Q1 2025 - Constellation Software & Its Spin-Outs - Full Analysis

Seemingly mixed quarter: strong margin expansion, healthy organic growth in maintenance, slow M&A start to FY25

Yesterday, Constellation Software Inc. (CSI) published its Q1 2025 report.

We’re going to dig deeper into the performance of the spinouts (Topicus (TOI) and Lumine (LMN)), CSI on a standalone basis, cash flows, margins, M&A activity and other factors that are relevant to the long-term investment case. As per usual, we’ll share the summarizing tables that help you sort through the quarterly reports more easily.

Finally, we’ll share our updated projections for CSI standalone, Topicus, Lumine, and the implications on the blended valuation for Constellation Software shares. For an introduction to CSI’s business model, track record and recent trends (prior to Q1), we’d like to refer you to our previously shared deep dive.

We covered some of our premium members’ questions on CSI in yesterday’s blog. It’s great to see that elaborating on key topics has been very well received by our readers, and we’ll continue this new series whenever new questions arise.

Headline Numbers

As usual, CSI’s headline numbers warrant quite a bit of contextualization.

First off, remember that the numbers in the press release above are on a fully-consolidated basis (whether it’s for revenues, net income, cash from operations, and M&A capital deployment). The only exception is FCF Available to Shareholders (FCFA2S) is adjusted for free cash flow that’s destined to non-controlling interests, i.e. entities that are being fully consolidated on CSI’s balance sheet, but in which it doesn’t hold a 100% economic stake.

Note that the reported net FX headwind to sales (and EBITA) stems mainly from the translation from Topicus’ financials (i.e. its reporting currency (EUR) to USD). Also, the completed M&A figure excludes the financial investment in Asseco Poland.

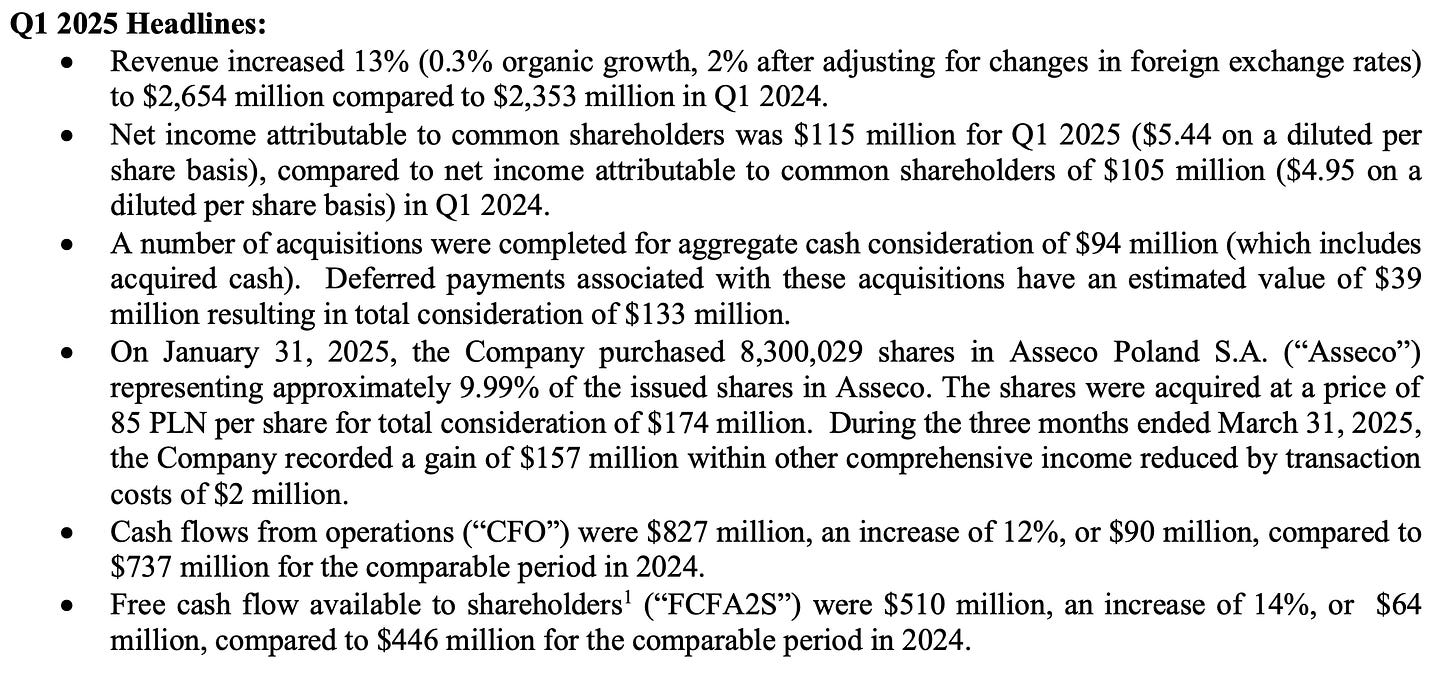

CSI’s Press Release

Given that roughly 89% of total NOPAT destined/attributable to CSI shareholders comes from CSI standalone (that is: CSI excl. the consolidated numbers of Lumine and Topicus), we believe a breakdown of its performance is necessary to gauge underlying momentum (e.g. large M&A deals for its spin-outs).

On a fully-consolidated basis, Topicus and Lumine made up 23% of Constellation’s total EBITA in FY24, a number that’s expected to grow steadily over time. Given that CSI fully consolidates the spins (but doesn’t have full economic ownership), we should treat total reported growth rates carefully.

Let’s now take a closer look at Q1.