How We Define Sustainable Quality Compounding (Part 3)

Copart's recent performance: rolling ROIC versus incremental returns

In this third part of “Sustainable Quality Compounding”, we’ll take a closer look at Copart to discuss its shareholder value creation track record and understanding the recent volatility.

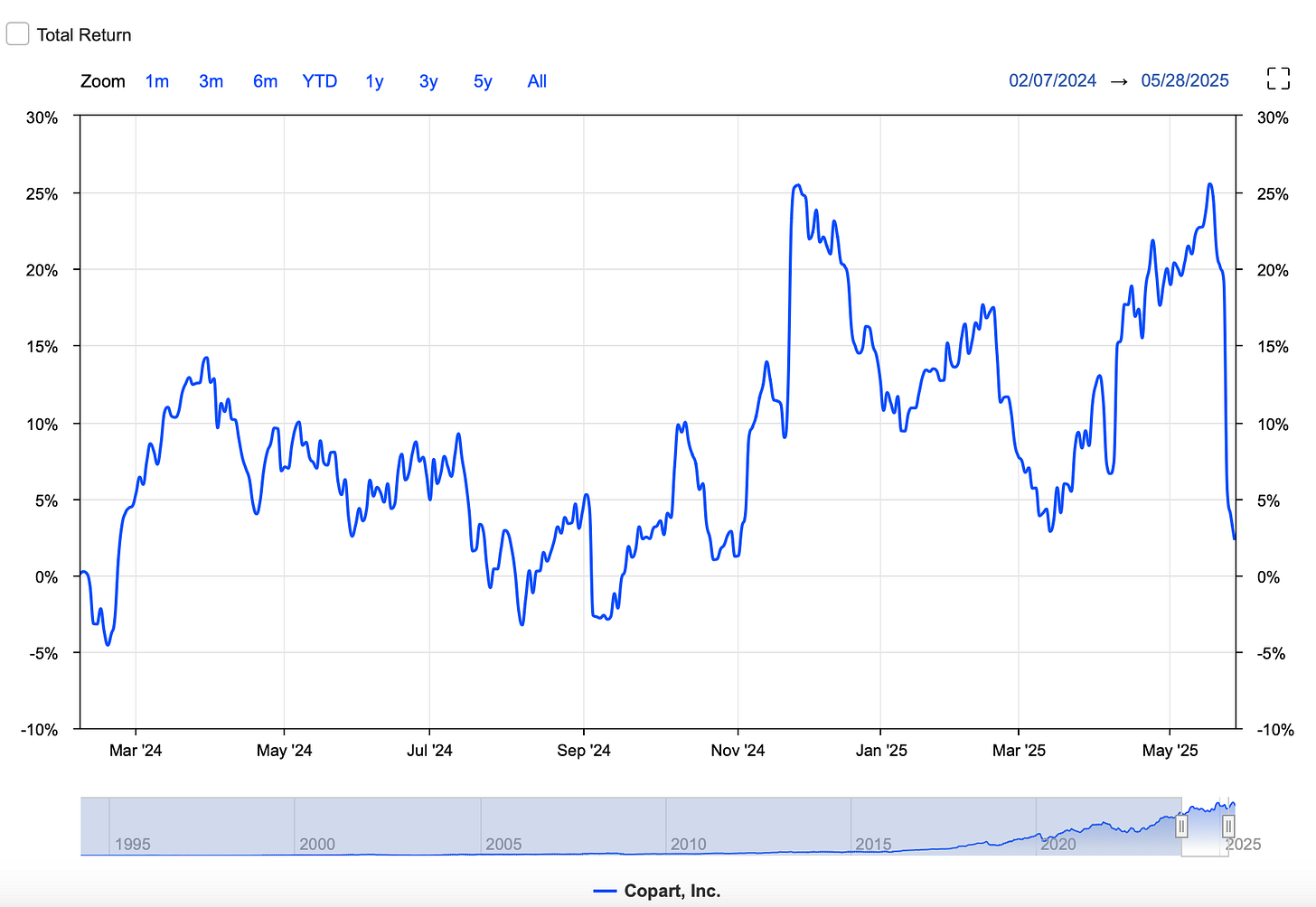

Copart’s Share Price Performance - MarketScreener

Initially, we intended to publish a three-part series on sustainable quality compounding. However, in response to our subscribers' questions about Copart’s recent share price weakness, valuation, and growth outlook, we decided to dedicate a single blog post to this world-class company.

