Constellation Software's 2025 AGM: Full Summary

On style drift, IRRs on acquisitions, Altera/Allscripts, and CSI's stock market valuation

The day after releasing its Q1 results, CSI held its virtual Annual General Shareholders’ Meeting. This once-a-year event offers a rare opportunity to hear the company’s executives reflect on the past and share their thoughts on what the future may bring.

Without further ado, let’s give you a full overview of the main takeaways, along with our personal thoughts. There are just so many lessons to learn from CSI’s AGMs and apply them to running our investment portfolio.

As per usual, many of the executives’ answers to the questions reflect a healthy dose of humility. Whatever happens, happens, and we’ll keep learning from our decisions. The opening remark from Mark Leonard on the remaining M&A opportunity was this:

So historically, we haven't done a great job of predicting how long the runway is. And so use that as context. And whatever I say probably isn't based on great experience forecasting.

M&A Runway - Broadening the Pool of Opportunities

The first M&A question was addressed to Mark Leonard:

CSI has historically been able to deploy the majority of its free cash flow and acquisitions that meet its hurdle rates. As CSI and its free cash flow continue to grow, does the company continue to have a long runway to be able to do this moving forward? And if so, how long the runway seems reasonable/predictable?

As we’ve talked about in our deep dive, one of CSI’s most solid competitive advantages is that they’ve doing this for multiple decades. Hence, they have a lot of data to rely on, while testing and learning what works well and what doesn’t (see further below). For instance, every quarter, the Board will profile a venture-backed VMS disruptor that’s gotten traction over the years, as many of them haven’t, to garner any useful learnings on organic growth, and overall strategy.

Leonard’s response to the above question was:

When we look at the marketplace, I think we do a reasonably good job of covering and knowing about the acquisitions that happen in our space. And the amount that we succeed in acquiring does not feel uncomfortable to me.

Now, that doesn't mean that we're always the acquirer of choice. We lose far more than we win. And we end up having to follow literally tens of thousands of acquisition prospects. We're adding to that base every year of prospects that we follow. But the quality of the additions in our funnel is nowhere near as good as it used to be, say, 10 years ago. 10 years ago would have been vertical market software tightly defined.

It would have been in geographies that we knew and loved. Nowadays, it tends to be much more far-flung geographies. And it's less tightly defined. We will look at horizontals. We will look at hybrid software hardware companies. We'll look at hybrid software data companies. You'll see that we're experiencing what investors call style drift. And that's frequently associated with less good performance. So today, we haven't seen that less good performance.

We're still hitting the hurdle rates that we set as we attempt to deploy our capital. And it's useful to put our capital deployment history in context.

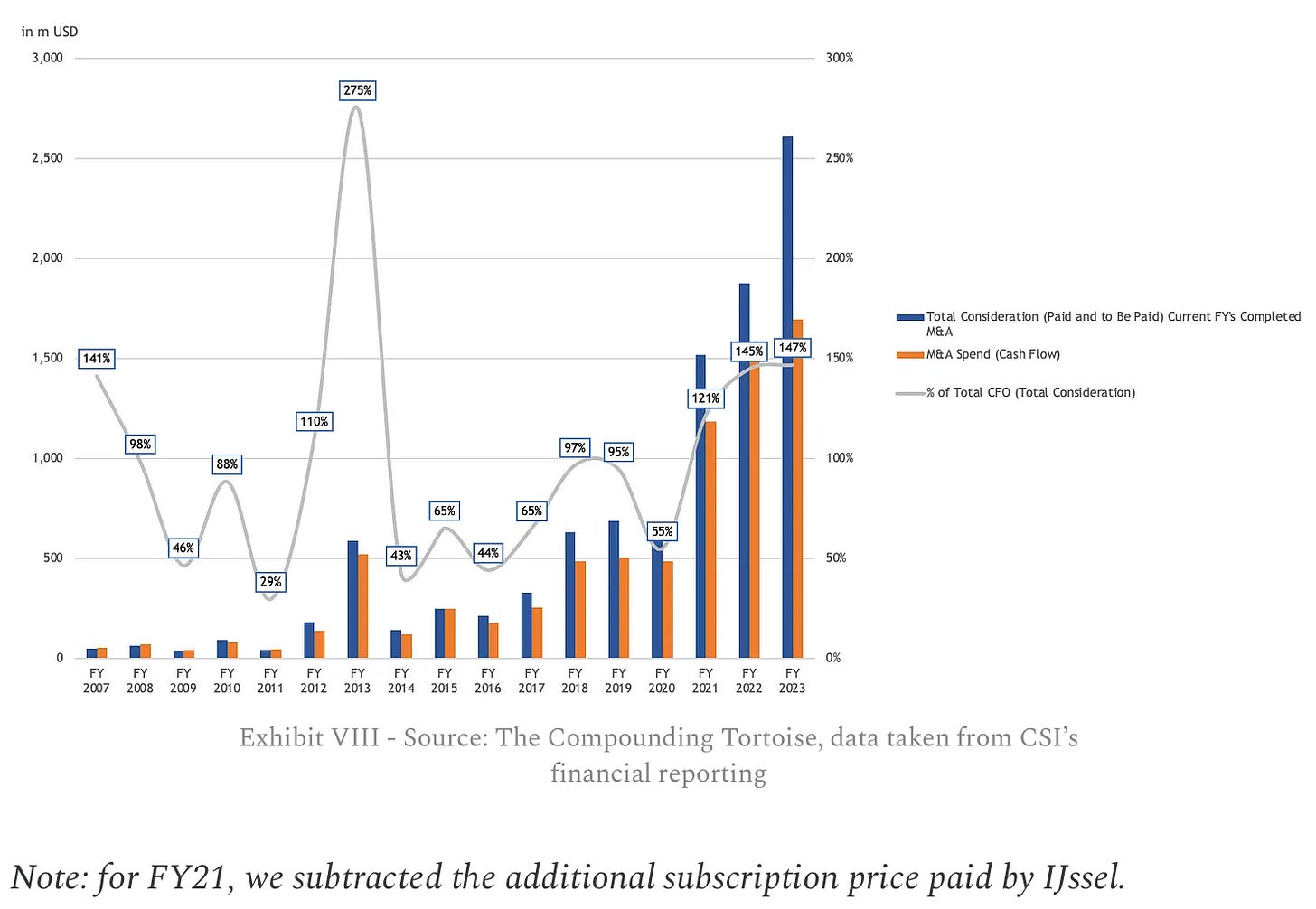

So the last four years, we've deployed over a billion dollars of equity in each of those years at what we believe are high rates of return. It certainly seems so when we deployed it. And we do track it every quarter thereafter. And there's no sign that it's deteriorating any worse than any previous vintages that we've seen.

Taken from our deep dive, the total consideration takes into account the equity portion in the newly created spin-out companies (TOI, LMN) paid to IJssel BV and WideOrbit vendors (see below). The cash flow impact reflects the actual cash outlay on M&A. Relative to cash flow, the reinvestment rates have recently hovered around 90-100%.