Thoughts on Longevity - Will Steady Still Win the Race?

The brutal sell-off in Fiserv

Hi there,

In this new video update, we’ll talk about:

unusual volatility in several said defensive quality names;

recent earnings reports, highlighting the key takeaways

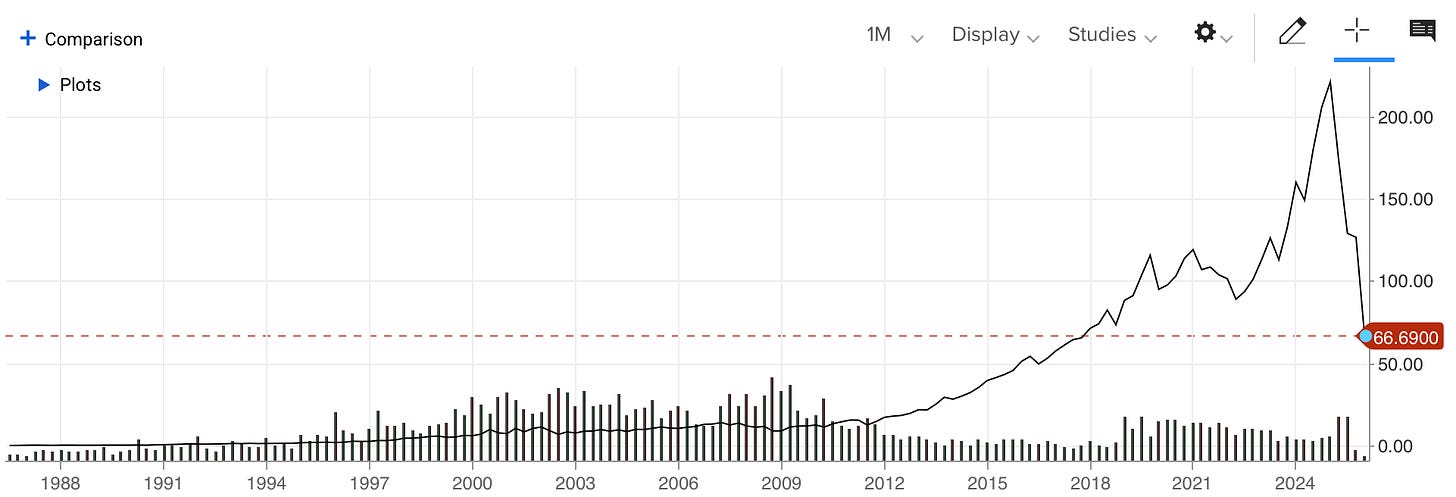

This week Fiserv shares plummeted more than 40% after the payments software company reported results well below estimates and cut its growth forecast for the second consecutive quarter. Analysts called the earnings “shockingly bad”.

They highlight growing pressure on the fintech’s core payments and merchant business, which has struggled to maintain momentum amid fierce competition and a slowdown in consumer spending. Interestingly, pre-COVID, Fiserv was one of the core holdings in the US Minimum Volatility index.

Fiserv

The brutal sell-off is a great reminder why investors should always be mindful of emerging competition/disruption and how difficult it sometimes is to measure the sustainability of past results and returns and build conviction for the long run. It’s what we’ve talked about in previous blogs, highlighting the findings of McKinsey’s Tim Koller (and others).

We believe true longevity remains underpriced in today’s market, and there aren’t many companies that meet the strict definition of pristine execution through the good and the bad.

The video can be watched below, including the transcript and slide deck.