🐢 The Best of The Compounding Tortoise

About Return On Invested Capital, business quality, the Art of Valuation, and much more

Reflecting on past investment choices, finetuning your strategy, keeping an investment diary, and determining what aligns with your risk tolerance and emotions - these are key steps to building a solid portfolio tailored to your goals.

Year-to-date, we’ve published close to 170 articles, webinars, earnings recaps, deep dives on what we call enhanced quality investing.

That’s a lot of content, so where does one get started?

Aside from our deep dives, earnings recaps and “Letters to Our Partners”, here are the 10 must-read articles and must-watch webinars that discuss the key pillars of our strategy: longevity, ROIIC, valuation, business quality.

(click on the titles to get directed to the article/webinar)

1️⃣ Will Our Quality Growth Companies Mean Revert?

As quality growth investors, our focus is straightforward: we seek growing companies. But how much growth should we aim for, and which growth rates are prone to mean reversion? While exceptional growth often reverts to the mean, the opposite is typically true for ROIC, which remains a key factor in sustaining steady shareholder returns. If our companies can reinvest a bit more than anticipated, it will provide a notable upside to initial assumptions.

As McKinsey’s book on Valuation states:

The returns of the best-performing companies do not decline all the way to the aggregate median over 15 years. High performing companies are in general remarkably capable of sustaining a competitive advantage in their businesses and or finding new business where they continue or rebuild such advantages. This pattern is stable over time - even over the most recent 15 years, which included the 2008 credit crisis. Since a company's continuing value is highly dependent on long-run forecasts of ROIC and growth, this result has important implications for corporate calculation. Basing a continuing value on the economic concept that ROIC will approach the weighted average cost of capital (WACC) is overly conservative for the typical company generating high ROIC.

The article highlighted the stability of value creation, providing practical examples of companies within our portfolio to illustrate this concept.

It’s unrealistic to believe that a company with a 30% organic ROIIC can indefinitely reinvest all excess cash back into the business. Eventually, the law of large numbers will catch up, with the size of investments causing delays before incremental invested capital starts impacting the top line and NOPAT. At some point, the company would outgrow its total addressable market, and ultimately, the broader economy. Of course, it’s preferable to have a 30% ROIIC with a lower reinvestment rate than a 10% ROIIC with a 100% reinvestment rate. Higher inflation and supply chain issues would erode the latter strategy, leading to increased volatility in stock prices and making it difficult to forecast reasonable assumptions.

2️⃣ Will Stock-Picking Outperform Treasuries?

A very interesting discussion based on Hendrik Bessembinder’s, a professor at Arizona State University, study which examined the lifespan, returns, and contributions to total market capitalization of stocks. The study concludes that the average stock investor is unlikely to outperform short-term investments such as U.S. Treasury bills. Only a small number of stocks perform exceptionally well and generate the majority of the returns in the stock market.

Surprisingly, even during the period of robust economic growth from the mid-20th century to the Global Financial Crisis (GFC), most listed businesses were unable to deliver attractive long-term returns. Consequently, if an investor did not allocate sufficient capital to the small number of high-quality, structural growth companies that generated most of the long-term returns, it was challenging to outperform the risk-free rate.

Therefore, it’s interesting to analyze what’s made the underperformers underperform? Analyzing losers, volatile growers, and the reasons they suddenly fail adds much more value than focusing on contemporary success stories and trying to predict the next explosive winner. For quality investors, it's about selecting past winners that will continue to perform well in the future, thereby yielding (abnormally) high risk-adjusted returns.

3️⃣ Sources of High-Quality Growth

Companies can grow too quickly with several hiccups and thus subsequently higher volatility in their share prices. High growth rates are like a honey jar: they attract competition, tend to lead to reduced returns for all parties looking to get a bigger piece of the pie.

