Hi fellow Tortoise!

Wishing you a very healthy and prosperous 2025!

In this first webinar of the new year, we’ll review 2024 performance across factors/investment styles, assess overall sentiment, discuss earnings growth expectations, and dive into our strategy buckets - like VMS serial acquirers. We'll also highlight the importance of benchmarking your stock-market performance.

2024 was an excellent year for our compounders, with portfolio-weighted NOPAT per share growth of +12.4% (based on December 31, 2024 allocations). Looking ahead, 2025 appears even more promising, with projected growth of +15.3%, assuming no major shifts in our positioning. Our strategy is simple: high-quality companies with steady, repetitive, low-risk growth at reasonable valuations.

Next week, we’ll publish our Q4 and FY Letter to our Partners. We’re also going to share part II of this Strategy Webinar series, elaborating on each of our companies’ investment thesis, outlook for 2025, valuation, recent trends…

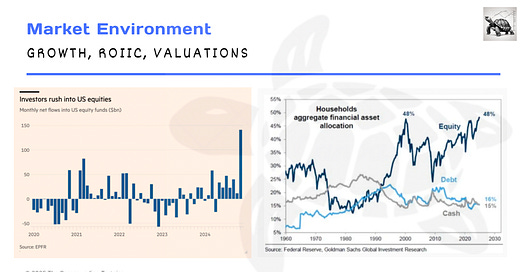

When the crowd is bullish, how do we profit if returns hover around 0% or dip to -5%? Markets rarely climb over 20% for two consecutive years (which occurred in 2024), particularly following periods of significant multiple expansion.

How can we brace for tougher conditions, remain invested, and aim for a more typical 7-8% return with permanent downside risk protection? These questions sparked the creation of a second Substack, “The Theta Tortoise”. Check it out, if you haven’t already. Becoming a premium member is easy through the below button.

The presentation can be watched below, including the slides and the transcript.

Note: there appears to be an issue uploading the PDF of the presentation, so we’ve added the slides as images.