How to Construct an All-Weather Quality Stock Portfolio

Putting absolute return goals first and defining your circle of competence

Occasionally, we’ll write an article to highlight items/concepts that haven’t yet been shared in a previous substack post, or have already been discussed but deserve more attention. So bear with us on the following topics for just a moment:

Why we shouldn’t be focused on relative performance

How to construct a quality growth portfolio (aka what could a new subscriber do?)

Staying within our circle of competence

1/ Why we shouldn’t be focused on relative performance

Naturally, human beings want to compare themselves to others. In the world of finance, it’s killing to think you can always beat the market and, in most cases, the market index won’t serve as a good comparator to your individually selected stock portfolio. Suppose the index is down 40%, does outperforming it by 5% make you feel happier? Conversely, will you be disappointed when the market was up 20% and your strategy delivered the targeted 12%?

Also, to beat the market by a very wide margin or to strive for lottery ticket returns, investors turn to more risk-taking (high beta) which does not correspond with a linear return relationship. Taking on excessive risks isn’t priced efficiently. In other words, you could end up feeling lucky with a few high beta stocks, but a whole collection of risky assets will demolish your risk-adjusted performance.

Our excellent “Compounding Tortoises” are characterized by a rinse-and-repeat approach to creating true shareholder value (reinvestment rate, ROIC, balance sheet strength, share repurchases/dividends). In most cases, annual NOPAT growth has remained quite steady for the past decade(s): predictability is at the core of compounding wealth. Warren Buffett once said: "The stock market is a device for transferring money from the impatient to the patient". That’s how you should think about our portfolio strategy, portfolio holdings and our substack: thorough analysis on what will be relevant to our long-term performance.

Still, annual returns will wildly differ from your longer-term CAGR objective. By overthinking/fearing multiple contraction or expansion, changing growth dynamics (every company, even one with an impregnable moat, is cyclical to some extent) et cetera you’ll lose sight of the overall long-term targets which, in the end, are backed by the core principles of shareholder value creation.

Therefore, we must accept volatility (distinct underlying returns from sentiment and hype) and the uncertain short-to-medium term outcomes. Outperforming your initial expectations when it’s driven solely by multiple expansion and thus timing: don’t become complacent about your investment skills.

In M&A, there’s oftentimes a desperate quest for synergies to get an immediate IRR kicker. Fredrik Karlsson, the former CEO of Lifco and current CEO of Röko, clearly stated that good serial acquirers don’t need to look for synergies. They typically buy already established capital-light businesses with competitive advantages, strong cash flow.

2/ Staying within our circle of competence

It’s striking to see how some investors are always looking for new ideas, sometimes outside of their circle of competence. Our core portfolio is in fact our investable universe and we’re more than happy with what we own.

Weighted average return on capital on organic growth: >40% (after tax)

Weighted average return on total invested capital (incl. M&A): 20-25% (after tax)

Weighted re-investment rate: >50% of NOPAT

Weighted dividend payout: approximately 26% of NOPAT

Weighted buybacks: approximately 9% of NOPAT

Weighted average EV/NOPAT (2024): 25x

We don’t need to be on the lookout for new ideas and it would be irresponsible to analyze and discuss companies we don’t fully understand (artificial intelligence, the next Big Thing, biotech, REITs).

What do reliable quality growth compounders have in common? Great management teams and corporate culture. If you don't trust the people, don't do the deal (i.e. don't put your nest egg into their stock). We frequently give a shout-out to Linde's CEO Lamba and CFO White. Why? Because their consistent approach to delivering above-average shareholder value creation is a million miles ahead of their nearest competitors. A few quotes from the latest conference call

Numbers do not lie - During good years and bad, Linde consistently outperformed the benchmarks to reward our owners. The performance culture and the corresponding compensation programs at Linde are designed to optimize these four metrics at all levels of the organization. Year after year, we’ve proven how we positively correlate to superior TSR and positive outcomes, two important ways to gauge shareholder value creation. Because of this, I remain confident in our ability to continue creating long-term shareholder value regardless of the economy.

The whole risk-return picture, that's what we should care about - Investing in the business is much more than just a dollar number. One of the most important responsibilities of management is to ensure capital is invested for an appropriate risk weighted return.

Conservatism: over-deliver and under-promise - Heroes aren’t made in February. So we believe it’s appropriate to remain cautious that’s early in the year. However, regardless of what 2024 brings, investors can rest assured that we will manage what matters most to create shareholder value.

Striking a balance between ROIC and reinvestment opportunities - We believe that maintaining an industry-leading and healthy ROC and operating margin while growing EPS, while growing OCF (operational cash flow) is the best combination for shareholder value creation and ultimately, relative TSR outperformance.

3/ How to construct a quality growth portfolio

Our portfolio currently consists of 13 names with the largest holdings now looking unattractive from a relative valuation perspective, at least based on our own base case assumptions (which others may deem as too conservative). So how about building a quality growth portfolio from scratch? Let’s just share what we do (as always, it’s not an imperative approach).