Plus, there’s plenty of empirical evidence that fast growers (or at least, investors expect them to meaningfully accelerate top line growth, i.e. the expectations treadmill) are prone to severe overvaluation. It’s not just about timing a reversal in sky-high growth rates but also factoring in the potentially devastating impact from substantial multiple contraction. Research conducted by McKinsey demonstrates why boring wins the race.

This article discussed sources of high-quality growth, and how high ROIC companies can keep growth initiatives going for quite a long time.

4️⃣ Why Excellent Working Capital Management is So Underrated

What Einstein said about compound interest (he who understands it, earns it… he who doesn’t, pays it) is applicable to very working capital efficient companies. And our portfolio holdings are very good at it (to say the least). It drives proactive capital allocation, as outlined in our 1H 2024 Letter to our Partners.

As of today, our companies’ working capital as a percent of sales, on a portfolio-weighted basis, is slightly negative. That’s value creation on steroids if you manage to grow the top-line, and do shareholder-friendly things with the incremental cash inflows.

5️⃣ When ROIC is a Flawed Metric - Part II

What we’ve seen over the past years is that many capital-light (low working capital and low maintenance CAPEX) and high-margin companies managed to dramatically improve their reported ROIC. That’s obviously a testament to their effective capital management and competitive advantages, but using that ROIC as a baseline for modeling returns on future growth investments is tricky.

We’re interested in three elements:

Returns on incremental invested capital (ROIIC) excluding extraordinary events such as supply chain constraints leading to year-over-year volatility (although a structurally higher inventory position should be accounted for, i.e. lower ROIIC).

Longevity of these returns: we don’t want these returns to vanish within 3 years. Post-COVID, many commodity-based companies enjoyed unprecedented margin expansion which didn’t last. Hence, their temporarily elevated returns proved to be unsustainable, leading to - at least initially -overly optimistic assumptions on ROIIC.

Quick contribution of investments to the top-line and NOPAT. If it takes 10 years to ramp up a project that will yield an ROIIC of 20%, the final un-levered IRR will fall short of expectations.

The investment crowd has gone all-in on the ROIC narrative, but there are many moving parts: inflation inflating profits while the initial cash outlay on long-term assets (e.g. plants) remains relatively stable.

When modeling future cash flows and growth, we’re looking at the returns on incremental invested capital. That is, investment needs based on today’s so-called new-build cost.

Digging deep in a company’s asset base, cadence in prior years’ inflation and other factors lead to a more nuanced/prudent view on ROIC vs. ROIIC.

6️⃣ Our Secret Sauce to Finding Great Compounders

Rather than saying: look for high-ROIC companies and you’ll be fine, we argue that there’s a lot of hidden value in picking those that have a strong ROIC (our hurdle is >25%) and whose competition does not. “Moaty” sectors are not necessarily the best places to look for steady outperformance throughout the whole cycle (just look at tech in the 2022 bear market despite generally favorable margin characteristics, capital-light business models and growth prospects).

When you’re able to achieve an ROIC that’s double or even triple your next close-in competitor’s, you’re doing something special: you possess some unique characteristics that will enable you to accelerate shareholder value creation when reinvesting cash flows back into the business.

Operating in an industry where you have many competitors that share the same ROIC and growth characteristics can come with greater risks. The theory is that as long as the ROIIC exceeds the capital’s opportunity cost (risk-free rate and risk premium) all growth initiatives should be undertaken. Hence, there could be an incentive for high-ROIC to compensate for temporarily lower growth by investing more aggressively (lowering price) to take market share.

7️⃣ Managing Expectations: Short-Term Comparisons and Headline Numbers

Over the past couple of years, we’ve experienced several economic shocks: COVID-19, inflation, interest rates, wars et al. For most companies, these events made year-over-year comparisons quite meaningless in 2022 and 2023.

Still, many analysts and investors continued to filter through the quarterly reports, adjust their short-term valuation models to justify low or high share prices (that’s what price targets are all about) and bombard management teams with short-sighted questions (as if they had a crystal ball on what would come next). As we’re definitely going to have to withstand many more shocks over the next years, how should we deal with these external factors? How will they impact our modeled investment returns?

