Hi there!

Welcome to the first discussion about our portfolio heading into 2024. 2023 was a good year for financial markets, but frankly: it’s already in the rearview mirror. Given that investing is a continuous process of adding, compounding and removing capital, past returns are just the past. Over the last years, financial markets have undoubtedly enjoyed the effects of ultra-loose monetary policy. Therefore, we shouldn’t put too much attention to a positive outcome that occurred in a very favorable stock market environment.

The long-term factor in compounding wealth is whether or not our companies managed to make wise capital allocation decisions. So don’t confuse euphoric bull markets with brains; it’s oftentimes a consequence of rising retail participation, not the fundamental drivers of shareholder value creation.

Due to fickle investor sentiment and heightened levels of volatility, keeping a decent portion of your investable assets in cash is instrumental in letting compounding on the stock market come to fruition.

Panta Rhei

In the world of investing and entrepreneurship, we regularly remind ourselves of the following: “panta rhei”. This is a Greek phrase to state that everything flows/changes/evolves, which was popularized by the intriguing pre-Socratic philosopher Heraclitus. In secondary school, studying Ancient History helped me better understand the aspects of life, our culture and human behavior such as hubris. And while this substack is focused primarily on compounding wealth in the stock market, a “Compounding Tortoise” is someone who enjoys steadily accumulating not only financial wealth but also wisdom, happiness, joy, love, friendships and much more.

Turning back to investing after this intermezzo 😀

We should be cognizant of the fact that a growing business sitting in our investable universe (of quality companies) will ultimately face the challenge of growing its underlying earnings at the same rate from the past.

Now, that does not imply we’re automatically going to hit the sell button whenever earnings growth slows down. It’s just a matter of rightsizing ambitious expectations to reality. I personally have no problem holding onto a stock that has earned me a 15-year CAGR of >20%, but is set to deliver a sub-10% annual return going forward, just as long as the quality of its earnings growth remains excellent and leftover cash flow is being distributed to shareholders.

