Key Lessons from Chuck Akre

On "never sell excellent businesses" and "management integrity"

Following our January article on 12 no-nonsense lessons from Mark Leonard, we’d like to present the key takeaways from Chuck Akre’s investment experience.

Three-Legged Stool

It’s thanks to his Fund that we’ve learned about the existence of O’Reilly Automotive and other steady winners that have surprised positively over many years. Chuck Akre's investment philosophy centers on identifying businesses with high potential for compounding returns over long periods, underpinned by his renowned "three-legged stool" framework.

This philosophy is simple but deeply effective, as it seeks businesses with three main characteristics:

Exceptional Business Models: Akre looks for companies with high returns on equity or capital, driven by a sustainable competitive advantage. This allows businesses to thrive in various economic environments.

Talented and Honest Management: Akre emphasizes the importance of management teams that are not only skilled but also align with shareholder interests, reinvesting profits wisely rather than prioritizing short-term goals.

Strong Reinvestment Capabilities: The final "leg" is a company's ability to reinvest its profits back into its business at high rates of return. This leads to compounding growth, a core aspect of Akre's long-term success. He frequently refers to these companies as "compounding machines", capable of delivering sustained performance over time.

If we buy companies in which shareholders’ capital compounds at a 20% rate of return over a reasonable time period and we pay a below-average multiple for it, our investors will do extremely well. - Chuck Akre

Akre's investment philosophy evolved through his career, drawing inspiration from Warren Buffett and other long-term investors. Unlike traditional value investors who focus on buying cheap assets, Akre concentrates on quality businesses with attractive reinvestment opportunities, even if they come with higher valuations. His approach underscores patience, often holding positions for many years to allow compounding to play out fully.

His US portfolio looks like this.

Our focus remains entirely on the long-term prospects of the businesses we own. Our simple view is that we will be successful (1) if the businesses we own are successful, and (2) if we do not overpay when buying shares of these businesses. - Chuck Akre

In his most recent interviews and annual letters, Akre discusses the importance of staying focused on long-term value creation, especially in volatile markets. He warns against reacting to short-term earnings misses or macroeconomic factors, reiterating that patience and discipline are vital in compounding wealth. He also highlights red flags when evaluating companies, such as those that erode shareholder value gradually but significantly.

Akre Capital Management's annual letters often emphasize these core principles, showcasing their enduring belief in finding businesses that can compound over decades, rather than chasing short-term trends.

Number one is, when we find really good ones our experience has been it’s been a mistake to sell them even at very high valuations, you just live through it. And then at the first part the atmosphere of the cost of money at large in the world affects the valuation you can pay. - Chuck Akre

Building Your Own Three-Legged Stool

We pay tribute to Chuck Akre’s three-legged school and have shared some mind map-type slides during our previous bi-weekly webinars. It’s crucial to develop your own strategy, skill set, circle of competence (you’re not forced to invest in all kinds of sectors).

Going back to basics and yet focusing on the best-of-breed companies, reading through the annual reports, understanding the accounting methods, modeling future growth, assessing business quality…

