Long Live Relative Underperformance

Taking advantage of dead-money periods

As the end of Q3 is near, we’ve started writing our Quarterly Letter and assessing the drivers our long-term performance:

High returns on incremental invested capital and a solid reinvestment rate;

Low- to mid-teens percent CAGR in NOPAT per share (or EBITA to make make apples-to-apples comparisons on changing tax regimes);

Buying more of our top names as aggressively as possible during stagnant periods or market drawdowns. And, we’re ready to now buy more every two weeks for the next few quarters; just dollar-cost averaging in our top names at what we believe to be attractive forward returns. In fact, we’ll be executing new purchases later today.

Looking at year-to-date performance, portfolio-weighted growth in EBITA per share has been >13% at constant FX, very close to last year and overall target.

From this perspective, it’s been boringly exciting: repeatable growth, stable and relatively reasonable valuations (if you’re playing the longer-term game). Yet, stock prices have been surprisingly volatile. That’s good, especially as increasingly more investors start to question why they’re sticking to “laggards”.

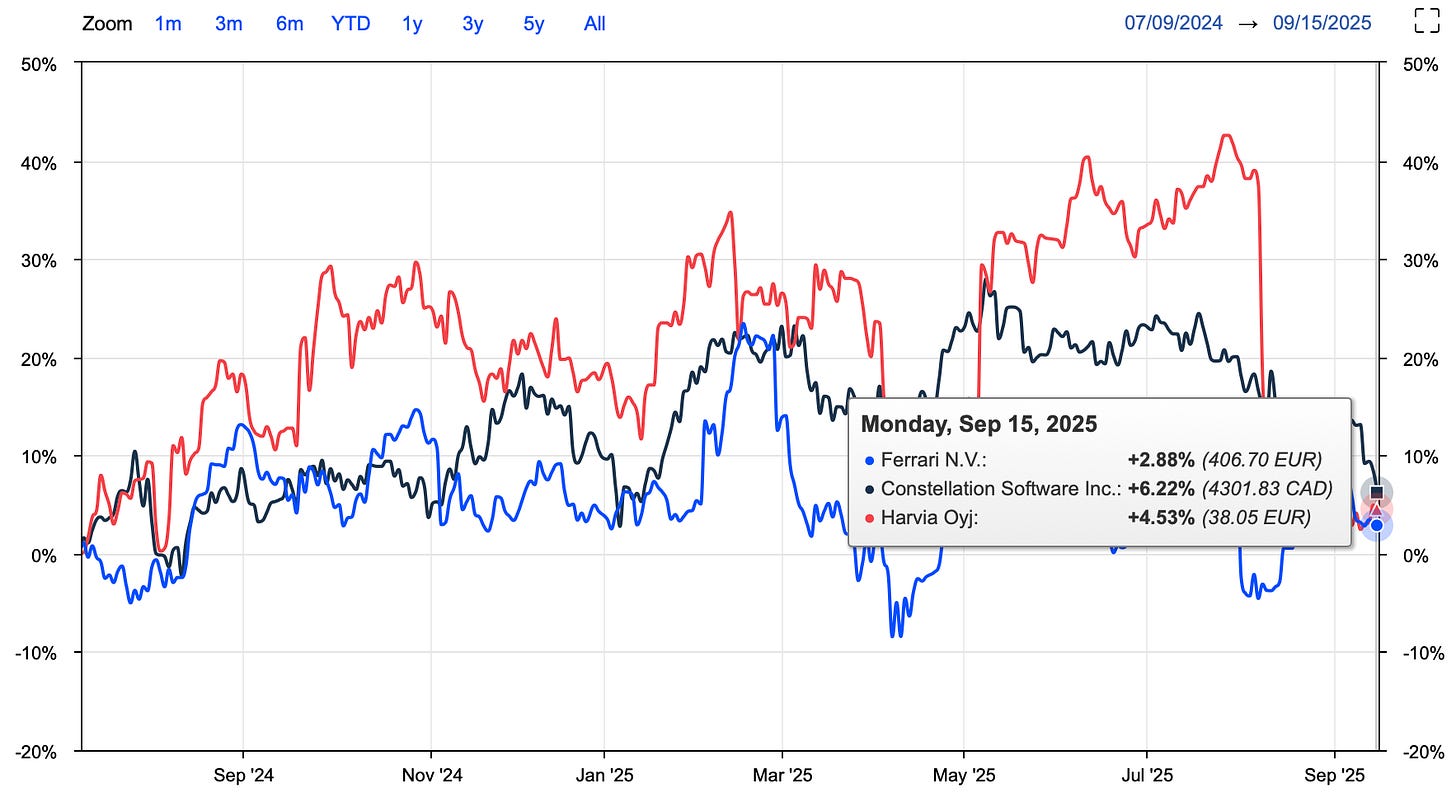

Laggards from a share price perspective; not from a fundamental perspective (that’s when there’s a real problem). Since July 2024 (to many, it feels like an eternal holding period), our three top positions haven’t moved much. Something must be going terribly wrong… It means we’ve entered a new stage in markets where one’s fundamental conviction is eroding based on relative underperformance.

We wrote the following down in our Q3 notes:

One of our routines is to always handwrite our thoughts and key themes for deep dives, earnings recaps, our quarterly letters, book summaries. Not only does handwriting help you memorize stuff much better, it’s also a way to think deeply about our strategy and content: writing is a slow and calming process, aimed at getting rid of the impulsive decision-making.

People find it hard to believe that boring repeatable compounding beats speculative excitement, which eventually will be very short-lived. When it’s obvious that there’s a massive opportunity, it’s reaching the headlines when optimism is already near the highs, especially during times when these stocks are lagging. “Help, my stocks aren’t moving or they’re even going down, but the market’s up. Something must be completely wrong; maybe we’ve been too bullish?”