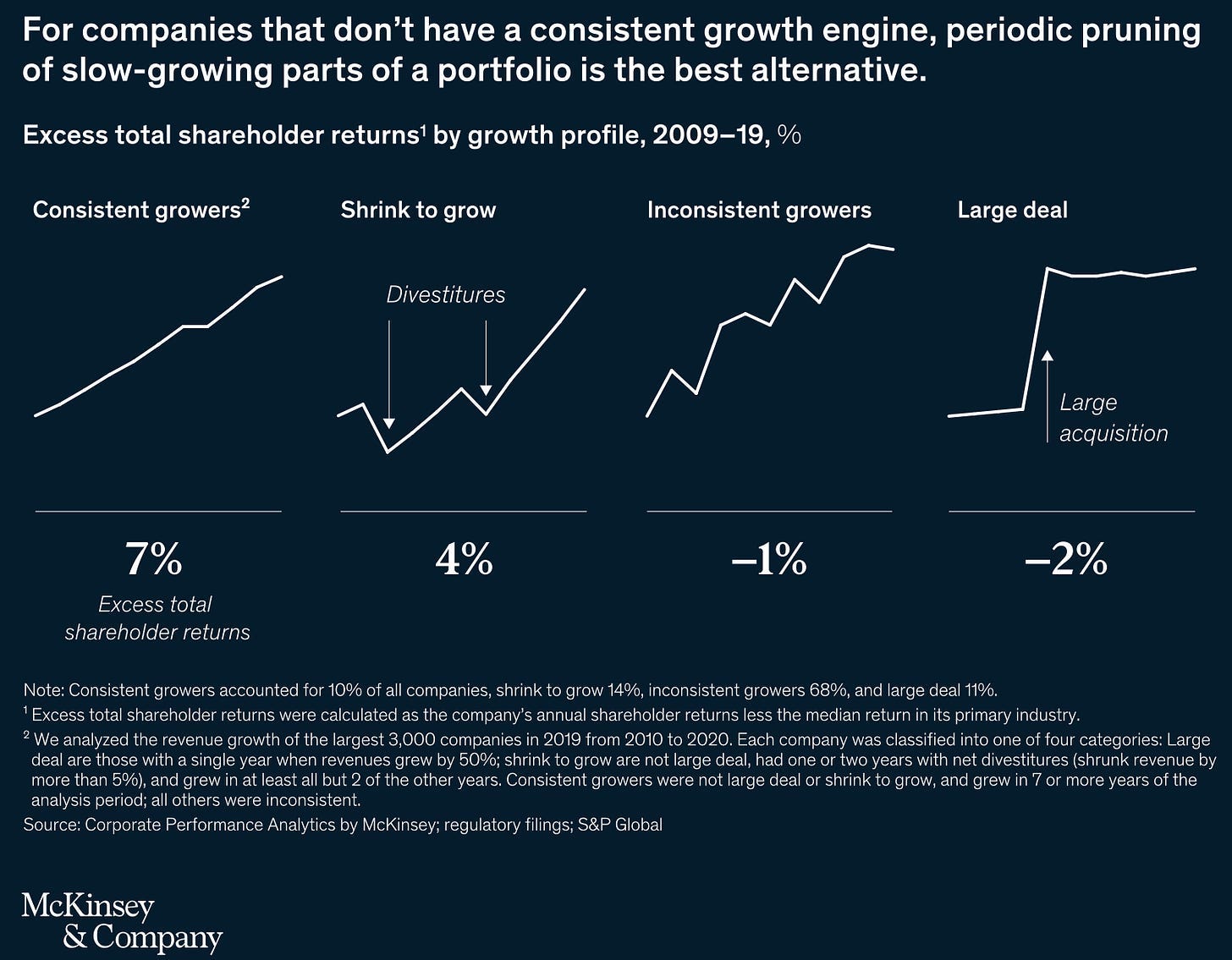

Chasing growth has always been the mantra of stock-market gold diggers: the faster a company is able to grow, the more investor enthusiasm it's going to attract. McKinsey’s book “Valuation, Measuring and Managing the Value of companies” is crystal-clear on diminishing revenue growth rates.

The median rate of revenue growth between 1963 and 2007 was 5.4 percent in real terms. Real revenue growth fluctuates more than ROIC, ranging from 0.9 percent in 1992 to 9.4 percent in 1966.

High growth rates decay very quickly. Companies growing faster than 20 percent (in real terms) typically grow at only 8 percent within five years and at 5 percent within 10 years.

Extremely large companies struggle to grow. Excluding the first year, companies entering the Fortune 50 grow at an average of only 1 percent (above inflation) over the following 15 years.

The investor treadmill is a very interesting concept we’re going to elaborate on in our next webinar. Buying shares of a fast-growing company won’t necessarily make you rich; it depends on the embedded terminal cash flow expectation and the moment at which the market counts on growth rates to fall off a cliff and/or to normalize.

Not All Growth is Created Equal

Aside from that, not all growth is created equal. What’s the value of generating high revenues but no real earnings, when you’re active in a highly competitive sector? To be clear, there are exceptions to this rule but the key element in this, though, is that high revenue growth rates tend to fade quickly over time, whilst return on capital is a given.

Generally speaking, high revenue growth rates and a low return on capital create immense share price volatility. Therefore, we won’t go after fancy growth or speculative stocks that happen to be popular at a certain time; it’s not in our best interest for generating the stable returns we aspire to.

Our “Compounding Tortoises” are businesses that have already won in their respective industry and on which we have a relatively strong conviction for continued long-term success. Return on Capital is the secret sauce for longevity.