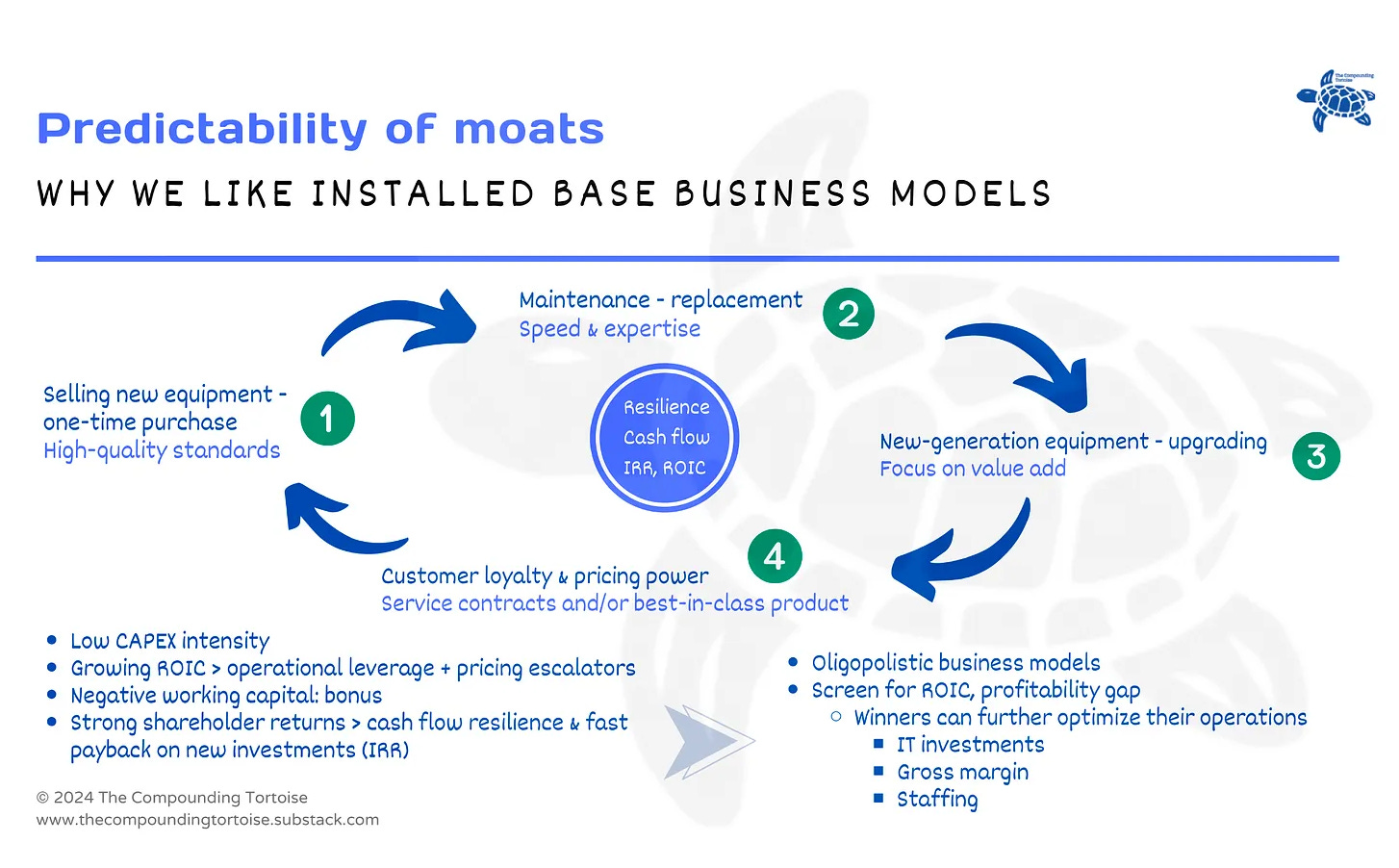

When we wrote the deep dive on Otis Elevators, we’ve summarized the installed base business model. The simpler you can present the long-term drivers of compounding, the easier it will be to ride that long-term compounding.

We don’t have sell targets on anything we own. One of the hardest things for an investor is to manage the temptation to sell a business when the stock has gone up a lot or when it’s having a lull in its performance. It’s maybe particularly hard when you come from the sell side, as I did, where it’s always been and remains to be about creating transactions. I don’t care about transactions and want to have as few as possible. I like to point out that if you have an investment that has gone up 50 times, the next time it doubles it’s now up 100 times. Compound return is staggeringly powerful. I have some investments personally that are up 200,000%, and I still own them. - Chuck Akre

Maximizing Safe Compounding - Here’s How

What we appreciate most about Akre (and his Partners) is his common-sense approach on staying rational about new trends that seem to deliver parabolic returns, as outlined in Akre Capital Management’s recent quarterly letter on the outperformance of AI stocks.

