Sources of High-Quality Growth

Not all growth is created equal

Steady growth

When looking for high-quality growth companies, it’s of utmost importance to assess their growth potential and the quality of that growth: is it sustainable? Does it require a lot of capital tied-up? What’s the pay-off on investments (wether that’s in the form of CAPEX or SG&A) and is it well-isolated from the macroeconomic backdrop?

Stated simply, we want to own growing companies (in Q1 2024, our portfolio-weighted growth in EBITA per share was 14.5%), otherwise it doesn’t make sense to justify our modeled exit multiple (typically at 18-20x NOPAT). We seek to own stable, predictable, and recurring revenue growth, well above the inflation rate, irrespective of the economic environment. That way, we will limit not only portfolio turnover but also the need for new investment ideas. We’re constantly amazed by how many investors are looking for the next Big Thing without fully understanding what’s already in their portfolio.

Fast growers & overvaluation

Companies can grow too quickly with several hiccups and thus subsequently higher volatility in their share prices. High growth rates are like a honey jar: they attract competition, tend to lead to reduced returns for all parties looking to get a bigger piece of the pie.

Plus, there’s plenty of empirical evidence that fast growers (or at least, investors expect them to meaningfully accelerate top line growth, i.e. the expectations treadmill) are prone to severe overvaluation. It’s not just about timing a reversal in sky-high growth rates but also factoring in the potentially devastating impact from substantial multiple contraction. Research conducted by McKinsey demonstrates why boring wins the race.

McKinsey

Aside from top line growth, the icing on the cake is margin expansion, which tends to be driven by two levers:

Efficient cost management, thereby increasing profits, but for most companies that’s not sustainable as cost-saving opportunities tend to become very limited at some point. And maybe: your competitors could start benefitting from the very same economies of scale that you’ve been enjoying for multiple years.

Selling more of value-add products or services is what will earn you higher margins and better customer retention.

Examining past drivers

While relying on past data is a good starting point, one must acknowledge that even the most reliable quality growth companies aren’t immune to a slowdown in growth. There are many ways to achieve growth, and not all opportunities are equally attractive or sustainable. What’s worked or attracted investors’ interest in the past may not work over the next years (e.g. growth driven by changes in the central banks’ interest rate policy, a post-COVID boom and bust).

In this article, we’ll outline some possibilities for companies to grow and delve a bit deeper into structural changes, also known as secular trends, which can lead to virtually limitless growth opportunities.

Differentiation is what’s key to sustaining the compounding flywheel. We’ve already talked about our secret sauce to finding high-quality compounders: the ROIC game. The safest way to capture steady high-quality growth is to pick a company that is so much better than its close-in competitor(s), with all the great metrics we look for (growth, ROIC, cash conversion, management track record). Maintaining a long-term view on what works well (based on their decade-plus experience of doing business) and benefitting from another’s inefficiencies to cement their highly lucrative strategy.

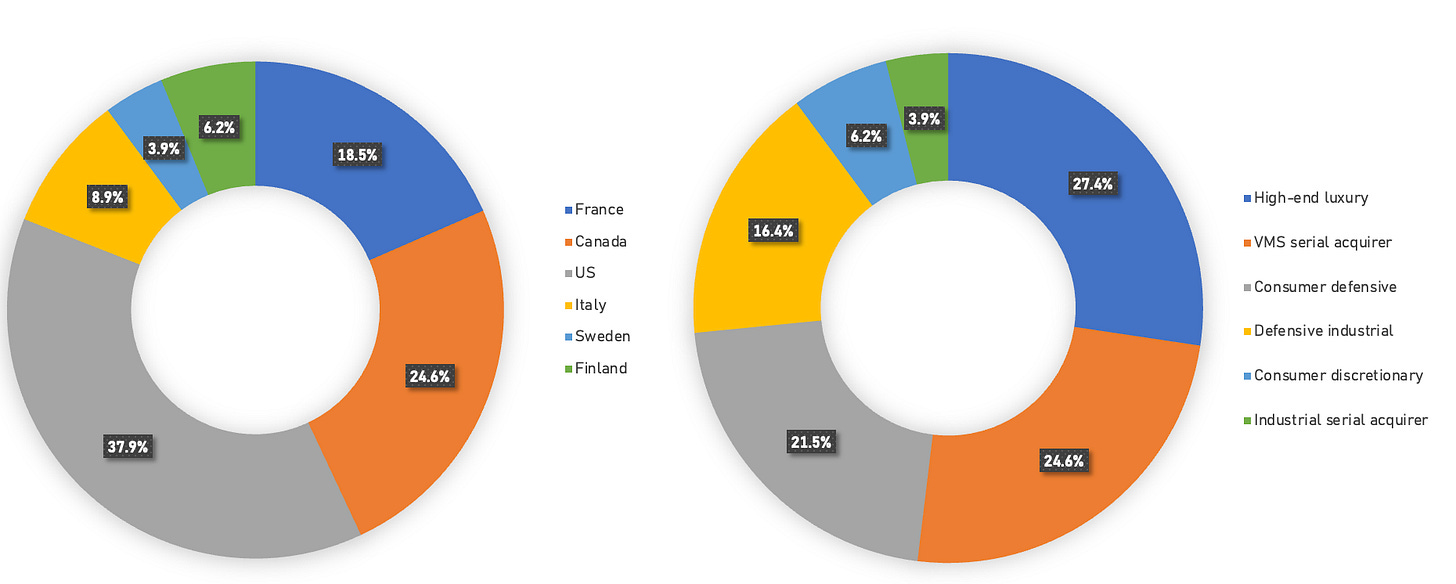

Without further ado, let’s examine the drivers of growth and how our portfolio is positioned as measured per our strategy buckets (as of July 12, 2024).