Our Top-5 Stocks For 2025 and Beyond

Growth at a reasonable price

Over the past one month, some quality stocks have come down quite a bit. Unsurprisingly, our members ask us: which stocks are deemed attractive?

Let’s take a closer look at our top-5 stocks for this year and beyond, because we’re not timing or predicting short-term performance. A healthy blend of quality, growth, defensiveness, exceptional managers, and boring businesses. That’s how a Tortoise wants to win the race: slow and steady.

5. Sanlorenzo

To kickstart the new year, investors should be looking at high-end luxury. While our core holding Hermès had a volatile but satisfying share price performance in 2024, Sanlorenzo’s stock sold off due to overall sentiment regarding small caps, European woes, and the acquisition of Swan.

On the latter: Sanlorenzo purchased it at multiple higher than its own. The multiple at which the acquirer is trading shouldn’t impact the thought process when closing a deal. For instance, Lifco trading at 20 or 40 times NOPAT doesn’t move the valuation for its acquisition targets: they couldn’t care less about Lifco’s stock market valuation.

Still, it’s hard to argue with Sanlorenzo’s track record.

The Compounding Tortoise

Recent positive news surrounding Sanlorenzo’s new product launches and customer feedback includes the launch of the SD132 yacht, the largest composite-built yacht ever crafted by the shipyard and the largest in the historic semi-displacement line of the brand:

We are thrilled with the launch of the SD132 project, which embodies the perfect combination of significant size, innovative design, and timeless elegance, in true Sanlorenzo style. The exceptional market response has been confirmed by the five contracts already signed before the launch, demonstrating the great success and appreciation this yacht is receiving among owners. - Tommaso Vincenzi

The mid-term outlook (especially in the US and APAC) remains favorable, with a solid backlog:

Following the acquisition of Simpson Marine, Sanlorenzo strengthens its presence in the Asia-Pacific market with the opening of the “Sanlorenzo Australia” office in Sydney. The event also marks an important milestone for Bluegame, which debuts in the country with the brand's bestselling BGX63. Sanlorenzo, on the other hand, brings two of its most iconic boats, SD126 and SX76.

