Why the ROIIC + Growth + FCF Optionality Framework is Underappreciated

Preserving compounding during the tough times: a couple of excellent and not so excellent examples

Last week, we shared a first blog on reverse thinking and why we opt for high-quality companies, which we’ve further detailed in the bi-weekly webinar.

The primary goal of that article is to make us wary of what could adversely impact our original thesis and modeling. Enhancing this pattern recognition should help us narrow down our investable universe, and it’s worthwhile doing this after quite a few years of volatility.

In this blog, we’d like to highlight the ROIIC, growth and free cash optionality framework. These three factors are linked directly to each other, and over time, they’ll help us understand why compounding is such strong mechanism. We’ll illustrate this with two of our overweight positions (one of which is Harvia), as well as two businesses we consider un-investable for our investment strategy.

As you know, we seek steady (>10% annual growth in NOPAT per share) wealth-creating machines, underpinned by high returns on incremental invested capital. Just growing EPS or NOPAT tells us little about longevity. By adhering to the ROIIC, growth and free cash principles, we look for companies that preserve their positive compounding especially during tough times.

While quality investing has always been some sort of a backward-looking momentum strategy (picking companies that score well at that point in time), we believe investors should set the bar much higher and end up with an investable universe of no more than 20 names.

A large part (+/- 80%) of this blog can be read for free. If you want access to the full article as well as our deep dives, feel free to join us. As a reminder, annual members have exclusive access to our Discord.

Harvia’s ROIIC and Organic Reinvestments

Let’s illustrate high ROIIC and shareholder value-creating growth with one of our overweight positions, Harvia (rated “STRONG BUY”). We shared our Q1 earnings recap two days ago.

Off note,

put out an article on Harvia yesterday using screeners’ info. In our research, we never use screeners, and we’d like to remind investors why:→ the high goodwill is mainly related to the acquisition/restructuring of Harvia Oy/Harvia Finland into the Harvia Group; it’s a one-off event.

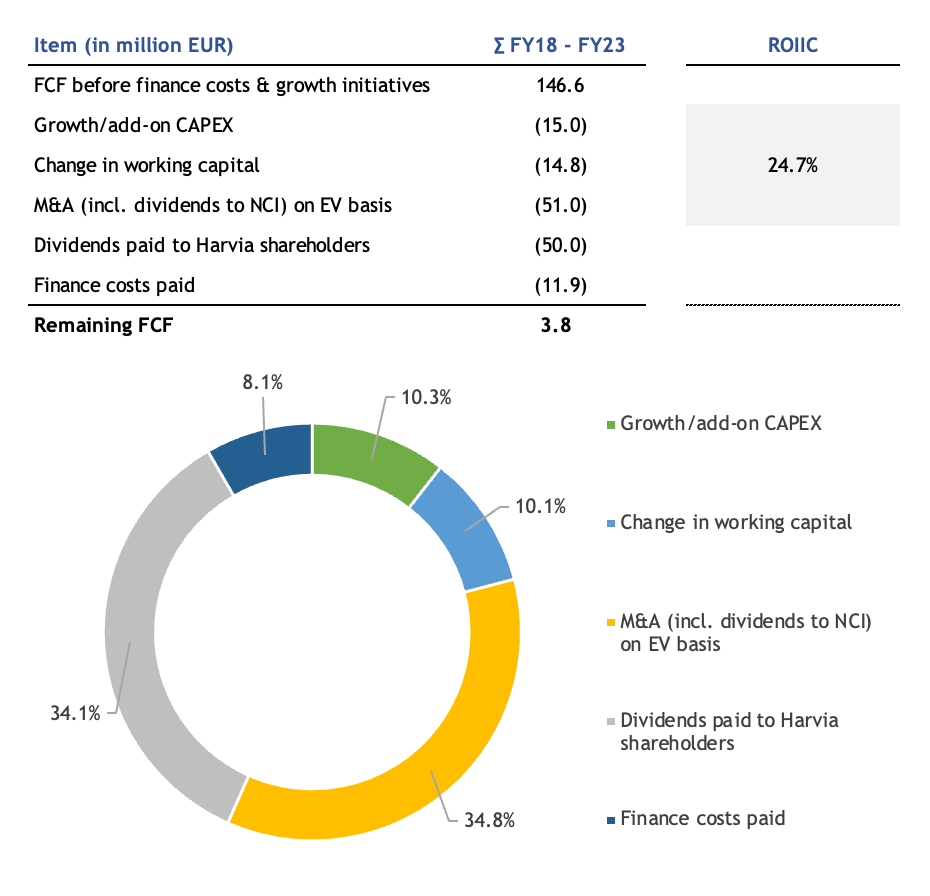

→ reported ROIC is off completely, and we’d better focus on incremental returns. The past is the past. Harvia’s underlying organic ROIIC is mid-thirties percent, and total ROIIC has been 25% over the period FY18 - FY23 including M&A which typically has much lower returns vs. organic growth. This is shown in the below overview we shared in our deep dive.

