What To Make of Topicus' Special Dividend?

Our base case remains intact - weighted reinvestment rate of 47% over next decade

Yesterday, Topicus.com announced the payment of a special dividend of 200 million EUR on March 28, 2024. Suddenly, all hell broke loose on X. What to make of this special dividend and does it matter to our long-term base case investment thesis?

Deep Dive - Topicus.com (TOI.V)

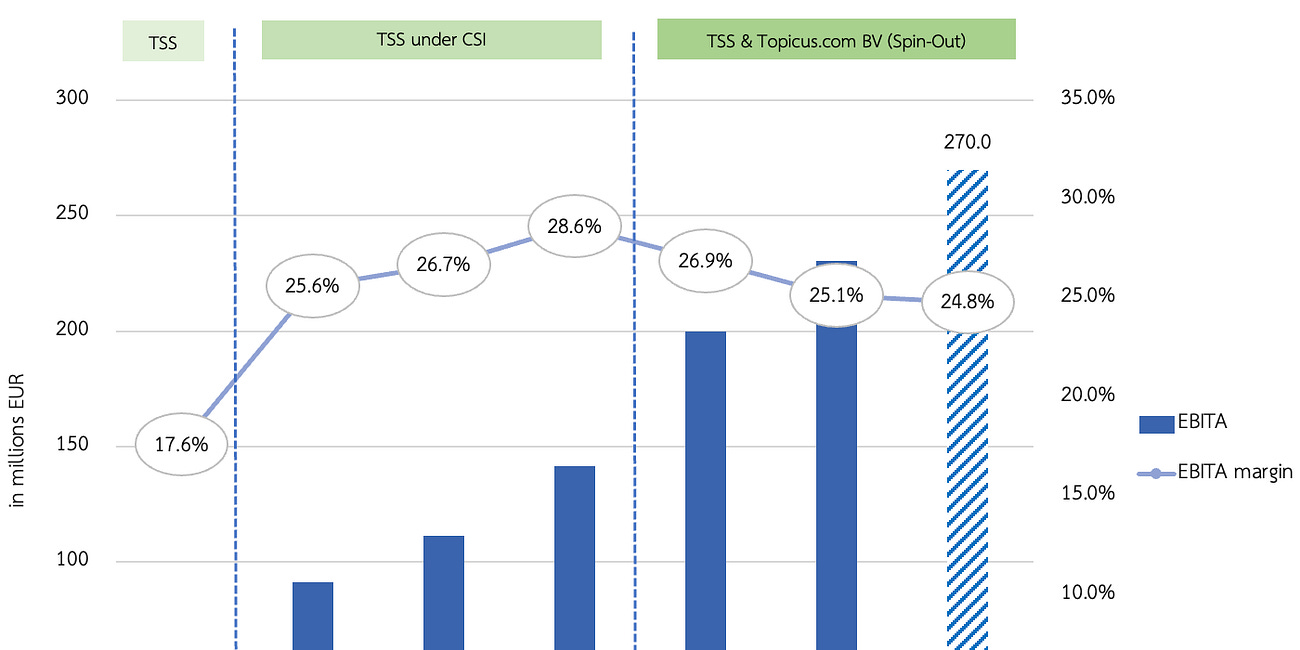

Summary On January 5th, 2021 Constellation Software (CSI) concluded the spin-out of Topicus.com (or Topicus/TOI). TOI’s main subsidiary is Topicus Coop, which fully consolidates TSS and Topicus.com BV, along with other entities such as Sygnity and GeoSoftware.

Let’s first sit down and read the press release.

Let’s remind you of what we stated in the deep dive.