This year, we believe the luxury sector’s doldrums present opportunities for long-term investors who look past tough post-COVID comparisons. Now that we’ve lapped many elections’ uncertainty, there are early indications that growth will pick up in 2025.

8️⃣ Interest Rates & Quality Growth Investing

In this webinar, we talked about our deep dive on Harvia, which combines high gross margins and reinvestment spend into sales and marketing and CAPEX with an industry-leading position.

Investments in automation, economies of scale leading to permanently higher EBIT profitability… they all should contribute to a future ROIIC of >30% on an organic basis. Its competitors are well below 5%. To us, that seems to be an open goal, which has also explained the success of Old Dominion Freight Line and Copart.

Additionally, we talked about interest rates and quality growth investing, and why we don’t let them interfere with our core investment themes (e.g. VMS serial acquirers, consumer defensive, high-end luxury, speciality consumer (discretionary), defensive industrials).

9️⃣ Dealing w/ Opportunity Costs As Quality Growth Investors

A quality growth investing strategy is highly unattractive from a relative risk perspective. Steady winners tend to underperform during a rising market environment, as we’ve highlighted in previous articles. In a bear market, they won’t make us money, and relative outperformance isn’t likely to make us feel any better (losing 20% when the market’s down 30%). On top of that, there are many possible quality investments, so we should set clear hurdles to separate the wheat from the chaff.

Aside from this, some of the best quality growth companies are trading at what many believe to be excessive multiples, but don’t necessarily see these revert. On the other hand, there are other well-priced quality compounders that could very well underperform our expectations over the next quarters, or even years.

That’s the opportunity cost active investors face: which stocks to pick, and what’s the likelihood of them outperforming the market? We argue that the quality growth investing’s outperformance relative to a benchmark is a by-product; it shouldn’t be our primary focus. Our goal should be to earn our targeted absolute return goal, whilst incurring a controlled amount of risk (i.e. low risk of permanent loss of capital).

At the same time, a market cap weighted ETF has now become an effective tool to better capture momentum/hype and multiple expansion for many tech companies. In short, there are several factors that make it harder for the average investor to stay the course.