We’re on the same page and don’t take recent returns as a proxy for true shareholder value creation. Distinct market sentiment and relative under- or outperformance from your companies’ true financial strength and compounding.

So, what are the fundamental drivers behind our three-legged stool?

1/ Business Quality

Rather than saying: look for high-ROIC companies and you’ll be fine, we argue that there’s a lot of hidden value in picking those that have a strong ROIC (our hurdle is >25%) and whose competition does not. When you’re able to achieve an ROIC that’s double or even triple your next close-in competitor’s, you’re doing something special: you possess some unique characteristics that will enable you to accelerate shareholder value creation when reinvesting cash flows back into the business.

As we look at our portfolio, our companies really stand out in what many would perceive to be boring industries. Sustaining that high ROIC while reinvesting for future growth is what creates a barrier that’s very difficult to overcome for new market entrants. A low ROIC for the existing business, a very low and cyclical ROIIC: they aren’t likely to incentivize your competitors to making aggressive investments (to take market share away or slow your market share gains).

High return businesses have something special which allows them to earn above average rates on employed capital. That may be intellectual property, scale economies, a regulatory advantage, high customer switching costs, or some sort of network effect. We want to see evidence the business model produces unusual returns, to understand why and to believe that’s likely to continue. Part of that is a function of the opportunity yet to be realized – we’re always asking, 'How wide and how long is the runway?’ Chuck Akre

2/ Return on Invested Capital & Return on Incremental Invested Capital

Break down all financials, and dissect the returns on organic growth, M&A, pricing tailwinds, accounting impacts from depreciation of very durable assets that don’t need much maintenance (production plants). This is what we’ve highlighted in yesterday’s weekly digest. As always, there’s not one perfect ROIC and ROIIC: it’s about understanding the nuances and making reasonable growth assumptions (and the related cash outlays to achieve x percent growth).

ROIIC and ROIC are just two metrics that take recurring NOPAT and invested capital (in our view, it should be gross capital to reflect the return on all investment decisions regardless of how much they’ve been depreciated; watch out for M&A and specific goodwill, earn-out and put/call accounting). We want our companies to make investments that will quickly contribute to NOPAT and whose contribution will last for a very long time. In other words, a high IRR on all investment decisions, past, present and future. Reality is that very few companies earn a satisfying return on every investment they make, so the weighted IRR is what counts.

3/ Management

On the management team theme, we’ve frequently referenced to Linde’s CEO Sanjiv Lamba and CFO Matt White. Being explicit about ROC and cash flow efficiency is what sets Linde's management team apart from the rest of the industry. Here are a few quotes, with many more in our deep dive and earnings recaps.

During uncertain times like today, shareholders want to sleep well at night knowing their investment is safe in management's hands, which is further supported on Slide 5. Proper capital management and quality cash generation have always been at the core of our operating rhythm. We've been following the same capital allocation policy for decades. It starts with generating true operating cash flow, because contrary to what some might think working capital does matter.

While our mandate is to maintain an A credit rating and grow the dividend, the priority for our capital is to invest into the business. This follows our time-tested investment criteria, which has enabled Linde to consistently achieve industry-leading ROC year-after-year. After investing into the business, surplus cash is used for share repurchases. Having a strong balance sheet, stable cash generation and an active stock repurchase program enables value-creating opportunities during turbulent markets. In fact, our best stock repurchases happened when equity markets overreact.

This is why we recently announced a new $15 billion stock repurchase program, allowing us to optimize our excess free cash flow and robust balance sheet. We'll continue to take advantage of stock market dislocations and return capital to our owners in a tax-efficient manner. - CFO Matt White during Q3 2023 conference call

But what if one of our great managers gets hit by the proverbial bus? We want to be sure that the organization’s success isn’t jeopardized by such event. Stated differently, every manager, blue collar, white collar worker should contribute to that high-quality longevity.

Based on all of the above, Compounding Tortoises are difficult to spot. 🐢🐢🐢

Cheers!

I love that, thanks!