Incentive Programs - Preserving the Compounding Flywheel or Destroying It?

Charlie Munger: "Show me the incentive and I'll show you the outcome"

As investors, we’re putting our faith and hard-earned money into businesses that are run by what we believe to be great people (from the CEO down to the blue-collar workers). There has to be a unique culture that makes sure the longevity and compounding flywheel stay intact for decades to come.

But how do we know managers themselves are keeping the eye on the ball to make sure shareholders’ capital is invested at attractive risk-weighted returns?

Incentive programs will offer some crucial insights into whether the executives do understand the long-term drivers of shareholder value creation. These are oftentimes described in the company’s filed proxy statement/annual reports. Simply stated, we don’t want to see lavish plans that please greedy managers and are based on criteria that do not align with the proven drivers of shareholder value creation.

Let’s look at four great compounders that merit your attention.

1/ Constellation Software

Constellation is a highly meritocratic organization that rewards dedicated employees. In 2015, over 100 employees had more than $1 million in company stock. The company's employee bonus plan requires all employees who reach a compensation threshold to invest a portion of that compensation in Constellation shares, which vest over four years.

Between 25% and 75% of an employee's after-tax bonus must be invested in Constellation shares. In this way, remuneration is linked to the performance of the individual and the operating group, while wealth is largely tied to the success of the organization. Today, insiders hold almost 1.5 million of Constellation's 21 million shares. This pay-for-performance culture is attractive to many of Constellation's potential targets.

Constellation is one of very few companies that so far hasn’t implemented the share-based compensation tactic and for good reason: transparent accounting.

We designed our plan so that the full expense of any compensation flows through the P&L. We don't like stock options as the P&L impact is not reflective of what the true expenses are. We also want people focused long term. We don't want employees focused on driving up the price of the stock so that options can be in the money.

We pay bonuses based on growth and return on invested capital, but there's a large component that gets withheld. We take that cash and we buy shares in the open market in an employee’s name and he or she is restricted from selling the shares for an average of 4 years. We have 6,000 - 7,000 employee shareholders now so we still have the benefit of employees being actual shareholders. - CFO Baksh

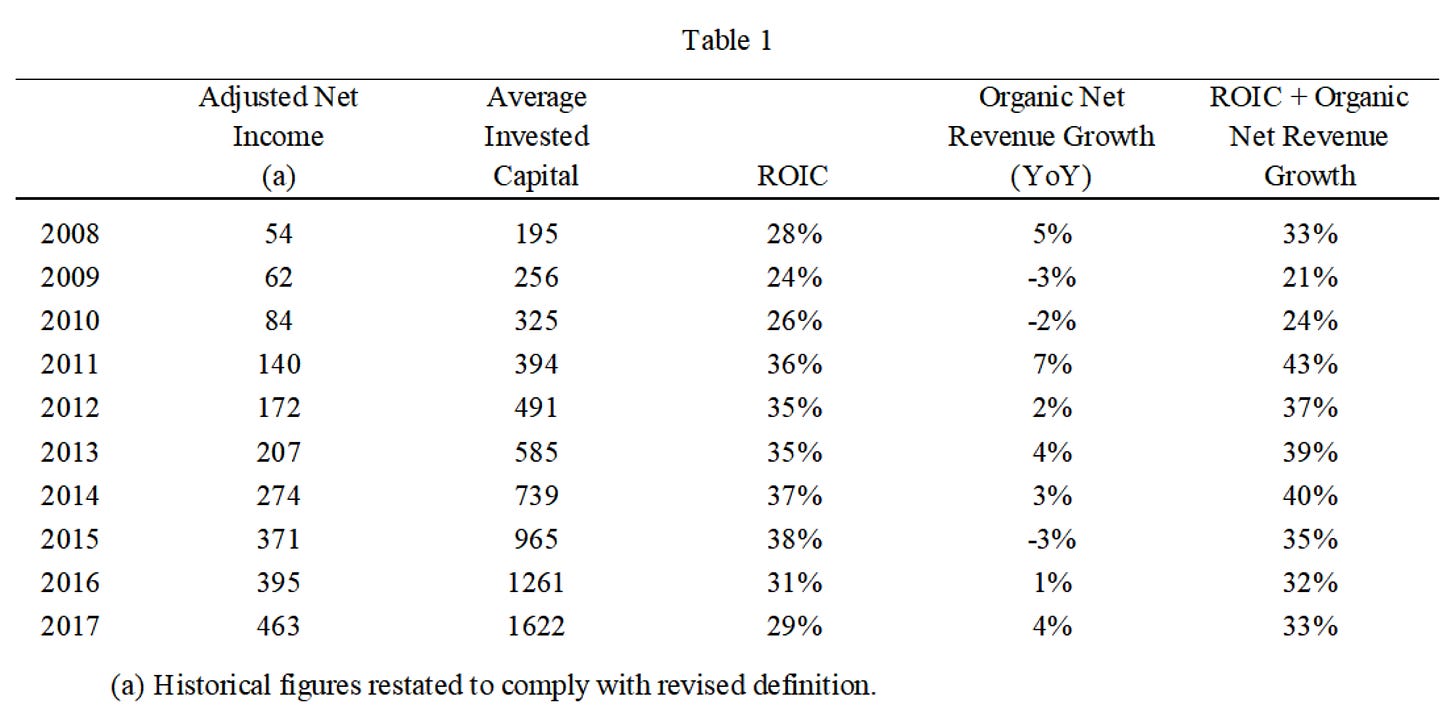

ROIC and growth. In order to achieve that growth, you have to make acquisitions and generate good returns on R&D to drive organic growth. ROIC is a pure non-levered metric that’s difficult to manipulate (especially now that right-of-use assets are shown on the balance sheet). Sustaining both ROIC and growth at industry-leading levels is what keeps the compounding flywheel going.

Constellation Software

And it’s worked out quite well (to say the least). Not the mention the additional returns coming from the post spin-off performance for Topicus and Lumine.

Finchat

Let’s quickly move on and look at the other three.