Successful Serial Acquirers - Is the Playbook Still Intact?

Part II on the Redeye serial acquirer event

Following part I on the Redeye event, it’s now time to elaborate on the Röko pitch and panel discussion on what has changed over the past decade(s), synergies and how to build and sustain a successful serial acquirer model.

Serial Acquirer Event Redeye - Part I

On March 6th, 2024 Redeye hosted its annual serial acquirer event. At Redeye, they provide content which is of insanely high quality. In this post, we’re going to summarize the serial acquirer model and the Lifco pitch. Introduction to the serial acquirer model

Röko - Frederik Karlsson Back in Charge

Röko was founded in 2019 by Frederik Karlsson, the former CEO of Lifco, and Tomas Billing, Frederik’s business partner. As of today, Röko isn’t a publicly listed company and although one day this could change, Röko’s current size doesn’t need any IPO funding to drive future M&A growth. The main reason why Röko would opt for a public listing is because of prestige, as Frederik previously mentioned in an interview. Showing what you’ve so far accomplished as a serial acquirer and competing for the golden medal in terms of the best TSR.

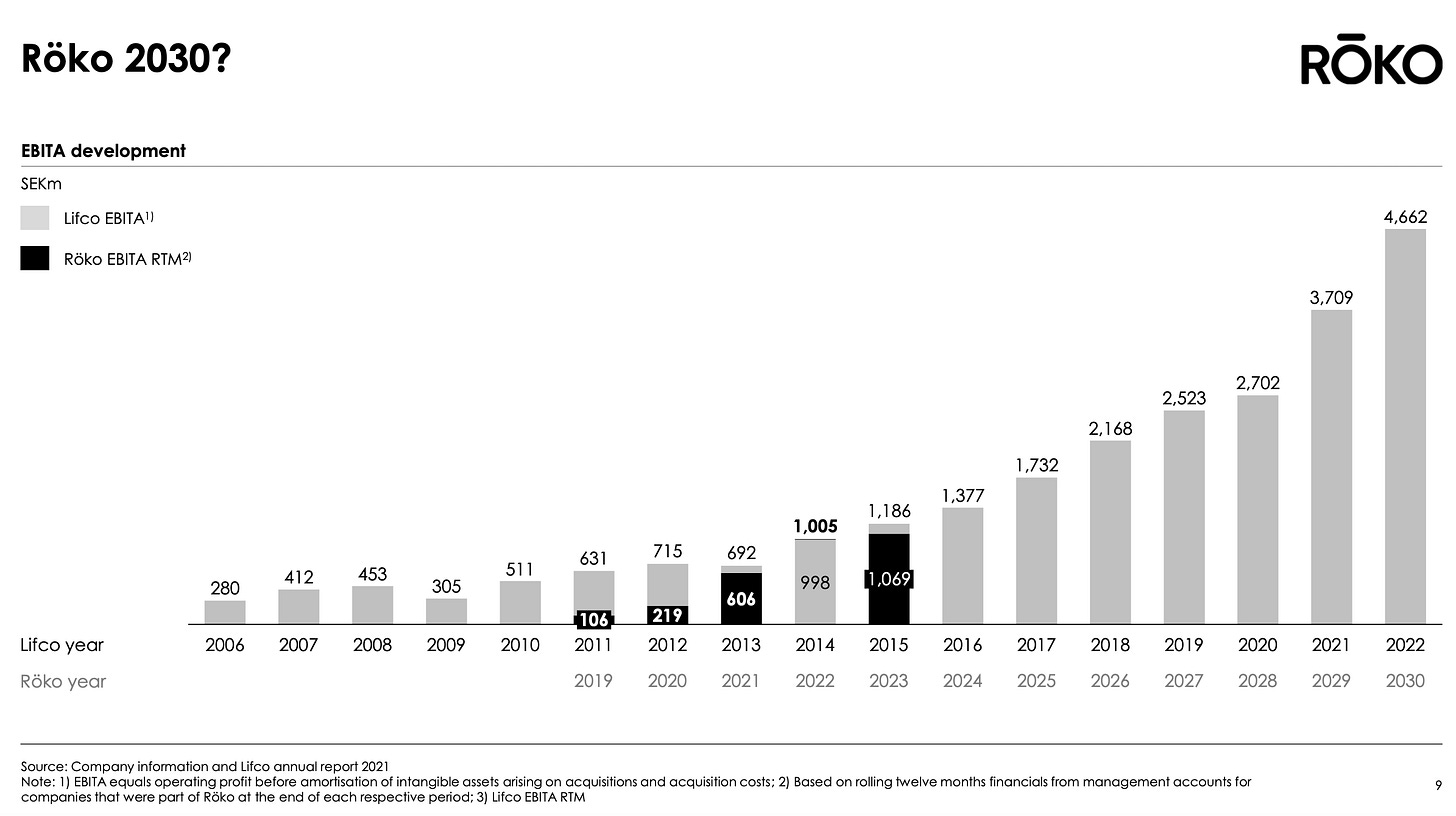

FY23 marked an important milestone for Röko with the underlying rolling 12-month EBITA reaching 1 billion SEK, which was well ahead of schedule. As we look at Röko, scaling the number of owned subsidiaries wouldn’t require a big change in the HQ headcount.

