Constellation Software - Analysis of Q4 23 and FY 23

Record M&A activity and Altera turnaround in the making?

Another article on the CSI family. Yesterday, Constellation Software reported Q4 and full-year 2023 results. We’ve previously discussed some of the free cash flow drivers in 2024 to get a better sense of the upcoming corporate events (i.e. preferred dividend for Lumine and subsequent conversion) and timing effects related to the Black Knight acquisitions.

Special events

Remember: Constellation’s balance sheet (with a reported NCI portion), income statement (and a separate line for net income to NCI) and cash flow statement are fully consolidated. Given that the spin-out companies already got their own listing and CSI’s direct economic ownership in them isn’t 100%, we should be mindful of some one-off events (the WideOrbit deal) and distinguish the CSI standalone performance from Topicus’ and Lumine’s M&A activity (although CSI still retains a significant economic stake in them and thus captures the recurring FCF from their growth strategy).

Headline numbers

Without further ado, let’s jump into the headline numbers before reflecting on some forward-looking items and the current valuation. Let’s start with Q4 2023:

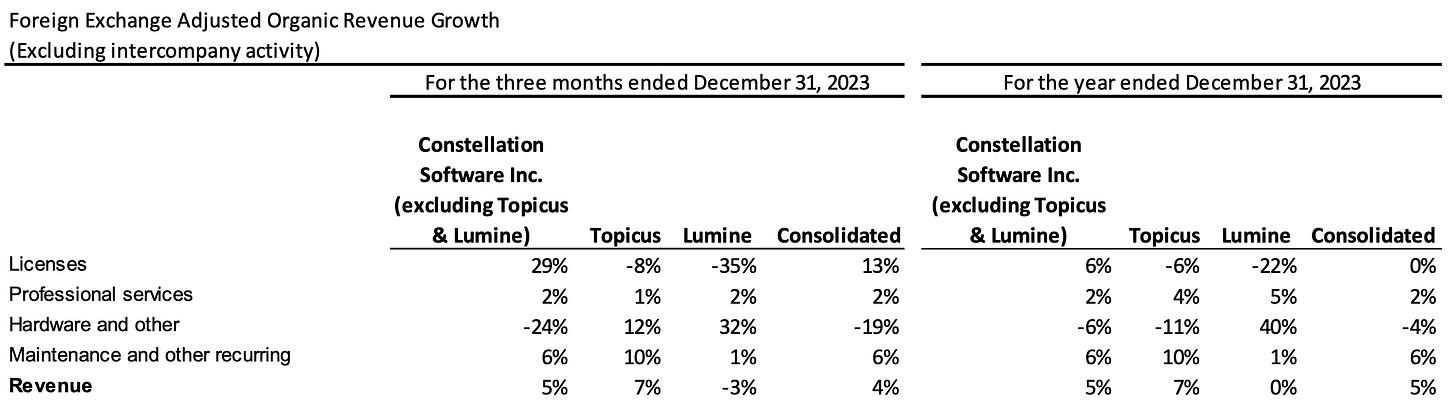

Organic revenue growth at +4% (constant FX) driven by 7% reported organic growth in maintenance and other recurring (should be 5% at constant FX then)

Total revenue growth at +24% (constant FX)

FCF available to shareholders up 12% year-over-year to 325 million USD

Completed acquisitions for a total cash consideration of 463 million USD incl. deferred payments (typically acquired cash offsets acquired debt items (incl. lease liabilities))

After two years of flat FCFA2S growth, CSI reported a strong +36% to 1.16 billion USD. The other highlights in FY23:

Total revenue growth at +27% (constant FX)

Total acquisition spend at 2.6 billion USD

EBITA margin of 24.3% was up from 2022’s 23.5%

Remember, CSI is a fully-consolidating entity so we should be mindful of certain one-off events, mainly the WideOrbit acquisition and large deals for Lumine. Given that CSI didn’t have a direct economic ownership in Lumine throughout 2023, we’d better not stack CSI’s realized FCFA2S against the reported M&A spend to figure out the underlying reinvestment rate for CSI on a standalone basis.

Of the above highlighted M&A spend (total consideration incl. the effect from getting the promissory note in the structured Black Knight deals):

143 million USD relates to Topicus.com;

504 million USD relates to Lumine: acquisition of WideOrbit;

Acquisition of Titanium Software for a total consideration of 36.5 million USD (Lumine);

Acquisition of Synchronous for a total consideration of 38.4 million USD (Lumine);

Reversal of considerations paid for WizTivi and Morse Holdings of -1.9 million (Lumine);

M&A deal volume for CSI standalone (consideration paid and to be paid in the future) was 1.887 billion USD, of which 905 million relates to the Black Knight deals (Empower and Optimal Blue). That’s the assumed number, because in fact, CSI paid only 40 million USD in cash for Empower.

FCF growth in FY24

Still, there’s no denying that 2023 was a record year on many fronts. Also, the Black Knight deals contributed very little to CSI’s results in FY23.

On top of that, CSI took advantage of two forced carve-outs at Black Knight: Empower and Optimal Blue, which we believe is the result of many years in becoming a trusted long-term partner and a one-stop shop for special situations. CSI acquired both companies for an aggregate 742M USD, or less than 6 times LTM EBITDA. Our guesstimate is that these acquisitions will achieve approximately 110M USD in FCF for 2024, with significantly higher margins and organic growth than the average CSI business on top. Remember that CSI finalized these deals at the end of September 2023, so the year-over-year contribution to the 2024 FCF should be somewhere in the 7-9% range (compared to 2023).

As a result of the upcoming Lumine conversion and Black Knight deals, reported FCFA2S is set to increase by 13-15% alone in FY24, on top of what could be 15+ % growth from other M&A effects and 3-4% organic growth. Another 30%-FCF-growth year in the making? It seems.

We’ve already set out the ambition for strong M&A activity in 2024 in our Topicus.com earnings analysis. It’s not just Topicus.com; the whole CSI ecosystem is off to a great start in FY24 (note: below numbers are in millions).

How’s Altera been doing? In 2022, CSI’s Harris Operating Group completed the Allscripts deal for a fair multiple of 8x operating cash flow. Honestly, we didn’t know what to make of this acquisition as it experienced organic revenue shrinkage. However, for the first time since CSI took over, Altera posted positive organic growth of 4% (+3% for maintenance).

On the profitability and cash flow side, it’s even better: 33 million USD in FCF in Q4 and a total 94 million USD for FY23. EBITA margin came in at 17.5% in Q4 and 14.1% for the full year. Clearly, the turnaround (or at least stabilization) is gaining traction, supporting our investment thesis for redeployment of capital in all sorts of VMS businesses (be it organically declining or growing subsidiaries).

In terms of financial liquidity: considering all debt items (excl. the IRGA liability) and the total FCF on a fully-consolidated basis (given that we’re looking at CSI’s total consolidated debt items), FCF of 1.485 billion USD (excl. the IRGA revaluation) covers net debt of 2.066 billion USD pretty well (1.4x leverage). The CSI family possesses significant financial scope to continue its acquisition journey.

Valuation

What about valuation?