In the final blog, we’ll talk about Pool Corporation and how it compares to Harvia, which also benefitted from COVID-19. It’s worth noting that the sauna market is somewhat associated with growth in pool bases.

Clearly, amongst all three, Copart stands out as the consistent compounder over the past years and decades, whereas Pool has enjoyed a COVID boom that’s now reversed. Broadening our scope, touching on new names, and reconciling returns on rolling invested vs. incremental invested capital; it’s what our readers highly appreciate.

Since our Substack’s inception, we’ve written quite a bit on the cornerstones of quality compounding. That’s a lot of content, so where does one get started? We’ve compiled our best 25 blogs to help you out.

Copart - General Overview

With that, let’s start the discussion with Copart, the leading multinational provider of online vehicle auctions.

Its business model can be divided into two segments: “Service” and “Vehicles”.

The largest segment, Service, which accounts for 85-86% of revenue, consists of the online auctioning of mainly damaged and stolen vehicles on behalf of third parties (primarily insurers). In this segment, the company does not take ownership of the vehicles but acts as an intermediary and receives a commission for each vehicle sold, as well as for towing, storage, inspection, auction preparation, and paperwork.

In the United Kingdom, Germany, and Spain, the company acts not only as an intermediary but also as a buyer of vehicles, which it then re-offers for sale. This capital-intensive segment, called Vehicles, accounts for 14-15% of revenue.

The main customers of Copart are insurance companies, which are about 80% of revenue. The rest of the customer base consists mainly of car rental companies, fleet operators, car dealers, and private individuals. Buyers of the auctioned vehicles are primarily scrap yards, used car dealers, exporters, restorers, and in some regions, also private individuals.

One advantage of online auctions is that the number of potential buyers is significantly increased. More bidders lead to better selling prices for the consignor, which results in higher commissions for Copart.

Sustainable Quality Compounding

Steady compounding of shareholders’ capital is driven by Copart’s:

high returns on total invested and incremental invested capital;

strategic decision to own its land directly (one-time CAPEX instead of leasing), and duopoly with Insurance Auto Auctions (now part of Ritchie Brothers);

focus on profitability by not going after lower value units ensures strong cash flow to be reinvested into the business (primarily organically). This was evident in its most recent earnings report, revealing that share losses on the lower value side of the business were somewhat intentional.

From the book “Junk to Gold”: “Every time you add a revenue stream to the same pipeline, the profit margins change drastically. You are putting more through that pipe. That’s what I always tried to do in my business, and it is how we were successful.”