In terms of track record, it takes time to build culture, to grow the subsidiaries organically (sharing best practice), amortize the acquisition-related intangibles and therefore, the current Return On Capital Employed isn’t anywhere close to Lifco’s. Overall, when looking at Röko’s underlying operating invested capital, we believe it will manage towards a peer-leading ROCE over the next 7-10 years.

Profitability is at the core of Röko’s strategy. Initially, it set the target for only acquiring companies with a 10+% EBITA margin. “The nice thing having a high profit margin is: it’s easier to have a nice cash flow and when there’s a problem at one of the companies, you don’t have to inject new capital.”

Indeed, profitability and asset turnover are the two components driving Return On Capital. The better you manage both, the more optionality you have to invest profitably for future growth. Karlsson called out that in 2023, Röko didn’t find many good M&A opportunities to make an offer for and it ended up at just 3 acquisitions.

ROCE Development

As mentioned already, the current ROCE reflects what Röko has so far paid for the acquired businesses. It doesn’t reflect the impact from compounding organic growth over a sufficiently long time span and it for sure doesn't yet reflect the accounting specific consequences of being a serial acquirer (amortizing intangibles, which causes the denominator in the ROCE formula (i.e. invested capital) to shrink and the reported returns to improve).

Of course, what’s driving performance over time is organic growth (revenue growth), margin development, growth from acquisitions (assuming all cash flow can be reinvested) and your leverage ratio. We’ve highlighted these elements in our first Substack post.

The Rinse-And-Repeat Strategy of Serial Acquirers

Introduction When searching for Compounding Tortoises, serial acquirers have proved to be a good starting pool for further screening. Coupled with organic growth, these vehicles can keep on growing at a double-digit clip, just by acquiring new companies

Lifco 2.0?

To fish in a large pool of potential targets, Röko’s strategy is based on being sector agnostic: buying good companies in any sector that meets its investment criteria (not any sector, there are many bad ones). That way, they’re not forced to pay increasing multiples in one particular subsegment.

Taking a closer look at the company profiles, Röko has some really nice Tortoise-like businesses, ranging from cleaning detergents, bar soaps, enterprise mobility solutions, artificial flowers and ski instructor training to industrial spare parts. We would argue that these businesses are TAM constraint with mid-single-digit organic revenue growth potential (in line or slightly ahead of GDP growth), which reduces the risk of the attracting intense competition from large players.

After all, serial acquirers are interested in one thing and thing only: resilient cash flow generation, high ROICs, prudent cash management and steadiness at the level of each individual subsidiary.

From multiple angles, Röko could be viewed as the smaller Lifco. Looking for consistent earnings growth, strong margin development, founder-owned and family businesses, a potential management buy-in (second-level management team becoming shareholder at Röko’s side). And in fact, the EBITA development compared to Lifco has gotten its own slide in the investor presentation.

As highlighted above, focusing on capital-light business models, good profitability, sufficient scale, diversified customer base. It all makes perfect sense to focus on this kind of attributes, especially in this rapidly changing economic environment. As Frederik said: “When the numbers are good, usually the company is good.”

Personally, we don’t believe in turn-around serial acquirers or serial acquirers that have too low profitability and ROIC: there are simply too many things that can (and very likely will) go wrong.

When it comes to finding good deals that meet the below listed stringent criteria, being market leader in a niche is the element for which Röko has made an exception more frequently.

Following the last equity placement, Röko’s interest-bearing debt dropped to 0.1x EBITDA (from 1.5x). While it has substantially more outstanding put-call debt related to acquisitions with minority interests (which is a formula that’s been working very well for Lifco as well), overall leverage is manageable (2.2x EBITDA), especially with RTM EBITA having recently crossed the 1 billion SEK threshold.

Are Serial Acquirers Still Good Investments?

In the panel discussion with Wigh (CEO Lagercrantz) and Ullenvik (CEO Alligo), Chris Mayer asked the question: what has become easier and what has become more difficult over the past decade?

So how has the landscape for serial acquirers evolved over time? As mentioned in our previous post, we’re targeting to extend our serial acquirer coverage. Time to dig deeper into why we continue to be excited about this space.