Why Do Quality Stocks Outperform Over The Long Run?

Multi-angle approach backed by empirical evidence

Quality growth investors are value investors

Quality growth companies are in fact long-term value stocks. They've outpaced our expectations, allowing us to earn returns way above our hurdle rate. The trick is to keep compounding your cash flow, NOPAT... through good times and bad. Steadiness over volatility. Financial prudence over irresponsible leverage. When the going gets tough, the tough get going.

Why do quality stocks outperform over the long run? The below graph is pretty clear, although recent years could question the conclusions drawn from it: does high-quality always outperform lower-quality? Market euphoria, quantitative easing et cetera oftentimes lead to temporary deviations from this general trend.

Whilst not every quality stock is created equal, there are some common denominators that explain the success of an aggregate and widespread quality portfolio.

Academic researchers have dedicated hundreds of papers to the topic “Quality Investing” but there isn’t a general consensus on which parameters to use. The tools to measure quality is food for thought considering it relies on accounting data. For instance, recent trends (e.g. IFRS-16) have led many managers come up with creative profitability metrics (adjusted EBITDA, adjusted EBITDAaL).

So watch out for this generalization: with quality, all roads lead to Rome. The quality label isn’t made up of a specific basket of quantitative metrics, every case is unique. What are the driving forces behind the strategy’s long-term success to then finally apply a bottom-up approach (i.e. concentrated stock-picking)? Somehow they all relate to how human beings approach risk and return and how we underestimate the power of consistent compounding (preserving earnings growth during tough times).