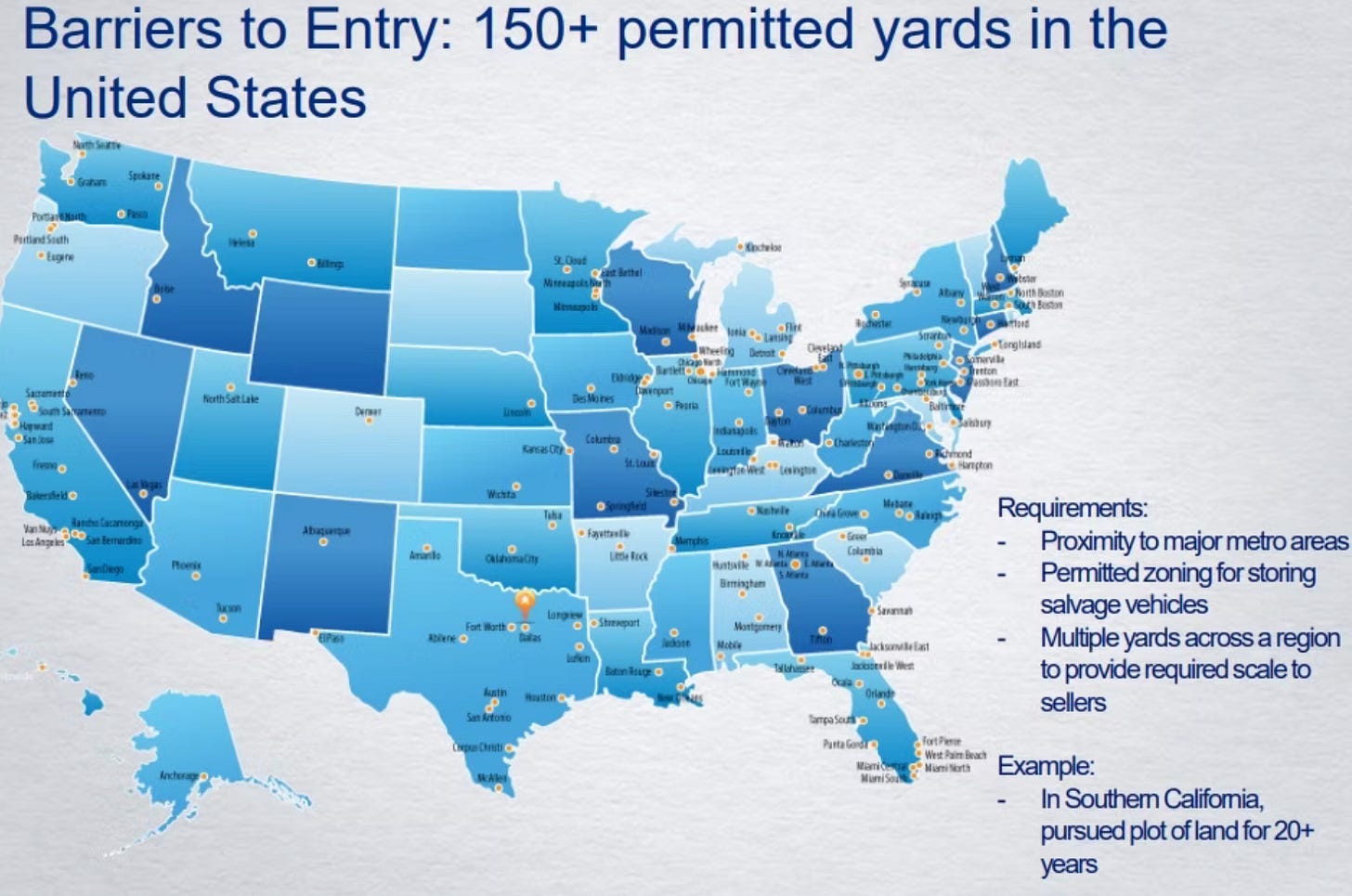

Insurance companies operate nationwide, which makes Copart’s numerous locations an advantage, as there is always one nearby. Towing costs, which can be significant, are therefore considerably reduced, and thanks to Copart’s dense network, the company can usually guarantee pickup of damaged vehicles within 24 hours.

For transporting the vehicles, the company has its own fleet available, and if that is not sufficient, it can rely on relationships with external transport companies. The below slide was taken from one of Copart’s previous investor presentations.

Copart IR

Copart also has specially trained teams that can be deployed immediately in the event of natural disasters, which often cause significant damage simultaneously. This is an additional reason for insurers to do business with Copart, and this service would not be possible to offer without economies of scale.

Industry Drivers

Aside from Copart’s internal operational strengths, industry drivers represent:

Higher mileages increase accident risk;

Older cars are more quickly declared a total loss because repair costs will more rapidly exceed the residual value of the vehicle. Although not directly comparable, O’Reilly and AutoZone benefit from an aging car fleet too, as well as total miles driven.