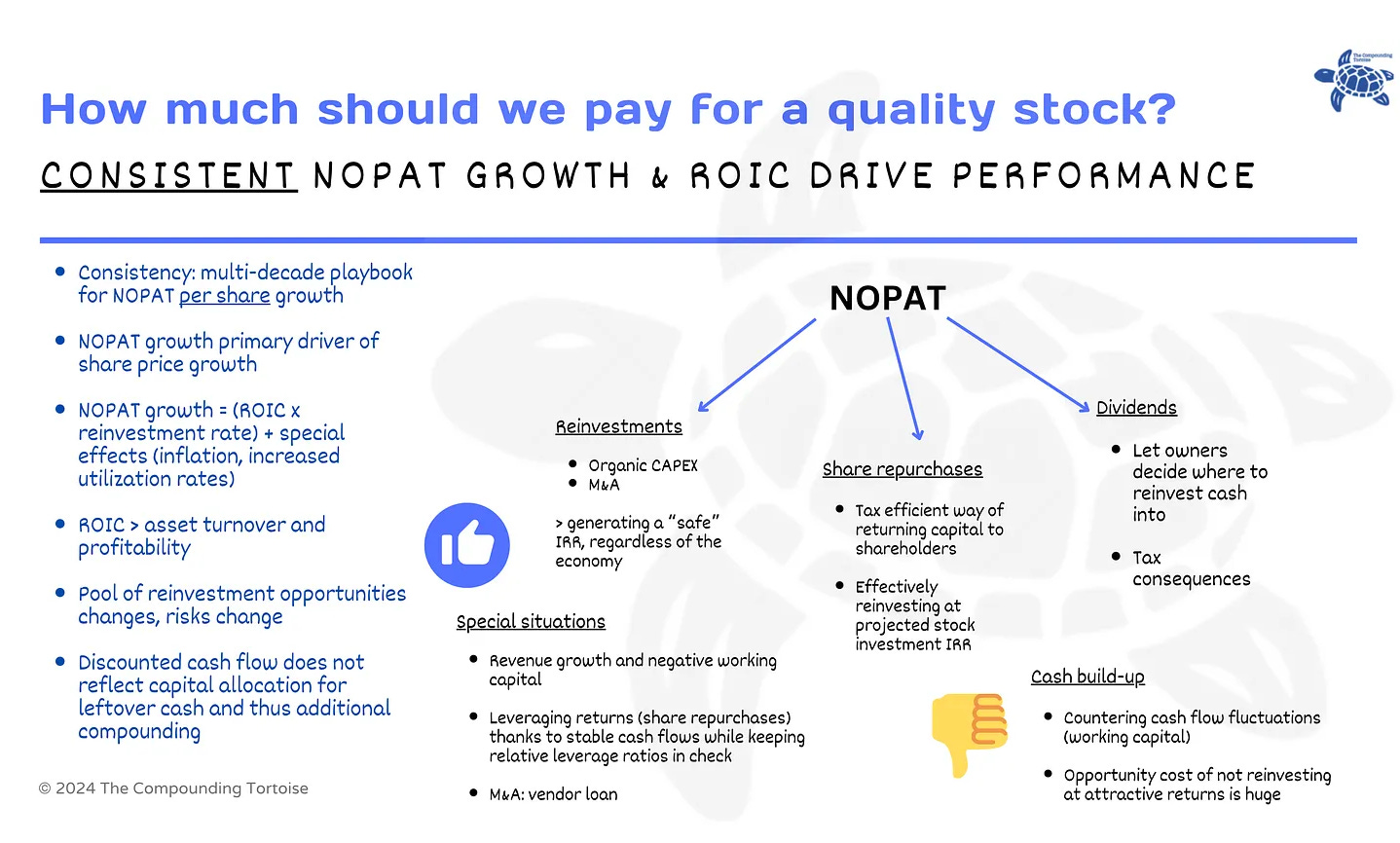

🔟 How Much Should We Pay For an Excellent Business?

Time for a new webinar which (among other items) will feature the bar graph Terry Smith has long been famous for: how much (P/E ratio) could you have paid for an excellent business and still equal the market index return? Does it make sense to do this exercise and what could one usefully deduce from it?

The key takeaway of this webinar is that evaluating different scenarios, thinking about optionality (both negative and positive), and debunking ROIC leads to a better understanding of risk vs. reward and reasonable growth expectations.

Many investors can’t model properly. They’re either overly optimistic or pessimistic (mean reversion). That’s what creates opportunities for the savvy long-term investor. Over the long run, the combo earnings growth and ROIIC proves to be much stronger than being spot on with the exit multiple.

Some investors use a reverse DCF, but that model still doesn’t account for the fact that, maybe, the company isn’t going to distribute excess free cash back to shareholders. How will you then account for the opportunity cost of cash not being returned to shareholders, sitting on the balance sheet and thus losing value (inflation)?

😊 Bonus - an 11th article to stress that investing is an ongoing process. It’s about performing scenario analysis, understanding a company’s longevity in a rapidly evolving world, and trying to get a sense of future returns on an after-tax basis.

That’s it. Whenever you’re ready, this is what the Compounding Tortoise is all about:

📚 Deep dives, earnings recaps, quarterly letters, reports on serial acquirers

📈 Access to our stock portfolio with full transparency

📊 Access to the Discord Community where there’s lots of additional content being discussed by our tremendous Partners!

A lot of valuable input worth to revisit! Thanks CT

For ROIIC it's important to also look for structurally higher inventory levels, which inherently lower ROIIC but may reflect a strategic adaptation rather than a fundamental inefficiency. So, yes, lots of moving parts as you say. Great post!