Q4/FY 2024 - Lifco AB - Full Analysis

4% negative organic EBITA growth in FY24; highly profitable companies acquired in Q4 and for the FY

The leading Swedish serial acquirer, Lifco AB, reported Q4 results this morning. At the time of writing, the stock’s up 1.7%. In our Strategy 2025 webinar we talked about the overall trend being stable for the past several quarters, and the full-year report didn’t reveal any major changes.

Full-year organic EBITA growth was lower than we expected, while the timing and size of acquiring highly profitable companies was a positive. As we commented in previous recaps, the lack of strong pricing and post-COVID volume weakness was a drag on organic EBITA growth. It was the first negative organic growth year since the IPO.

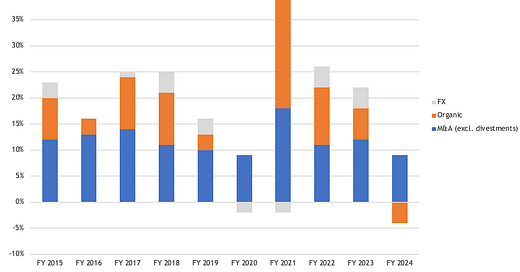

Lifco: YoY Growth in EBITA (Rounded Percentages) - The Compounding Tortoise

Acquisition spend in FY24 met our assumptions (acquired EV of 3.676 billion vs. our 3.667 billion SEK estimate). We’ll have to see if that EV figure includes all debt items (i.e. acquired lease liabilities), but the implied EV/EBITA of 7.3x matches the long-term average.

Over the course of the past few months, we did notice that Q4 activity was lower on an acquired sales level, which meant that it was possible to see a relative shortfall versus our acquired EBITA expectation. The explanation for Lifco still ending up acquiring for 3.68 billion SEK? Focusing on even more highly profitable companies in Q4, and that’s a low-risk strategy we love.

As we’ve stated in our deep dive, one shouldn’t focus on sales but on incremental EBITA from acquisitions and their organic capital employed. Typically, higher-margin companies have lower capital turnover and vice versa.

Let’s take a closer look at the Q4 and FY performance and our updated model, including projected 10-year CAGR.