Common sense metrics to screen for quality

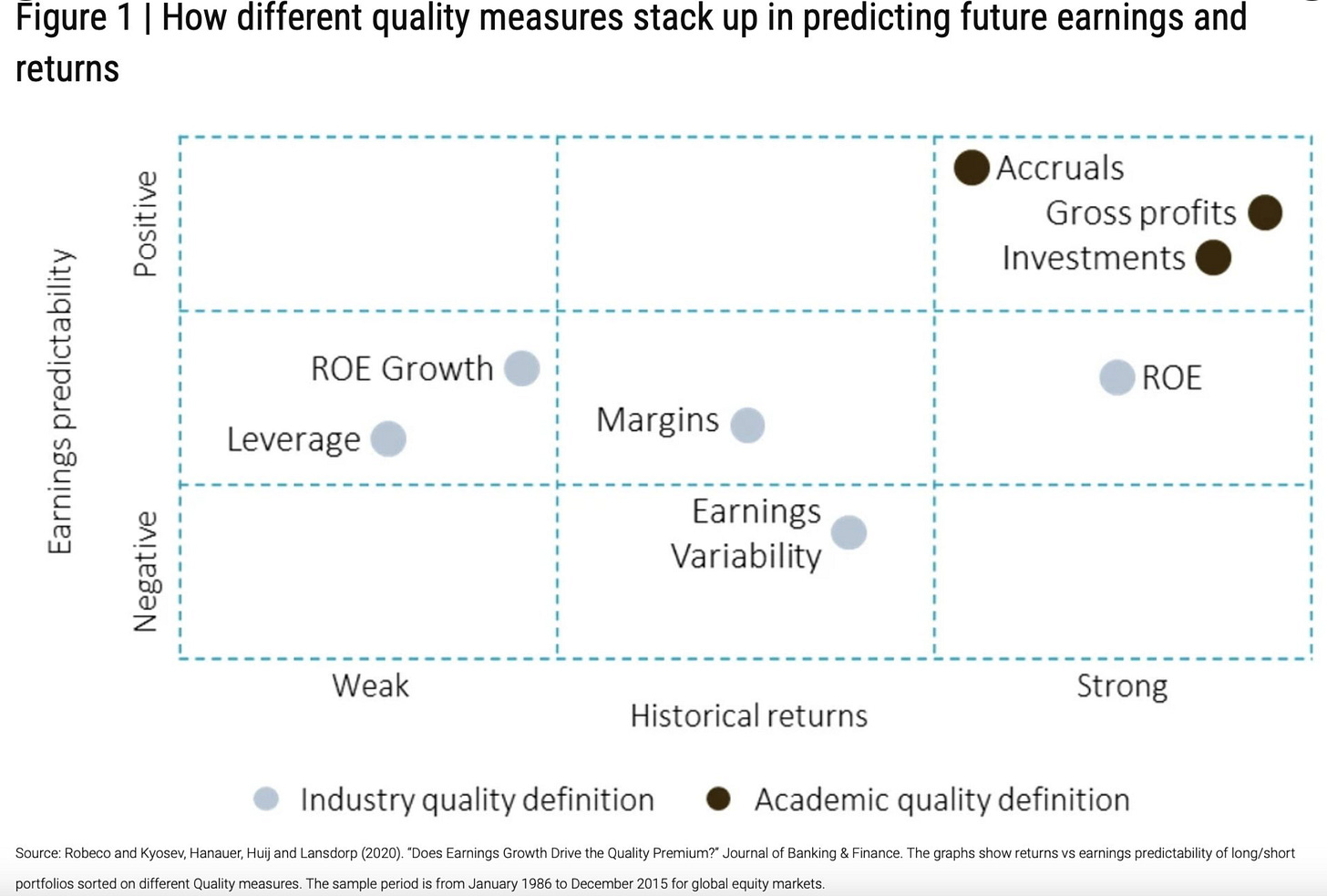

Not all quality definitions are created equal. Quality measures documented in the academic literature – gross profitability, operating accruals and investments – were more robust measures than more commonly used metrics in the industry such as earnings variability, leverage, margins or return on equity growth.

Accruals are a particularly interesting tool. One role of accruals is to shift or adjust the recognition of cash flows over time so that the adjusted numbers (earnings) better measure a firm’s performance. However, accruals require assumptions and estimates of future cash flows.

Prepaid expenses for example are expenditures paid in one accounting period, but will not be recognized until a later accounting period. Prepaid expenses are initially recorded as assets, because they have future economic benefits, and are expensed at the time when the benefits are realized (the matching principle). As a result of these mechanisms, screening for cash flow vs. earnings distortions should help gauge true financial quality.

Gross profitability speaks for itself: companies with pricing power, low COGS relative to sales are able to better fend off input cost inflation. It’s even more prevalent today… Looking at the past (history doesn’t repeat itself but it oftentimes rhymes), investing in low-cyclical companies with strong gross margins has proven to be a decent strategy.

Regarding the “investments” part, companies should strive for an optimal IRR and sustainable ROIC on their investments. A stable payback on investments (no cost overruns, embedded pricing escalators) makes owners sleep well at night. Just consider Linde Plc vs. Air Products.

