Roaring Kitty is Back - Long Live Risky Stocks!

Chasing high-beta won't reward you in the long run

Meow!

On Wall Street, trading in GameStop was halted briefly Monday morning after the stock price shot up about 110 percent in a matter of minutes. The trigger: a mysterious tweet from Roaring Kitty - better known as Keith Gill. The amateur investor and Youtube personality also stoked a rally in the gaming chain a few years ago.

X

During the 2021 COVID pandemic, Roaring Kitty unleashed a rally in GameStop by touting the stock on his social media. Among others, via the r/WallStreetBets subforum on Reddit - where Gill operates under the pseudonym DeepFuckingValue - the stock was then picked up en masse by retail investors. These, in the absence of other activities, engaged in frenetic trading in the stock markets, mostly through low-cost investment platforms like Robinhood.

The ailing American gaming chain GameStop then grew to become the meme share par excellence. By buying the company's shares en masse, millions of small investors drove GameStop's stock price into the stratosphere. There was a rebellious side to this buying spree, however. GameStop was massively "shorted" at the time by professional investors on Wall Street, who speculated on a decline in the stock via short positions. Hedge fund Melvin Capital lost billions of dollars when GameStop's stock price did not fall, but rose tenfold, ultimately leading to the fund's demise. The GameStop saga was filmed last year in the tragicomedy "Dumb Money.

And it seems we’re getting another round of speculative frenzy in meme stocks.

High beta doesn’t make you rich

We all know how these bubbles end: in tears… Still, the current risky behavior isn’t in our quality stocks’ favor: lower volatility stocks underperform when high beta is soaring. We’ll talk about portfolio concentration, correlation in next Friday’s post.