An 8-Point Shortcut to Finding Great Tortoises

Talking about the fundamental profile of a “Compounding Tortoise”, it boils down to a company:

being transparant with its owners, as evidenced by a management team’s integrity and skin in the game;

posting positive organic growth;

investing in assets that generate secured cash flows (implies a high degree of economic resilience with little disruption risk);

looking for stable growth rates, based on a sustained return on capital;

having a large pool of potential investments, whether it be organic or acquisitive;

having a strong balance sheet to weather any economic downturn. You don’t want to see a declining ROIC being made up for by borrowing for future investments;

distributing all leftover cash to shareholders;

and lastly, with no dilution of existing shareholders through excessive share-based compensation. Share-based compensation is a very handy approach to artificially growing your cash flow from operations (and free cash flow, by its theoretical definition). SBC-adjusted earnings are a perfect indication of a shortsighted management team trying to persuade the market of its (“adjusted”) value creation.

This concise 8-point list will certainly keep you out of a lot of trouble. Why is it so simple? It’s based on common sense. The only things I care about is ROIC (i.e. capital intensity), earnings and cash flow visibility, and a relatively fast investment payback.

“The Compounding Tortoise" portfolio as of January 6th, 2024

To us, “Compounding” is all about striving for and effectively achieving efficient and stable growth. A “Tortoise” is an organization that does not impose dramatic changes on its workforce, but develops a collectively strong entrepreneurial spirit that’s very hard for others to replicate. It does not let distraction come into play, it’s solely focused on achieving the long-term objective instead. That doesn’t mean the “Tortoise” isn’t wary of changing macro-economic and/or technological trends, as it is constantly looking for ways to fortify its already impregnable moat through multi-decade experience and new learnings.

Based on the above, our watchlist (and ultimate portfolio) isn’t that extensive as we purposely migrated towards companies where we’ve built great and detailed comfort level over the past years. We don’t copy screeners’ information but stick to our in-house research based on company filings and management interviews. Having too many choices oftentimes leads to indecisiveness.

