The Kings of Buybacks - Why Consistency Leads to Mind-Blowing Returns

Theoretical DCFs and IRRs don't take proactive capital allocation into account

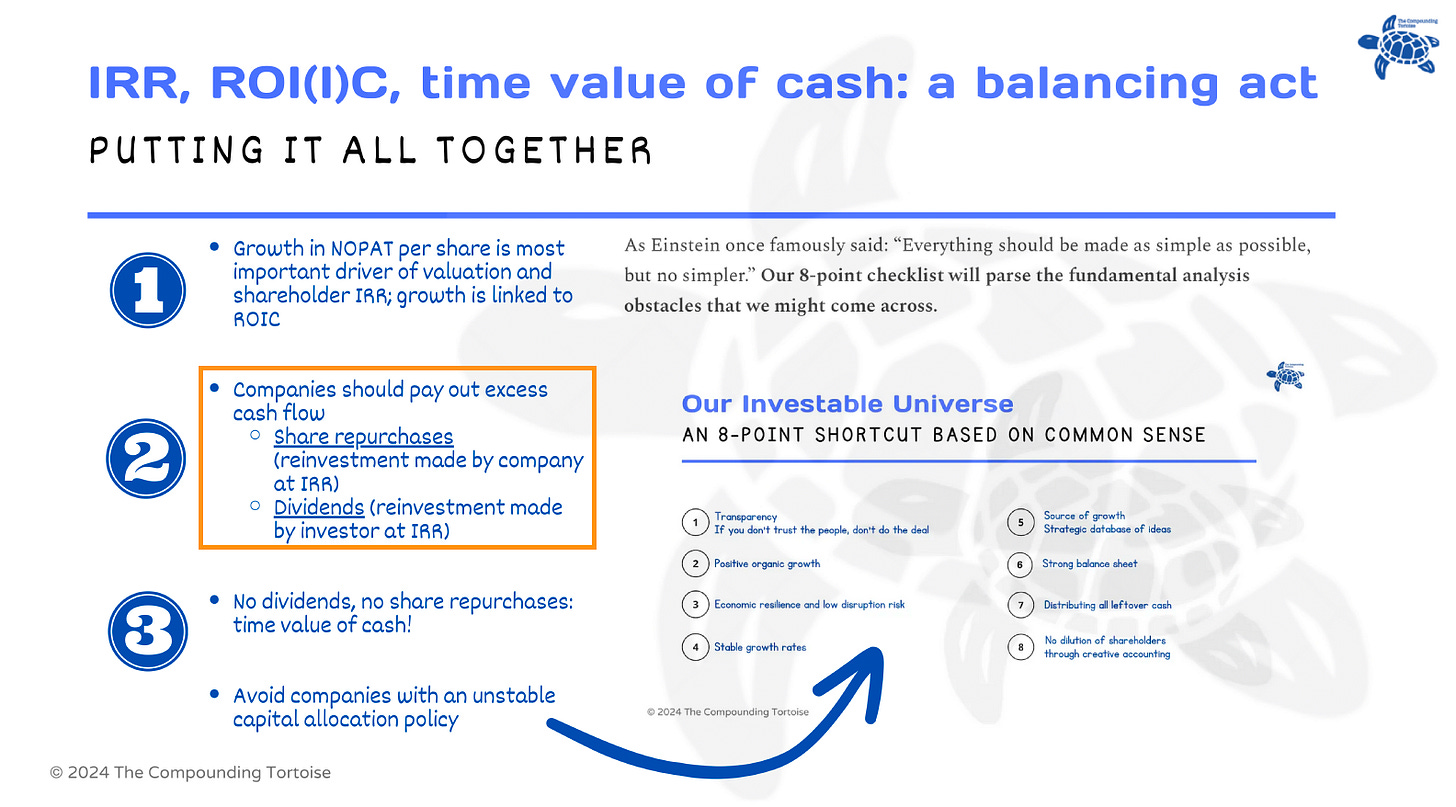

Following yesterday’s webinar, which highlighted our IRR model and the pitfalls of a theoretical DCF, we’d like to dig deeper into the below slide.

If we’re unsure of a company’s allocation, a Discounted Cash Flow (DCF) and/or calculated but un-nuanced IRR will make us draw the wrong conclusions. A company that does not pay out excess cash flow through dividends and/or share repurchases (a more tax efficient manner of returning capital to shareholders) is likely to disappoint investors who are laser-focused on the reported DCF fair value and IRR. Whereas companies with a clear strategy, good revenue and NOPAT growth AND negative working capital are likely to outperform our expectations if and when they are keeping excess cash balances low.

After all, if we don’t effectively receive these cash streams, their time value will decrease and thus hoarding cash represents a major opportunity cost. Think about serial acquirers not being able to find good deals and keeping the cash inside: delaying their future growth is likely to disappoint investors. So when look for management teams that deliver on their stated aims… You don’t want them to be overly conservative, but not irrationally ambitious either.

We want companies to be proactive and strive for a consistent, shareholder-friendly capital allocation mix. Otherwise, our targeted IRR will be overstated. It’s no secret that “Compounding Tortoises” excel at delivering shareholder value courtesy of their stable capital allocation strategy through thick and thin.

Mid January, we published an article on O’Reilly Automotive and reviewed our initial expectations which it has - so far (we never ever declare victory) - beaten handsomely.

Silent Compounders: Put This One on Your Watchlist

Silent compounders: we love them! Although the share price may suggest otherwise, these companies tend to fly under the radar. Their ability to beat market expectations boils down to ROIC, reinvesting for growth, and distributing all leftover cash back to shareholders

Let’s now discuss the outlook for the automotive aftermarket retail industry a little more.