The Compounding Tortoise

→ net income is impacted by non-cash amortization of acquisition-related intangibles, similar to Constellation Software, Topicus, Lifco…

→ net income is also impacted by depreciation of one-time growth investments, underlying CAPEX intensity is a lot lower than what’s shown in D&A; better use steady-state NOPAT to figure out valuation

Taking the above into account, diving deep into the company’s capital allocation and growth trends (factoring in the post-COVID period) reveals a totally different picture.

Based on our assumptions of a 35/36% organic ROIIC, future revenue growth, and including some bolt-on M&A at not so low valuations, the projected CAGR is 13.8%. Excluding M&A, the outcome is 12.1% (at a 47.00 EUR share price). Put another way, if your return goal is to make 15% per annum, then Harvia doesn’t make the cut right now. If your goal is to make 11-12%, then today’s price is attractive.

The Compounding Tortoise - Harvia’s Valuation

Note: Harvia's steady-state NOPAT and the way we've computed it: (EBITDA - maintenance CAPEX (including lease repayments) ) * (1 - 0.23 (tax rate) + net income from associates - net incomes destined to NCI. We don’t want to punish a company based on higher D&A related to one-time growth investments that require few maintenance CAPEX.

In Harvia’s case, the organic reinvestment rate comes in at 35-38% over the next four years, driven mainly by changes in working capital. As can be noted, growth CAPEX for FY25 are projected to be lower vs. FY26 as the company still has leftover capacity versus at the end of 2021.

It also means that today’s reported rolling ROIC is still depressed by underutilization. When thinking about ROIIC, we look for steadily growing business that can maximize the incremental NOPAT output on new investments, hence we model ROIIC based on a high utilization rate.

Lower ROIIC and the Implications on Shareholder Returns

Let’s now assume the following hypothetical (it’s by no means reflective of today’s situation):

projected revenue growth rate remains unchanged;

working capital-to-sales ratio remains unchanged;

dividend payout remains unchanged;

but: ROIIC drops to 15%, pointing to the fact that Harvia has become a more capital-intensive business with a lot of replacement CAPEX required.

One could also change the working capital-to-sales ratio to reflect the lower ROIIC. From our experience, it leads to even worse results as inefficient working capital management leads to a significantly more volatile cash profile.

Without doubt, the 15% ROIIC is a significant step change, and it results in six headwinds to shareholder value creation:

less attractive growth efficiency vs. other businesses (i.e. Harvia’s investment case has become less unique);

maintaining the dividend payout means that Harvia’s net leverage will increase, along with its financial charges;

lower exit valuation vs. our base case of 19x NOPAT;

Harvia’s stock is now trading at a higher valuation multiple, as recurring investment spend has increased notably;

lower FCF optionality to accelerate growth investments (whether it’s through SG&A or tangible capacity investments and/or M&A);

higher risk of being hit very hard by a downturn. As we stated in last weekend’s webinar, starting with a 35% ROIIC based on a 95% utilization rate means that even at a 50% utilization rate, the investment will still be quite accretive. Versus other consumer discretionary COVID winners, Harvia’s high ROIICs allowed it to maintain healthy profit margins and good payoff on FY21’s growth investments during the 2022-2023 post-COVID normalization.

The Compounding Tortoise - Harvia’s Valuation

Now, drumroll, the CAGR comes in at 6.8% or likely below 6% when including dividend taxes. That’s not anywhere close to the 11-12% shared in our base case.

It’s fair to say that, over time, most quality growth business with steady growth, high ROIICs, free cash optionality, and proactive excess cash allocation are effectively grossly undervalued relative to low-ROIIC companies whose management teams believe growth will yield strong return.

While one cannot get ROIIC exactly right, the margin of safety is in a high starting ROIIC, also necessary to fend off competition (as, under most circumstances (in tangible industries), there’s no incentive for a low-ROIIC to take share aggressively).

Cash Included in ROIIC?

A very relevant question:

Does invested capital include or exclude cash?

When we're looking at ROIIC/ROIC, we're interested in how much incremental NOPAT growth investments will yield. If we include cash in that invested capital number, it would seem that cash is an investable asset. A growing or declining cash balance is a consequence of management's prudence, timing of investments not being executed shortly, timing of debt repayments et cetera. For instance, Ferrari has to repay its Euro Bond with an outstanding amount of 456m EUR in May 2025. So, we fully exclude all cash when thinking about the attractiveness of ROIIC since it's an operating metric.

However, we look for companies that have stable working capital dynamics and generate solid free cash flow. Any quarterly/seasonal cash outflow in working capital is expected to be funded through other operating cash flow. The following quarter, that situation could then reverse.

We think the most extreme example of proactive cash management is O'Reilly. We remember clearly the analyst's question on "share repurchases/cash returns to shareholders, as the cash balance has come down quite a bit" in July 2022. Many retailers were crumbling and O'Reilly kept executing.

O’Reilly’s Reporting

At O'Reilly, you get an 18-20% ROIIC, rolling ROIC on their existing network of >50% (insane how defensive businesses, accumulating same-store sales growth), and all free cash being returned to shareholders (while keeping interest expense fairly under control).

