Dissecting the US’ Outperformance Since 2010

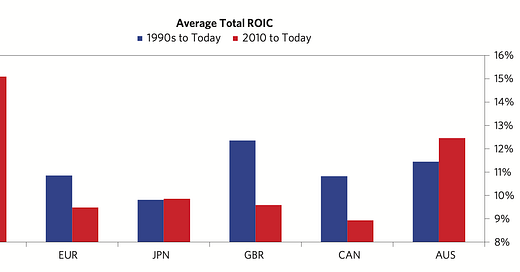

ROIC, profit margins, shareholder-friendly policy, and significant multiple expansion

Welcome to another weekly digest to stay informed about everything that matters most to quality growth investors!

The goal of these digests:

to elaborate on premium members’ questions (you’ve provided some great inspiration for future posts and deep dives, thanks for that!);

to have a high-level discussion on some macro events;

to elaborate on some fundamental topics;

to talk about portfolio strategy;

to highlight a research piece that may be of interest to our members;

In case you’ve missed our previous articles/webinars/earnings recaps/deep dives:

In this digest, we’d like to take a high-level view on market expectations and past returns for US stocks vs. RoW (Rest of the World), and what’s been driving performance since 2010. Also, what do we think about valuations going forward?