Coupled with a holding period that’s never been shorter, this behavior won’t make you much money, because it reveals the lack of patience, understanding of randomness, and fragile conviction about your fundamental analysis. Also, it tends to be induced by leverage: people looking to make a quick profit while facing sizable mortgage payments, or anything that’s related to a short investment horizon.

Frankly, if you’re worried about dead-money periods or drawdowns, then you shouldn’t be invested at all and not follow our framework; or at least, you shouldn’t watch your portfolio every day, week, month or even quarter. Given the euphoria around AI and other explosive growth stories, we should expect more “emotional pain”, and the more periods you’ve dealt with, the easier it’ll be to stay the course.

The good news is that we’ve seen many so-called long-term investors already surrender to short-term narratives. It’s a promising sign. Remember that successful investments only benefit intrinsic shareholders who’ve been sitting very tight on their shares for a long period of time. I can’t imagine someone who’s become rich because of trading O’Reilly Automotive or Constellation Software. There have been many occasions that these names weren’t moving much and then shot 50% higher in 7-9 months.

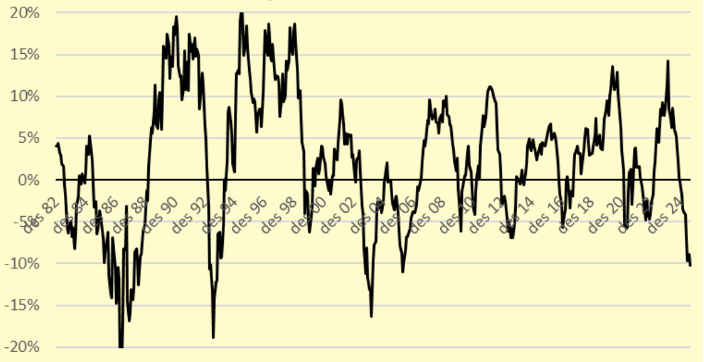

The below graph was shared by Mathias, a highly respected Partner in our Discord community, illustrating the rolling 12-month performance of the MSCI World Quality relative to the MSCI World. If it’s positive, quality has been outperforming the average index (which reflects the aggregate of quality, average quality, and junk), and vice versa.

The picture’s clear: stock-picking or sticking to a certain style will always result in relative performance.

A simple statistic reveals how absurd it is to think we can get short-term performance right. Aiming for a 12% annualized return means that your portfolio should increase by a compounded 0.95% per month, or 0.031% per day. Very small moves after all, and it’ll never work out this way. Looking at some stocks, they’re moving 4-6% per day.