman) acquired a majority shareholding from Janetti, marking a change in ownership. Under Perotti’s stewardship, the company navigated through the challenges of the Financial Crisis and experienced significant growth. The growth has been remarkable and consistent compared to some of its larger direct peers, and shows no signs of slowing down.

Exhibit IV (source: Sanlorenzo presentation)

It’s clear that mr. Perotti truly lives and breathes Sanlorenzo:

I always try to remember Janetti’s way of doing business, and that’s a key-point in the heart of Sanlorenzo's branding. I learnt from Jannetti the philosophy “tradition and innovation” and I improved the product by technical innovation and design, always without forgetting the tradition of the brand throughout the years.