The market in which Copart operates is not particularly sensitive to economic cycles. The volume is driven by the installed base of the current vehicle fleet, not by new vehicles.

Cars that are more quickly declared a total loss are often, logically, less damaged, which leads to higher bids at auctions. Rising auction prices result in higher commissions for Copart.

Similar to O’Reilly and AutoZone, Copart benefits from the increased complexity of vehicles, leading to rising repair costs. As a result, it is often more economically attractive to declare a vehicle a total loss rather than repair it. Nowadays, technology accounts for an average of 40% of the total price of a new car. In 2005, a vehicle contained an average of 15 chips, but 10 years later, this had already grown to sixty. One of the main culprits behind the rising repair costs is the airbag, which is now present in ever greater numbers in vehicles. Repairing such an airbag can easily cost between 1,000 USD and 4,500 USD per airbag. No wonder insurers are increasingly declaring damaged cars as total losses.

Not In My Back Yard is a term from urban planning that indicates that many people want to use certain facilities but do not want to experience any inconvenience from them. A junkyard contains harmful substances and materials, which prompts local residents to do everything they can to prevent the opening of new sites. Newcomers with the ambition to operate a junkyard will therefore have to go through long and expensive procedures to get an opening approved. There’s a good chance that these procedures will ultimately prove pointless because the best locations are already taken by market leaders, and local residents can argue that there are already enough junkyards, raising the question of whether a new site would even be approved at all.

Relatively recession-resistant. The situation around nominal insurance volumes not keeping pace with the rise in total loss frequency during Copart’s third quarter (which essentially is calendar Q1) was flagged as a cyclical headwind. The CEO noted that the number of non-insured and underinsured drivers has been increasing over the past four years. This trend should eventually reverse, but for now, it’s creating a headwind for insurance volumes.

Corporate Culture

For those who enjoy immersing themselves in Copart’s corporate culture, the founder, Willis Johnson, wrote his life story in 2014 in the book “Junk to Gold”. The book tells an exceptional entrepreneurial story while also providing insights into the philosophy of the company; it’s a must-read.

It paints a picture of how the company was built, starting from the first junkyard in California where the founder lived in a trailer with his family, through the IPO in the 1990s, to the first international acquisitions in the early 21st century. An extraordinary story that reads well about a smart but down-to-earth entrepreneur.

ROIC, ROIIC, capital allocation, and changing investor expectations

Let’s now review Copart’s rolling ROIC, ROIIC, capital allocation, and how any cyclicality in growth impacts investor expectations.

As for most long-term compounders, there’s some inherent quarterly cyclicality or better, short-term nuances. For Copart, they’re being driven by for instance catastrophic events, one-time expense growth to start up new facilities, non-cash depreciation of growth CAPEX, geographic performance differences, shift in revenue streams (“Service” vs. “Vehicle” sales; growth in lower vs. higher-value units).

Therefore, it's crucial to take a step back and evaluate the long-term attractiveness and consistency of Copart’s reinvestment strategy using clear metrics like ROIIC, while adjusting for discrepancies in working capital and inflation, and thus analyzing ROIIC across different timeframes. This also involves understanding the company’s future direction and how it intends to use any excess free cash after dividends and/or buybacks.