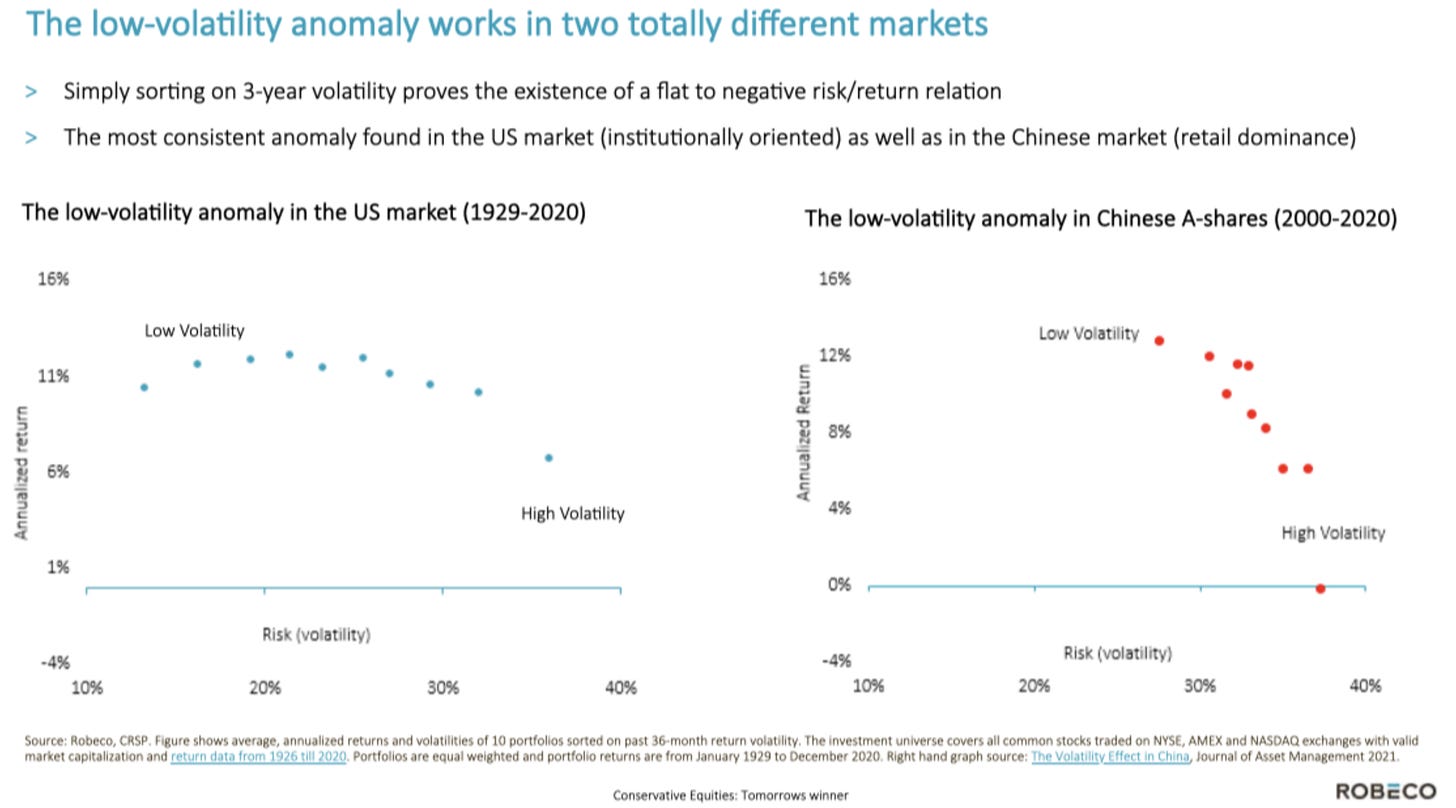

Higher-quality stocks outperform lower-quality stocks: it doesn’t seem counterintuitive but shouldn’t this be priced in already? The quality proposition resonates to one of the most powerful stock market paradoxes: the concave return-risk profile.

More risk-taking does not correspond with a linear return relationship (measured on a rolling long-term basis and based on a wide basket of stocks). It’s about generating high risk-adjusted returns: striking a balance between a company’s future growth prospects (which drive your effective returns) and the corresponding volatility. In other words, you could end up feeling lucky with a few high-beta stocks but a collection of risky assets will demolish your risk-adjusted performance. The steadier your return trajectory, the easier your investment career is going to be.

The following graph depicts ROBECO's ground-breaking research findings around this topic. In market environments where retail investor participation is on the rise, the effect of low-volatility investing on your long-term performance will improve drastically (both in absolute and relative terms).

As per ROBECO, conservative stocks should provide alpha during periods of stagflation, high inflation and “normal” economic growth. Moreover, on the valuation front, defensive stocks tend to outperform by losing less in the down markets, especially when the earnings yield and thus risk premium is low.

We highly recommend this episode with Pim van Vliet, who spent multiple decades on researching the low-volatility anomaly.

During 2020, we analyzed the long-term performance of lower-volatility stocks vs. their high-beta counterparts and found that 2020 was a truly remarkable year: high beta outperformed, primarily because of exposure to tech. Despite their 2020 outperformance, the low-volatility factor was still ahead of the risky alternatives when measured over a decade-long and pre-2008 time frame.

When volatility increases, a portfolio of stabler quality stocks (consumer staples, healthcare, defensive tech) is likely to produce positive returns, even in a 20+ % VIX environment. We’ve talked about the VIX in the below post.

The Compounding Tortoise

For more volatile portfolios, it becomes tougher to generate positive long-terms returns in a rising VIX environment. Add to that: more volatility makes the impact of bad timing of additional purchases even more outsized.

The Compounding Tortoise

In 2022, low-volatility outperformed thanks to resilient performance in Q2 and Q3, but it didn’t provide meaningful cushion in Q1, as some consumer companies got hit by the Russian sanctions and fears about overall inflation.

With Roaring Kitty making a comeback, inflation being sticky (we’ve just got another proof of that in the latest PPI print) and bubbly “adjusted” earnings multiples, we expect boring quality companies to ultimately make a meaningful comeback. But for now, excessive risk-taking could pull our quality stocks down, that’s how sentiment works.

Maximize the risk-adjusted IRR on every purchase

As we’ve pointed out already in previous posts, we could care less about relative performance. Our goal is simple: generating our targeted IRRs on every single purchase we make, and with as minimal risk of permanent capital loss as possible. Granted, markets have become intrinsically more volatile since COVID, so volatility for whatever asset you’re looking at will be structurally higher. Maximizing risk-adjusted IRRs on your investments is no different from our companies targeting good reinvestments to grow their future earnings.

It’s very important to stress that we look at the IRR on every purchase. All of our investment decisions combined will determine the long-term return outcome. Most investors are laser-focused on their cost basis and feel safer when they can average down, because that would imply a very cheap multiple and thus good investment opportunity. We argue: don’t let a historically lower purchase price dictate whether or not you should buy more of a great business.

Let’s now screen for some opportunities in our portfolio and the buying orders that are in place as of today.