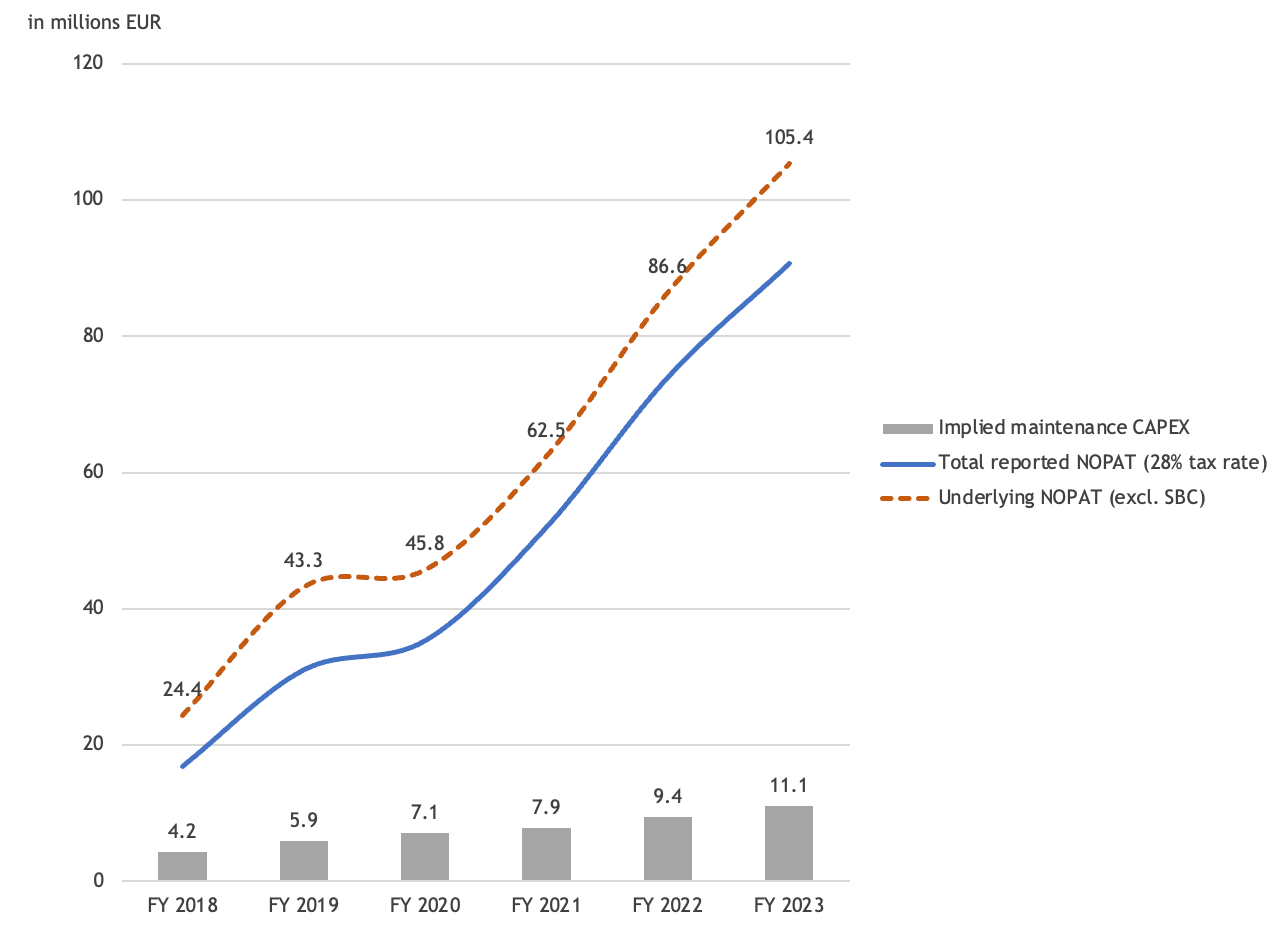

Based on Sanlorenzo’s normalized steady-state earnings (NOPAT), which should factor in the run-rate depreciation (which are now higher because of recent growth investments), the stock’s trading at 8.7x underlying profits. Not bad for a company able to grow its earnings at a low double-digit clip over the next 3-4 years.

4. Linde Plc

Boring is good, and so we pick Linde as our fourth favorite stock for the conservative quality growth investor.

Following the Q1 update with no increase in the guidance, some portfolio pruning on the hard goods (packaged gases), investors somewhat started to doubt Linde’s (LIN) excellence. The Q2 report confirmed why its resilience and built-in conservatism should help investors sleep well at night. They have a culture to plan for the worst but hope for the best.

When central banks are talking about inflation being defeated, we turn to Linde for some real understanding on this topic. As such, it will be interesting to hear them talk about pricing over the next few quarters. Sequential pricing/mix was a positive surprise, especially in Americas where both volume and pricing improved by 2% from Q1. Pricing/mix was up 4% year-over-year. We argue that not all of that pricing is being driven by a few hyperinflation countries (such as Argentina), but instead could be more structural (especially as we compare against easier inflation comps in 2H 2023). Looking at Air Liquide’s merchant pricing, they’re seeing the same effect vs. Q1.

Q3 showed an in-line report, but Linde announced its largest-ever sale of gas project with Dow in Canada. A 2+ billion project that clears all investment criteria (double-digit un-levered IRR), and encompasses all of Linde’s core competences to provide fully-integrated gas management solutions that are in great demand.

Overall, Linde remains a SWAN type stock: sleep well at night, and own a great quality company at a reasonable price (20.8x recurring FY25 NOPAT excluding impact from growth D&A). Additionally, it has an un-levered balance sheet and secured cash flow model that should support more aggressive stock repurchases.

Let’s move to our top 3.