Adesso - Volatile FCF, Increased Lease Debt and Rising Financial Charges

Let’s now look at a company that’s uninvestable for our strategy: Adesso, a leading German IT solutions provider. The EBITDA growth imperative is likely to attract many sell-side analysts. Meanwhile, we’re particularly concerned about:

for a long time, management didn’t take high recurring high lease repayments into account;

poor working capital management;

increased financial charges

Adesso’s 2024 Annual Report

On a reported basis, Adesso’s net invested capital excluding goodwill stood at approximately 360m EUR as per December 31, 2024. Reported EBITDA was 98.3m EUR. When deducting 45m EUR in recurring depreciation (leases and CAPEX) and normalized taxes at 30%, NOPAT stands at 37.3m EUR. This translates into a 10% rolling ROIC. One could debate on the 45m figure, but it won’t move the needle much.

Let’s now break down Adesso’s past four years’ cash flow picture, which has been volatile. Negative free cash flow leads to incremental borrowing and/or share issuances.

In the below table, we’ve explicitly calculated the ideal/perfect Free Cash Flow many analysts are sticking to (some of them aren’t even deducting lease repayments and/or interest charges over the forecast period).

Adesso SE’s Cash Flow (Reconciled by The Compounding Tortoise)

While we prefer our own NOPAT approach to figure out steady-state valuation, we’d be very reluctant to using it for companies with a heavy debt burden, high interest charges, and volatile cash flow. As for Adesso, total interest-bearing debt was 331m EUR at the end of 2024.

After M&A, total recurring free cash flow has been a negative 9.3m EUR over the period. Clearly, the company reinvested a lot back into the business, but at which returns?

EBITDA grew by 17% over the period FY21 - FY24. The share price didn’t track this seemingly positive performance. Similar to what we wrote about Delta Plus, incremental returns have been poor. Even if a company grows, the market will eventually figure out whether it’s been good growth. It’s a crucial lesson we learned before we became intensely focused on high-quality companies.

Marketwatch

High ROIICs and Growth Still Yield Excess Cash - Buyback Optionality

Contrary to popular belief, in of and themselves, buybacks don’t create shareholder value. They’re an excess capital allocation decision, and if you control for the quality factor and favorable timing, there is no meaningful alpha vs. shareholders reinvesting their dividends.

Timing could play a role as buybacks can be ramped up during sharp but short-lived share price corrections. Autonation has been an aggressive share repurchaser, but over the period FY11 till FY18, the stock didn’t go up as cash from operations didn’t grow materially, while its EPS increased >4x. ROIIC and growing the top-line, EBITA are the key factors to watch.

Autonation’s Stock Price - MarketScreener

That doesn’t mean buybacks aren’t useful. Returning excess cash in a tax-efficient manner means our projected gross CAGRs will match our after-tax returns much more closely, compared to getting all excess cash through dividends (subject to withholding taxes).

Advance Auto Parts Has Never Gotten Near the Heels of AutoZone or O’Reilly

We’ve talked about Advance Auto Parts previously, and since August last year, value investors hoping for a rebound got a reality check with another 36% haircut.

In the long term, they aim to maintain a 2.5x ratio, which is crucial for staying investment grade. However, even with the $1.2 billion cash inflow from the Worldpac sale, the medium-term free cash flow and dividend payments won’t bring them below 3x anytime soon. So, where will the capital for reinvestment, such as DC development or stock buybacks, come from?

Lastly, on profitability, cash rent expenses increased by nearly 4% year-over-year ($23 million), consuming 10% of the projected EBIT. Wage pressures persist, and retaining talent is becoming increasingly challenging.

In conclusion, Advance Auto Parts is in a difficult position due to operational and financial struggles, and we doubt its ability to meet its updated full-year targets.

From Advance’s 2021 investor day, it’s fair to conclude that its management team was totally overconfident, calling for margin expansion at a time when industry stalwarts AutoZone and O’Reilly became conscious about understaffed/overly efficient store operations. They already understood that further margin expansion would limited.

Advance’s 2021 Investor Day

Over the period FY19 - FY22, Advance bought back a lot of stock, but it didn’t pay off as margins crumbled, working capital headwinds emerged amidst higher inflation, slower-turning inventory, and lack of 100+% accounts payable-to-inventory ratio. To this date, Advance’s management team believe they should be capable of somewhat bridging the gap with AutoZone and O’Reilly. It’s a very daunting task as the company’s been losing share for the past several years.

Three-Year Comp Stacks (Compounded) for the Auto Parts Retailers (The Compounding Tortoise)

That doesn’t necessarily make the industry leaders compelling investments right now. As we noted last month, we’ve grown cautious on O’Reilly’s growth outlook for the first time in many years. While the company has been a powerful share buyback machine, its stock is now trading at historically high multiples at a time of still operating deleverage (which is quite atypical for the Springfield-based retailer).

It’s more prudent to acknowledge this downside risk today than to issue a downgrade after the stock has already declined. It’s all about expectations and how they’re being priced in by the market.

Let’s take a closer look at our largest position where buyback optionality is an under-appreciated tool to keep delivering shareholder value creation during volatile times.