Risk is not efficiently priced - low-volatility paradox

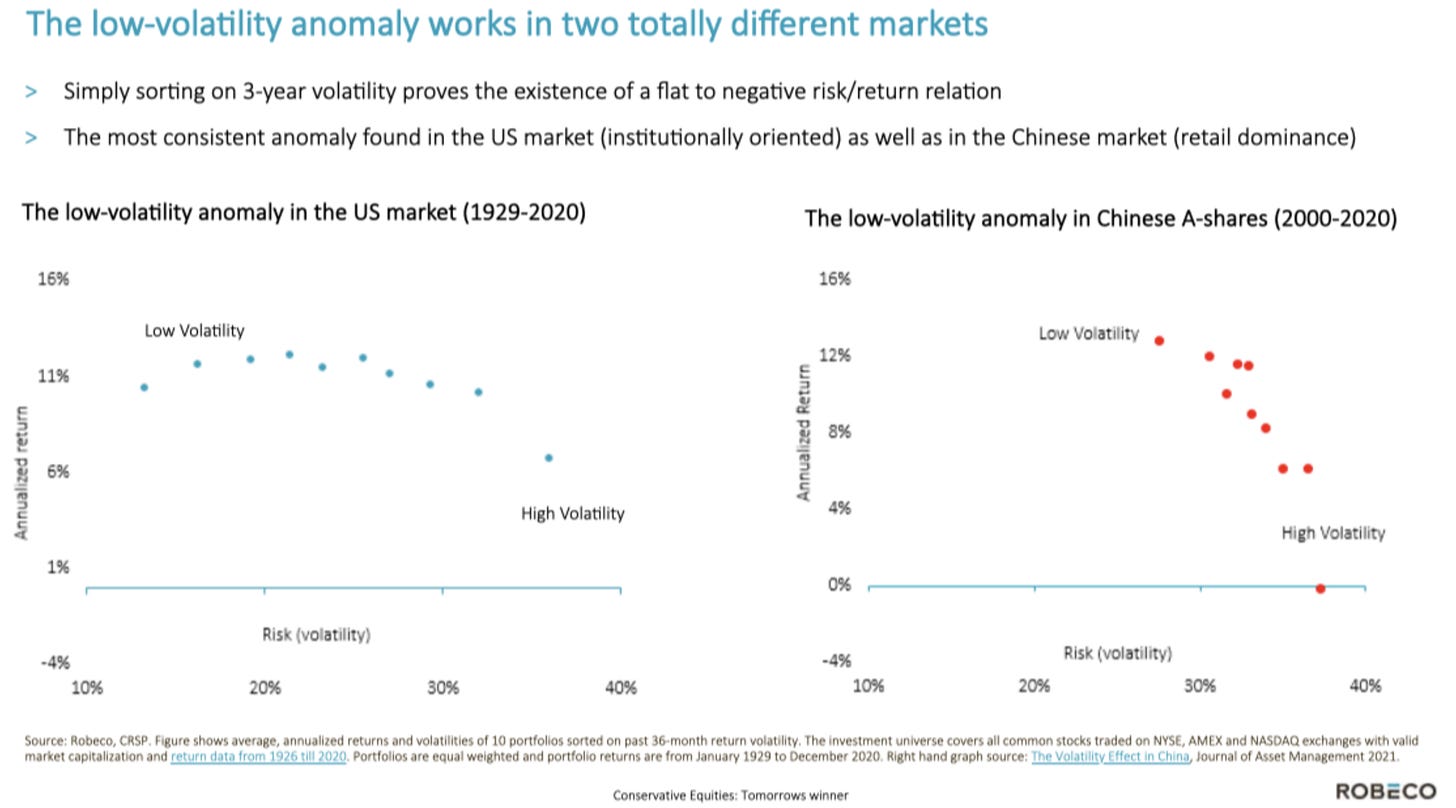

Higher-quality stocks outperform lower-quality stocks: it doesn’t seem counterintuitive but shouldn’t this be priced in already? The quality proposition resonates to one of the most powerful stock market paradoxes: the concave return-risk profile.

More risk-taking does not correspond with a linear return relationship (measured on a rolling long-term basis and based on a wide basket of stocks). It’s about generating high risk-adjusted returns: striking a balance between a company’s future growth prospects (which drive your effective returns) and the corresponding volatility. In other words, you could end up feeling lucky with a few high-beta stocks but a collection of risky assets will demolish your risk-adjusted performance. The steadier your return trajectory, the easier your investment career is going to be.

The following graph depicts ROBECO's ground-breaking research findings around this topic. In market environments where retail investor participation is on the rise, the effect of low-volatility investing on your long-term performance will improve drastically (both in absolute and relative terms).

As per ROBECO, conservative stocks should provide alpha during periods of stagflation, high inflation and “normal” economic growth. Moreover, on the valuation front, defensive stocks tend to outperform by losing less in the down markets, especially when the earnings yield and thus risk premium is low.

Managing expectations

The above outlined paradox applies very well to serial acquirers. We highly recommend you reading our first Substack post on this topic.

The Rinse-And-Repeat Strategy of Serial Acquirers

Introduction When searching for Compounding Tortoises, serial acquirers have proved to be a good starting pool for further screening. Coupled with organic growth, these vehicles can keep on growing at a double-digit clip, just by acquiring new companies

There’s a reason why Constellation Software has been the world’s best serial acquirer in terms of risk-adjusted returns: steady growth, attractive economics of VMS businesses, a pretty constant deal volume and very sticky shareholder base (at least that’s what we have concluded from the daily/monthly/yearly turnover).

For industrial serial acquirers, interest rate fluctuations and economic shocks could delay future growth prospects thereby inducing higher levels of volatility. We saw this movie during most of 2022.

Just compare the last 5 years’ drawdowns for Constellation to Indutrade’s, Diploma’s or Lifco’s, especially during 2022 and 2023. Constellation’s valuation multiple has remained pretty stable over the past 5-7 years, although it shot up remarkably during 2023 as investors cheered the highly accretive Black Knight deals.

We’re not necessarily saying that share price volatility is a bad thing but it naturally reflects more volatility in growth expectations (and thus investors becoming either ecstatic or miserable about a company’s future return profile).