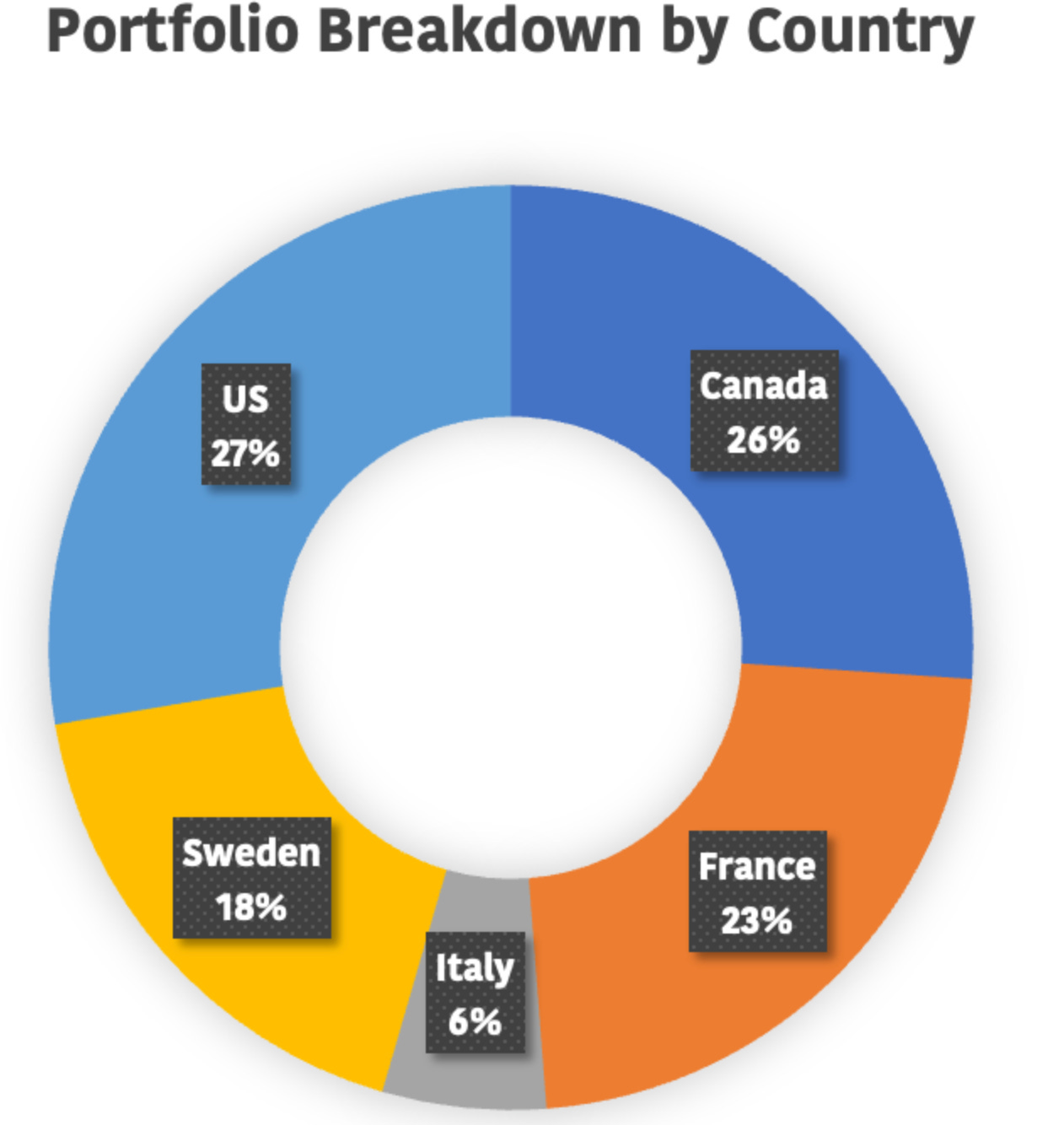

We’re fond of the KISS strategy: a selective set of parameters to determine whether a company is 1) capable of compounding total shareholder capital at a decent clip, whilst earning a high return on that capital and 2) whether or not it’s already priced in from a long-term perspective. Below is our portfolio breakdown by country of listing, i.e. companies originated in developed markets, as of January 4th 2024.

What do we expect from our portfolio? Time is the friend of a great business that can compound its invested capital at a fast clip, whilst keeping financial risks low. Here are some features of our stock investment portfolio:

Weighted average return on capital on organic growth: >40% (after tax)

Weighted average return on total invested capital: 20-25% (after tax)

Weighted re-investment rate: >60% of NOPAT

Weighted dividend payout: approximately 20% of NOPAT

Weighted buybacks: approximately 10% of NOPAT

Weighted average EV/NOPAT (2024): 27x

Based on the above, annual earnings growth is projected to come in at roughly 12% to 15%. We’ll get a 0.7% dividend yield and 0.35% buyback yield. That’s 13% to 16% total ROIC, before any assumption on declining or rising valuation multiples after taking a position. It’s far better to benchmark your fundamental portfolio characteristics than its (short-term) stock performance. It’s a long-term focused portfolio with little turnover (other than adding more capital to the portfolio).

