Q1 2024 - Full Analysis of Constellation Software & Its Spin-Out Companies

A lot to talk about

Constellation Software Inc. published its Q1 report yesterday, and, as always, there were some special items (related primarily to the Lumine spin-out). We’ll be diving deep into CSI later this year (without doubt, that will take quite some time).

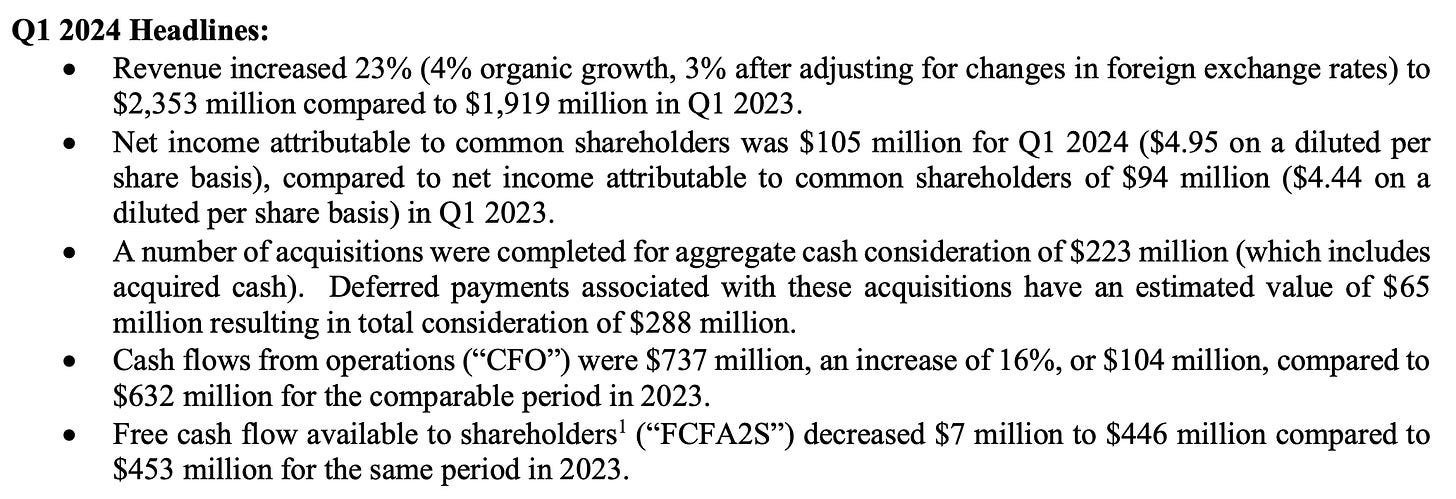

CSI press release

The above screenshot reveals that FCFA2S declined (surprisingly), and we wouldn’t be surprised to see this scare the children a bit next week. Free cash flow available to shareholders has been a more volatile metric as of late, especially as CSI continues to grow with larger deals whose timing is unpredictable (resulting in more volatile working capital in and outflows upon closing of these acquisitions), the magnitude of the non-cash IRGA liability revaluations, and the changed ownership in the spin-out companies.

As such, the only way to contextualize Constellation’s performance and valuation is and will always be: looking under the hood (by the way, that’s what you should do with any other quality growth company as well) and gauging the performance of each entity it has direct ownership in.

There’s a lot to talk about, so let’s go straight to the topics:

Revenue performance - continued margin expansion

Cash flows - some timing headwinds in accounts payable

Topicus’ special dividend from a CSI cash flow perspective

Exercised call option to buy more TOI from Joday

M&A activity - Nokia and Conduent deals

Valuation