Trimming O'Reilly Automotive (>35% Gross IRR)

Buying more of a leading VMS serial acquirer and a top-notch high-end luxury player

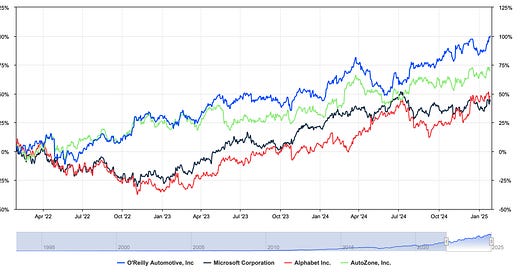

Later today, we’ll be cutting our overweight allocation in O’Reilly quite significantly on the back of a surprisingly strong rerating following the May 2024 close-to-bear-market price action. For us, it’s been a long-time winner, crushing the average Magnificent 7 stock, the Nasdaq, the S&P-500.

Back in May we wrote:

Has growth really slowed down? For sure, O’Reilly is facing increasingly tougher comps due to lapping post-COVID growth on the DIFM side and inflationary tailwinds to top line in FY22 and FY23. Let’s look at the last quarters’ two-year comps which will show the highly consistent performance.

Year-over-year comparable sales growth and two-year stacked comps

Our long-term target for O’Reilly is for it to deliver roughly 5-6% comp growth, in line with pre-COVID performance, coupled with new store openings and a little bit of long-term margin accretion. Combined, an 8-9% annual growth in EBIT and 5-6% accretion from buybacks is what makes the long-term story simple yet quite compelling.

The recent 18% pullback definitely spooked many investors, just like the stock may have attracted buyers in February and March. Let’s not forget that, at some point, the stock was up 23%, just after three and a half months. That’s the kind of volatility we’re dealing with today.

For O’Reilly, the buyback accretion is probably under-appreciated right now. Back in April 2022 (after the stock was trading 20% below the highs, after a light Q1 report), we summarized the drivers of TSR as follows:

annual comps of +5%;

a 2% increase from new store openings;

a 1% EBIT tailwind from operational leverage;

and 6-8% in share repurchases

Or a 15-19% in total annual shareholder returns, which it’s outpaced since, given the strong top line growth in DIFM offsetting some margin pressure. And above all, strong cash generation that’s allowed it to continue to buy back stock.

As we've mentioned multiple times before, O’Reilly isn’t an easy stock for the average investor to hold. While it may seem boring - with a 20% ROIIC, a strong share buyback program, and stable gross margins alongside consistent SG&A investments - it has the potential to underperform when it’s not that convenient for an active fund manager or even just a retail investor.

As a result, turnover in O’Reilly stock tends to be high, as few investors have the patience to hold onto such a strong but unpredictable performer (from a short-term share price perspective).

Of all our positions, this core holding has made us most money over the past several years, as we’ve managed to compound our invested capital at a low-thirties percent clip by proactively buying the dip when the company bought back its own stock heavily.

Making money with old friends, as Terry Smith would say, and making sure to act on contrarian buying opportunities.

O’Reilly’s Free Cash Flow and Quarterly Stock Repurchases

However, even the best companies with overweight allocations can become borderline attractive in terms of future returns. Considering that we own both AutoZone and O’Reilly, and that the valuation gap between the two has widened beyond what we consider fair, it’s prudent to resize one of these two allocations.

Let’s take a closer look at why we’re trimming and to which existing positions we’ll be allocating the proceeds.