First, we have a decent cash position to take advantage of opportunities whenever we spot them. Life is full of surprises (e.g. something really bad can happen to one’s health resulting in rising medical costs, or even buying a (new) house (downpayment)). Margin of safety does apply not only to investing but to life in general.

Second, our existing portfolio is our base collection of great compounders from which we don’t want to withdraw any funds over the next decade(s). We continue to plan on writing one deep dive per month (Hermès is up next). The deep dives are in fact our library on the best “Compounding Tortoises”. It takes several weeks to dig deep into every investment case (contextualizing financial numbers to model growth expectations, identifying a potentially mispriced long-term risk-reward opportunity). You can (re-)read our first deep dive on Topicus.com (up 19% since the publication). We pay little attention to such a sharp move in such a short period of time. Again, we have a specific annual target (>12%) in mind and ignore short-term fluctuations.

Deep Dive - Topicus.com (TOI.V)

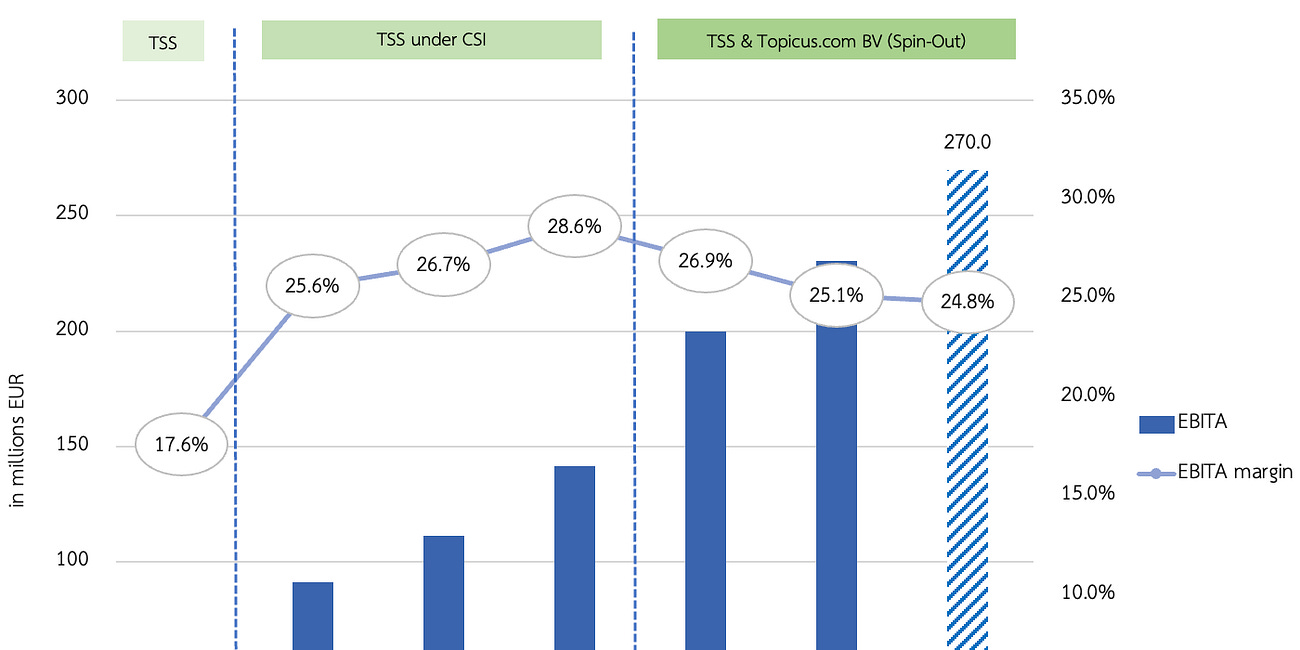

Summary On January 5th, 2021 Constellation Software (CSI) concluded the spin-out of Topicus.com (or Topicus/TOI). TOI’s main subsidiary is Topicus Coop, which fully consolidates TSS and Topicus.com BV, along with other entities such as Sygnity and GeoSoftware.

Our largest holdings have become even larger (their relative weightings went up) due to multiple expansion and above all stronger than expected NOPAT/cash flow growth (combination of improving ROIC and reinvestment rates). It would be very tempting to sell out, look for new opportunities or add to existing positions that have incredibly attractive IRRs.

Let’s stop there for a minute: finding new opportunities and building sufficient comfort level in their investment cases (talking to the management teams if possible (smaller-sized companies)) is very time-consuming and could be risky (buying too fast). Most of the time it’s better to buy more of the high-quality stuff you already own without becoming over-confident about the projected base case IRRs. We’re not going to lift our return objective on these more expensive stocks as that would imply us becoming less stringent in the analysis process.