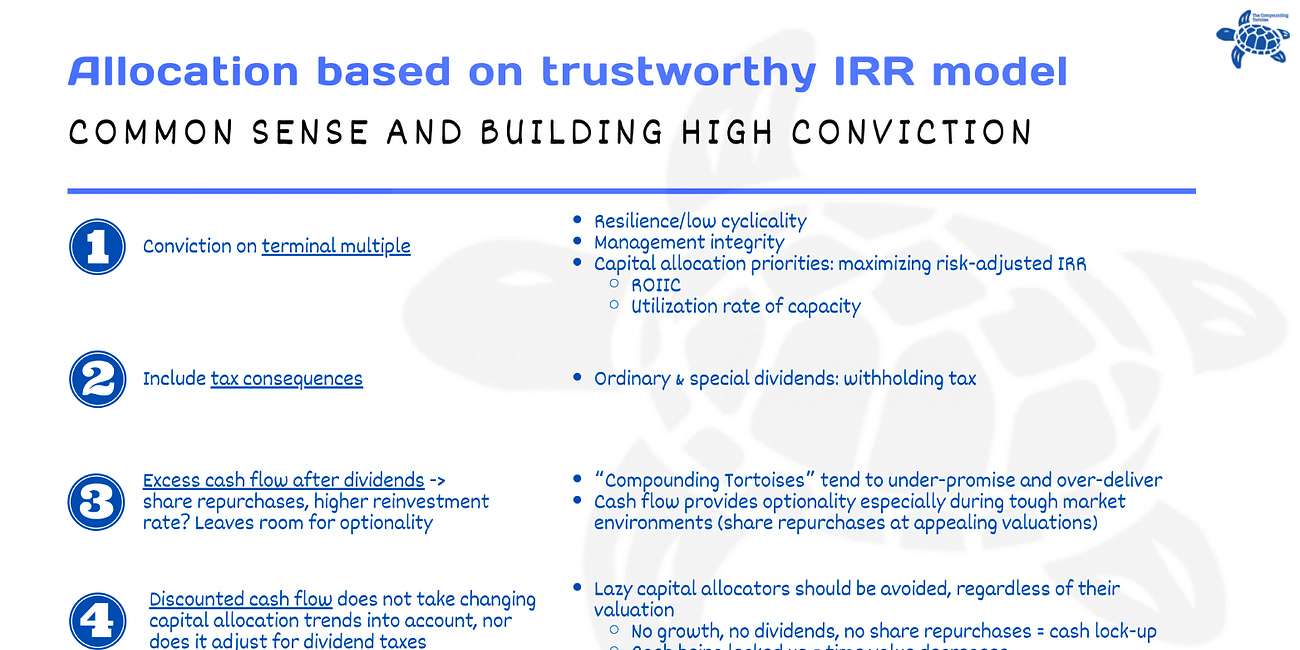

Based on our conservative mid-to-long-term assumptions, TOI will end up accumulating a lot of cash flow that’s likely to be distributed back to shareholders. Given that the IRR is a before-tax metric, significant dividend payments will be a burden on the actual yearly returns.” But of course: receiving dividends allows us to reinvest them elsewhere, thereby compounding our capital beyond our initially set IRR.

It’s difficult to continue to scale operations externally (and internally through organic growth). Just be a little rational and keep your expectations in check (rather than chasing stock prices and being clueless about the implied long-term market expectations).

A couple of factors that make us believe we shouldn’t overreact to the special dividend announcement. Remember how CSI ended up paying out special dividends only to then ultimate enjoy record-breaking years in terms of M&A dealmaking.

Topicus' free cash flow (after taking the "pure" NCI (GeoSoftware, Sygnity) into account) is projected to be 285m EUR in FY24. We expect them to make close to 287m EUR in acq. 300-350m EUR seems a nice mid-term goal but it's far from guaranteed.

It seems so obvious that ROIC x reinvestment rate is the magic formula, while most are neglecting the difficulties of continuous scaling. I mean: we were and are not banking on a 100% reinvestment rate in our model. The serial acquirers' M&A deal volume isn't static...

In fact, the weighted reinvestment rate (accounting for growing FCF) we've utilized is 47% over the next decade. Counting on 80-100% would be irresponsible to modeling conservatively and leaving room for positive optionality.

When estimating a stock investment's IRR, you're just discounting the future cash streams without making any assumption on reinvesting that cash elsewhere (or the company repurchasing own stock).

What we're alluding to: Topicus should distribute all excess cash flows back to shareholders. Letting the cash balances swell would be a huge opportunity cost (as we've highlighted in our most recent webinar). After all it's still just a special dividend, not the start of an ordinary dividend policy.

Despite getting taxed on the dividend, we can then take that cash and reinvest it elsewhere. That way we're able to maximize the time value of the received special dividend and exceed our modeled IRR (assuming we're reinvesting the cash proceeds rationally).

Of course, we want Topicus to reinvest everything back into M&A but lowering the hurdle rate is still too early. Topicus growing organically at 6% per annum (with stable or increasing margins), reinvesting 50% at 25% cash ROIC and special dividends would still result in a high-teens CAGR. Don't get too greedy and don’t let the market expectations dictate your investment decisions.

Other elements that could come to mind:

Stronger than expected FCF (especially as Q1 is the best quarter due to WC timing) and they fear the inability to redeploy it all at once.

Their ROIC on acq exceeds their expectations (it could be, despite all the chatter around Constellation’s declining ROIC), meaning they'll need less reinvested capital to drive the same relative growth rate.

Joday wanted to get some cash back (as the IRGA liability is still a non-cash item/charge to Constellation Software and the only way for Joday to get some cash back is through dividend payments) similar to when they received the preferred dividend back in 2022.

They understand the time value lost and opportunity cost by not distributing cash back to shareholders.

Hoarding cash does not improve your valuation multiples on the public stock market (i.e. the reported market cap/NOPAT, not the EV/NOPAT). Companies should be proactive with generated cash flow.

Webinar - The Art of Valuation

Hi fellow Tortoise! We’ve received a lot of questions regarding our IRR model and how to allocate new capital to high-quality growth companies. In this webinar we’ll go over the following topics: Our practical IRR model and how we should contextualize theoretical concepts such as DCF that lack information on how a company allocates excess cash flow

Currently, we leave our TOI position unchanged. There’s no need for us to overthink the special dividend announcement as we’ve already baked excess cash flow into our model. Of course, that doesn’t mean our short-to-mid-term expectations align with the market’s: (valuation) volatility is a prominent part of today’s environment.