Topicus.com - FY23 Results & Strong Start to FY24

Strong Q4 23 margins & room for significant M&A in FY24

Two weeks following the publication of our deep dive, Topicus.com reported full-year and Q4 2023 earnings yesterday (after market close). The investment case boils down to:

strong organic growth (above-average compared to CSI)

redeployment of capital into M&A

high ROIC (ideally >25% over the next couple of years)

Deep Dive - Topicus.com (TOI.V)

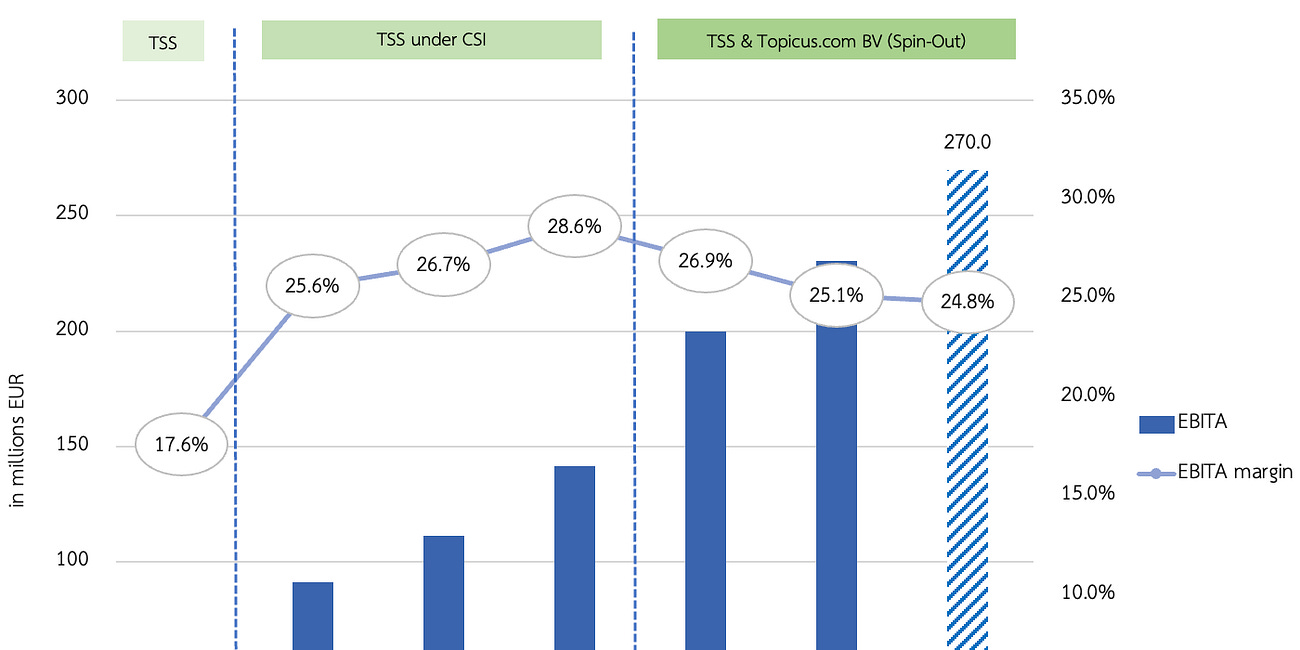

Summary On January 5th, 2021 Constellation Software (CSI) concluded the spin-out of Topicus.com (or Topicus/TOI). TOI’s main subsidiary is Topicus Coop, which fully consolidates TSS and Topicus.com BV, along with other entities such as Sygnity and GeoSoftware.

Pick-up in M&A?

So how has the company performed as of late? We knew M&A activity was set to be light but those who read the full MD&A, got a nice teaser on the first weeks into the new year. Now, the total consideration doesn’t reflect the amount of cash, ordinary debt and lease liabilities acquired in those entities but still, it’s good to see increased dealmaking activity.

Key figures

Anyway let’s first take a helicopter view before delving into the numbers (NFP, cash flow dynamics, profitability) to see whether they have changed our initial thesis materially.

Organic revenue growth: +7% YoY, maintenance revenues up +10% YoY against pretty tough comparators. Incremental but above all disciplined spend on R&D continues to pay off;

Reported EBITA margin rock-solid: 27.2% (+60 bps YoY);

Fully-consolidated underlying EBITA of 289.1m EUR (up 25.4% YoY);

Talking cash, free cash flow available to shareholders came in at 123.4m EUR (after deducting NCI portion related to Joday, IJssel BV, Sygnity, Geoactive et al), up from 54.5m EUR last year (due to one-off preferred dividend payment of 66.6m EUR). FCF growth got hit by working capital timing effects (to be reversed in FY24).

The net financial position, including lease and acquisition-related debt (holdbacks and earn-outs improved by a very strong 83m EUR reaching a net debt of 145.5m EUR. By the way, the lowest level since FY20.

Total consideration new M&A stood at 119.7m EUR excl. cash acquired (acquired debt of 12.7m EUR). Total cash effect from FY23 and previous years’ M&A: 119.2m EUR. Positive revaluations of contingent considerations (i.e. lower fair value of earn-outs yet to paid) were relatively immaterial (1.3m EUR).