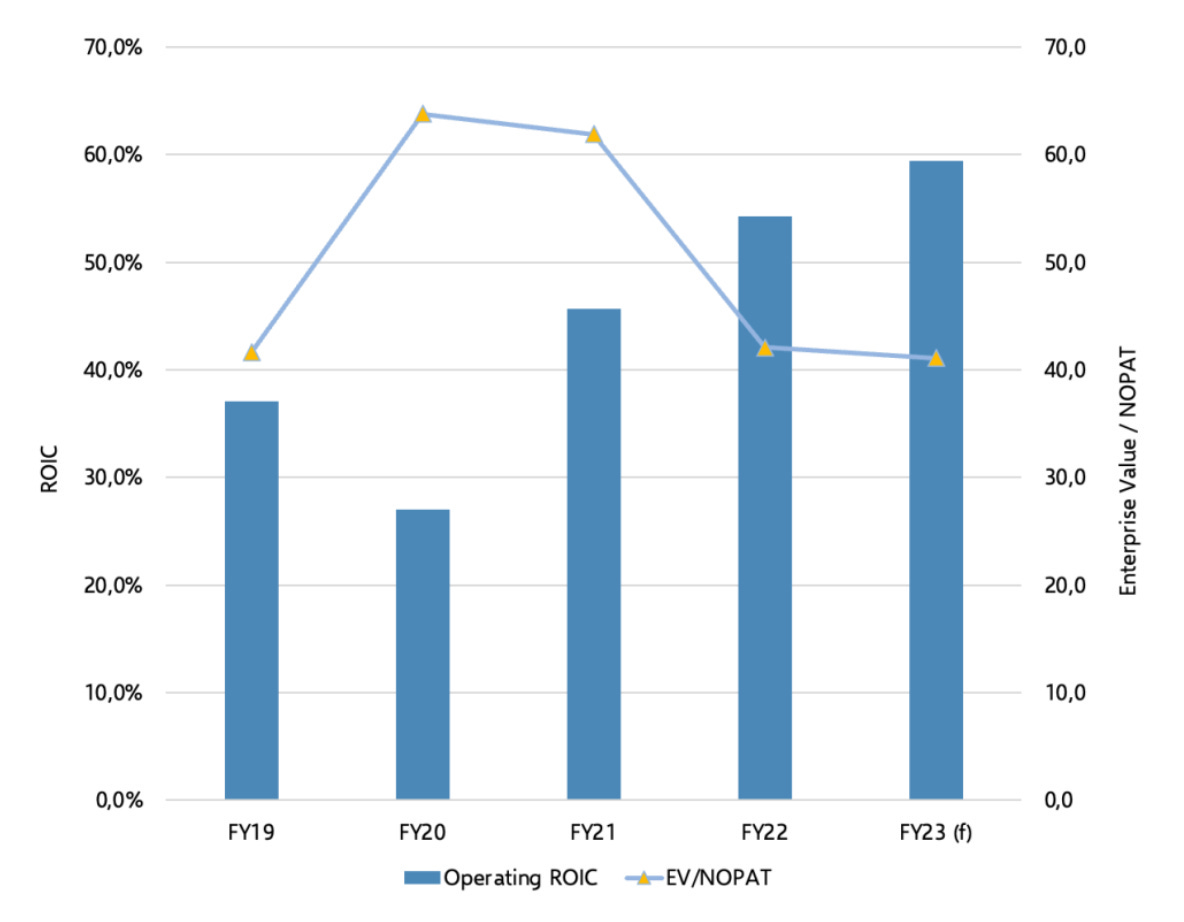

One of our largest holdings is Hermès International, the famous luxury brand that - let’s face it - has its own league. The below graph depicts the return on invested capital excluding cash and goodwill and Hermès’ valuation multiple (EV/NOPAT).

Return on capital has increased significantly compared to pre-COVID levels, yet the valuation multiple is roughly the same. Ceteris paribus, this makes us believe Hermès future total shareholder ROIC to be higher than in 2019, because of:

higher NOPAT growth per unit of newly invested capital

more leftover cash to be distributed to shareholders (currently a mere 0.7% dividend yield)