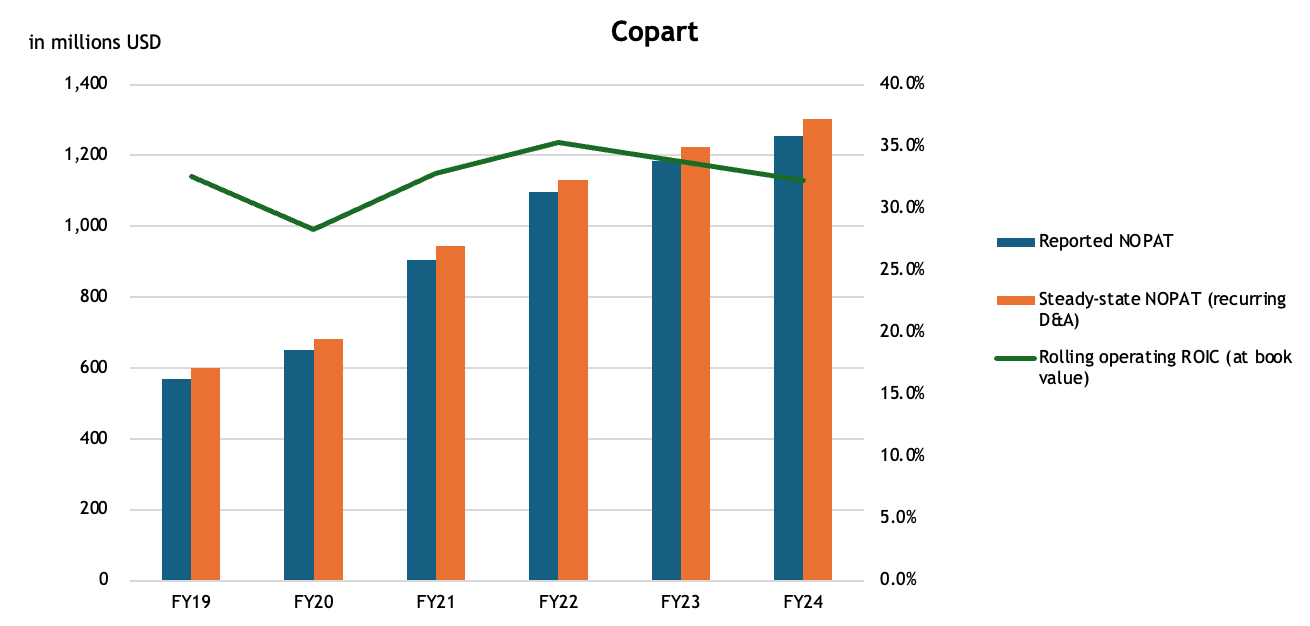

Rolling ROIC

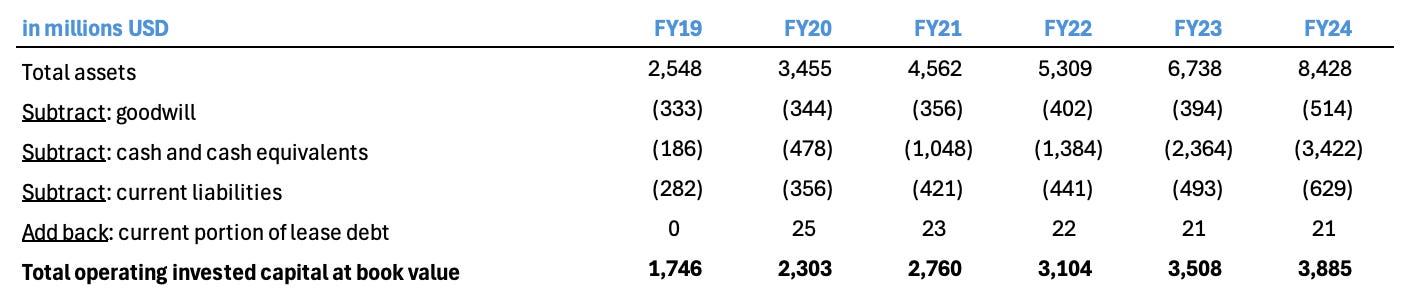

Starting with rolling ROIC, we define this metric as reported NOPAT divided by operating invested capital at book value. For companies reporting under US GAAP, it’s worth noting that NOPAT should exclude interest expense related to operating lease liabilities which is directly reflected in EBITDA, and separately via financial charges (below EBITDA). Hence, these interest charges should be added back as ROIC measures a company’s operating returns, irrespective of how its operations are being financed.