There isn’t a defense against drawdowns, they’re part of the long-term game. However, ask yourself: does higher share price volatility reflect permanent changes in a company’s growth outlook (more uncertainty, lower ROIC) or is it just noise (which you’ll should take advantage of). Remember: businesses constantly change (some faster than others).

Being cognizant of volatility is especially helpful when you’re still accumulating capital. You want to maximize the total IRR over your investment career. Your income will not be put to work all at once. You want to periodically invest for very satisfying future returns, period. Nobody wants to pay an egregious price; there should be a margin of safety embedded in your growth forecasts and long-term investment horizon.

As Mark Leonard said in his 2011 letter to shareholders:

Moving on to the “manage the stock versus manage the company” issue… I used to maintain that if we concentrated on fundamentals, then our stock price would take care of itself. The events of the last year have forced me to re-think that contention. I’m coming around to the belief that if our stock price strays too far (either high or low) from intrinsic value, then the business may suffer: Too low, and we may end up with the barbarians at the gate; too high, and we may lose previously loyal shareholders and shareholder-employees to more attractive opportunities.

I think we all now acknowledge the importance of managing our stock into a price range where we neither invite another Process, nor encourage our employee shareholders and long-term investors to liquidate their holdings. I don’t think it will be difficult to keep our stock price marching in lock-step with the intrinsic value of our company. The board and I just have to be conscious of doing so.

This is effectively managing the expectations treadmill. Great quality growth companies manage to set already ambitious goals that are still beatable… We’ve highlighted this with Sanlorenzo.

Sanlorenzo: Underpromise and Overdeliver

Look for steady compounders Companies that underpromise (but already set a nice target) and overdeliver are the ones that make up the bulk of our portfolio. By keeping market vs. realistic management expectations in check (the so-called expectations treadmill), valuation multiples become stabler and that’s a good thing to sleep well at night.

This way, investors can continue build wealth in their concentrated portfolio knowing short-term intrinsic value is relatively good on par with the current share price. That’s the short-term view at least.

Underestimation of winners that keep on winning

Quality growth companies outperform because of analysts’ under-appreciation of durable long-term compounding in underlying earnings. As such, these companies are in fact long-term value stocks. They've outpaced our expectations, allowing us to earn returns way above our hurdle rate. The trick is to keep compounding your cash flow, NOPAT... through good times and bad. Steadiness over volatility. Financial prudence over irresponsible leverage. When the going gets tough, the tough get going.

Forecast data show that financial analysts are, on average, too pessimistic regarding the future profits of highly profitable companies. This gives rise to the profitability anomaly, which they also find to be particularly strong for firms with persistent profits. As we mentioned earlier, ROIC normally doesn’t mean-revert. Quite the opposite is true for high revenue growth rates.

Our “Compounding Tortoises” are businesses that have already won in their respective industry and on which we have a relatively strong conviction for continued long-term success. Return on Capital is the secret sauce for longevity.

In general, rapid revenue growth combined with low returns on capital leads to significant share price volatility. For this reason, we avoid high-growth or speculative stocks that may be popular at the moment; they don’t align with our goal of generating stable returns. Additionally, investors often overpay for these underperforming companies.

How to weather the next storm(s)

The above highlighted elements represent a basket of criteria to build a concentrated high-quality growth portfolio:

Transparent accounting

Management skin in the game

Under-promising and over-delivering

Controlling for the expectations treadmill

No or very low dilution through share-based compensation

The economic backdrop remains challenging, risk happens fast and that’s why we’ve further streamlined our portfolio last week. Ultimately, we believe our Substack’s added value will only increase by focusing on the companies we know best and applying our practical and common-sense framework to creating long-term shareholder value. Providing generalist information? It wouldn’t be the right thing to do from a long-term perspective and it would juxtapose with our objective to create an outstanding community of Tortoises who are eager to learn more about enhanced quality-investing and entrepreneurial best practices.

Over the past four years, we’ve been through several economic shocks, some of which have permanently changed business return profiles and value creation opportunities. Higher inflation, severe drawdowns and volatility and retail investors still choosing fancy growth stocks over robust boring cash flow compounders. That won’t go away anytime soon. Fortunately, this environment should bode well for our strategy over time.

Putting it succinctly: you don’t need AI or explosive growth stocks to make serious money in the stock market.

Keen on learning more about our thorough research process and portfolio of quality compounders?

Excellent!