pricing power

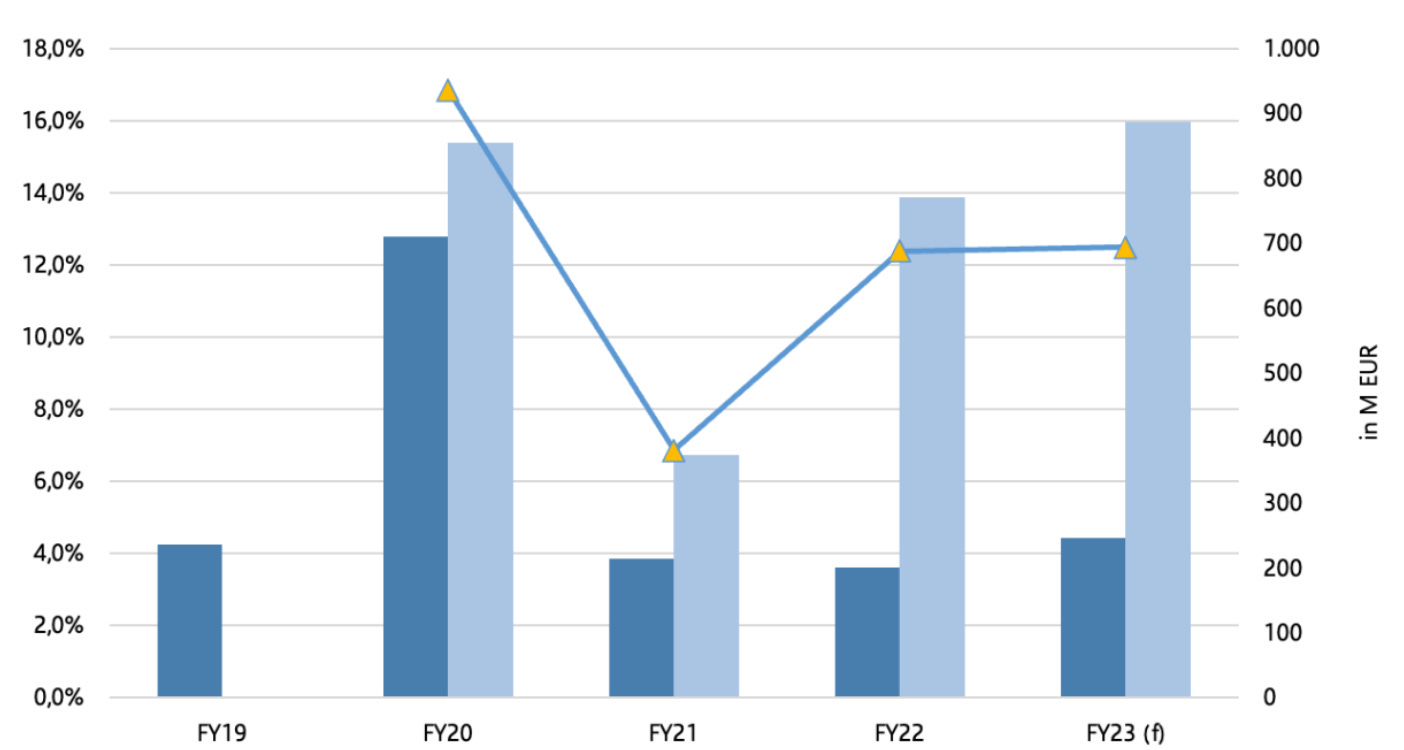

The below graph shows three things:

adjusted CAPEX, inclusive of net new lease arrangements (dark blue bars)

total change in invested capital (i.e. net working capital) (light blue bars)

theoretical change in annual NOPAT growth

Based on Hermès’ new store openings and total sales volume growth, the ROIC-reinvestment rate algorithm implies a 12% annual NOPAT increase. What about future economies of scale, i.e. higher profitability, and most importantly pricing?

Management previously described the latter as follows: “We are putting us at a place to have a perpetual growth higher than the model, which has more impact than to know what I'm going to do in 2023 in terms of growth. We have a perpetual growth, which for the moment is quite high. And that is what I try to preserve.”

There you have it: perpetual growth and long-term optionality (thanks to its sizable cash position) for such a strong mono-brand luxury group.

Contextualizing ROIC, future pricing power and store location growth is what’s key to understanding and drawing conclusions from Hermès return profile and premium valuation. These factors won’t be presented on a silver platter by a stock screener.

And that’s precisely what we’re aiming for at “the Compounding Tortoise”: providing you with a small set of thoroughly researched, actionable quality-investing ideas and an effective framework for compounding wealth in the stock market.

So let’s jump right into our current 12-stock portfolio, which we will regularly discuss in our bi-weekly video updates and written follows-up.

This portfolio is reflects our real individual stock weightings. Our goal is to show the performance excluding cash additions or withdrawals. It’s not a portfolio that implements dollar-cost averaging. We want to show the result of a permanently invested high-quality stock portfolio. The returns are not money-weighted. In reality, we have a decent amount of cash we can put to work whenever we want. We’re not market-timers, it’s just a personal preference to hold cash and that’s irrelevant to someone else’s situation.