Given that Copart’s recent track record has been driven primarily by organic growth (CAPEX for land, yard facilities, equipment, software, and working capital), we’ve excluded goodwill from our calculations to better reflect the underlying returns.

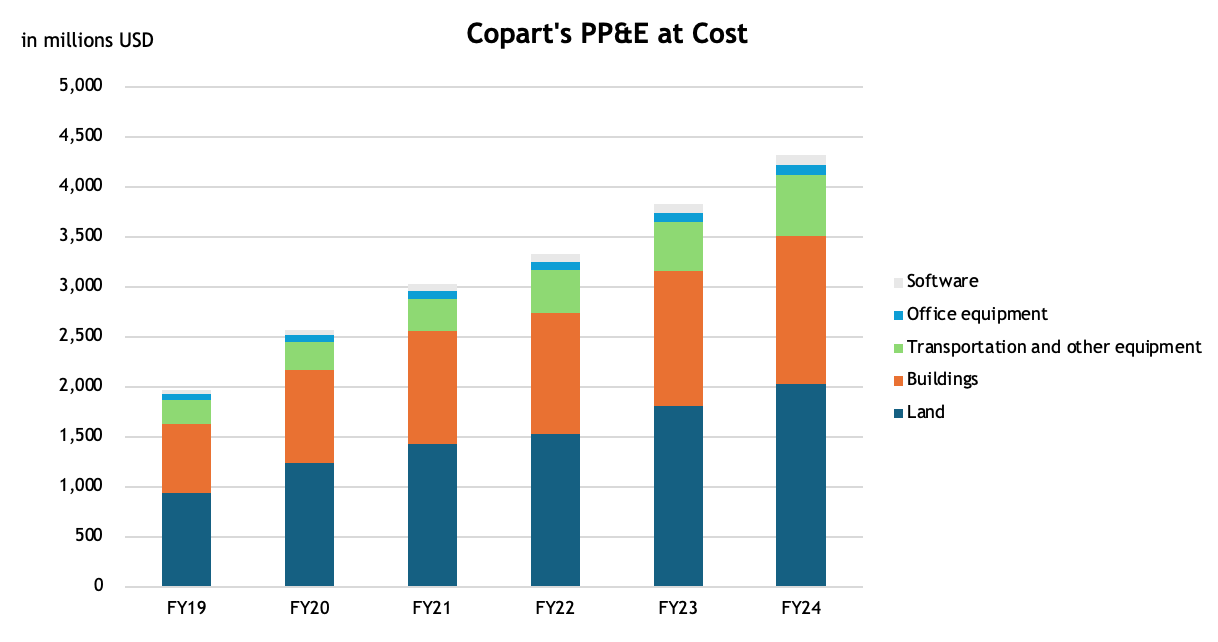

As we look at rolling returns, it’s worth remembering that companies with structurally low recurring CAPEX and pricing power have scored very well over the recent years. Their assets, which don’t need frequent replacement (e.g. plants, latest state-of-art machinery) are being depreciated, while NOPAT continues to grow. For Copart, land and buildings account for roughly 82% of its total property, plant, and equipment at cost. Lease liabilities are fairly insignificant relative to the below figures.

The Compounding Tortoise

As can be noted from the below graph, we’ve made some assumptions on the steady-state NOPAT, which excludes depreciation and amortization of one-time growth CAPEX.

To be consistent, we’ve assumed a 20.5% effective tax rate for all fiscal years. Taxes due and paid fluctuate, but we’re interested in the like-for-like operating returns.

The Compounding Tortoise

The Compounding Tortoise

In a previous blog, we’ve advocated for this metric in order to not penalize companies that are reinvesting for future growth.

The delta between the reported NOPAT and our own version is about 4-5%. Additionally, one could make another argument on accounting for start-up/occupancy costs for recently acquired facilities not being as productive as Copart’s existing network. Clearly, NOPAT and returns on (incremental) invested capital is not exact science.

Incremental Returns

The question becomes: what do incremental returns look like from here, and at which pace can Copart keep growing its NOPAT?