Persistence of High Risk-Adjusted Returns

Benefitting from the low-risk anomaly and concentrating our portfolio

It’s Friday: time for a new weekly digest covering the following topics:

last week’s macro news;

persistence of high-risk adjusted returns;

ignorance of relative performance;

and lastly portfolio concentration

Some news on the macro front

The biggest story of the past week was the in-line US CPI report. Hip, hip, hurray! The narrative of the FED starting to cut rates sooner than later gained traction, and financial conditions have again loosened over the past weeks (which is likely to drive future inflation).

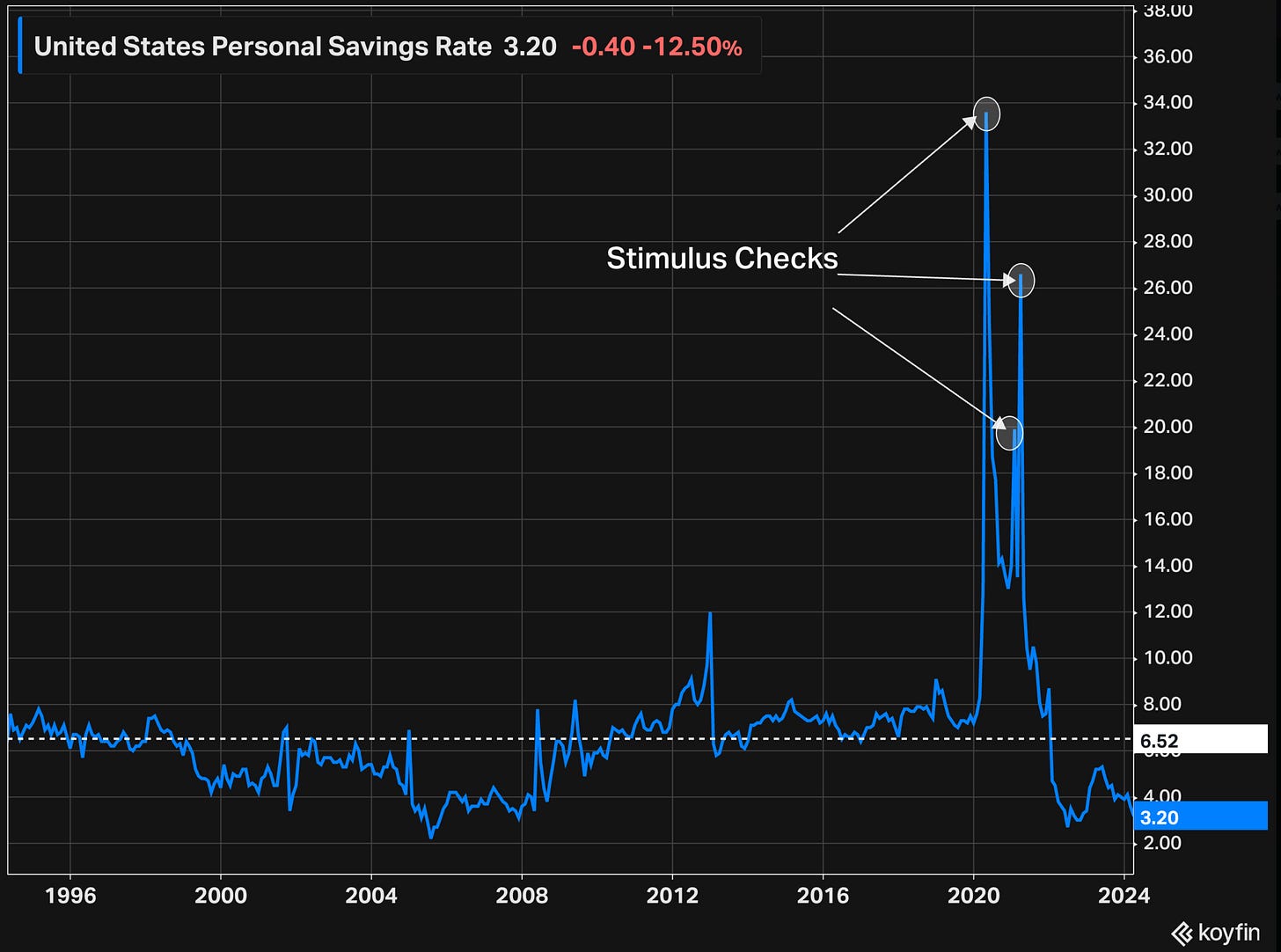

Meanwhile, some indicators for the lower-end income consumer point to more financial distress: falling savings rates and more frequent credit card delinquencies.

But hey, all of this should be bullish: interest rate cuts, a soft landing, and maybe rising valuation multiples (analysts lowering their not so stringent DCF discount rates to reflect lower risk-free returns).

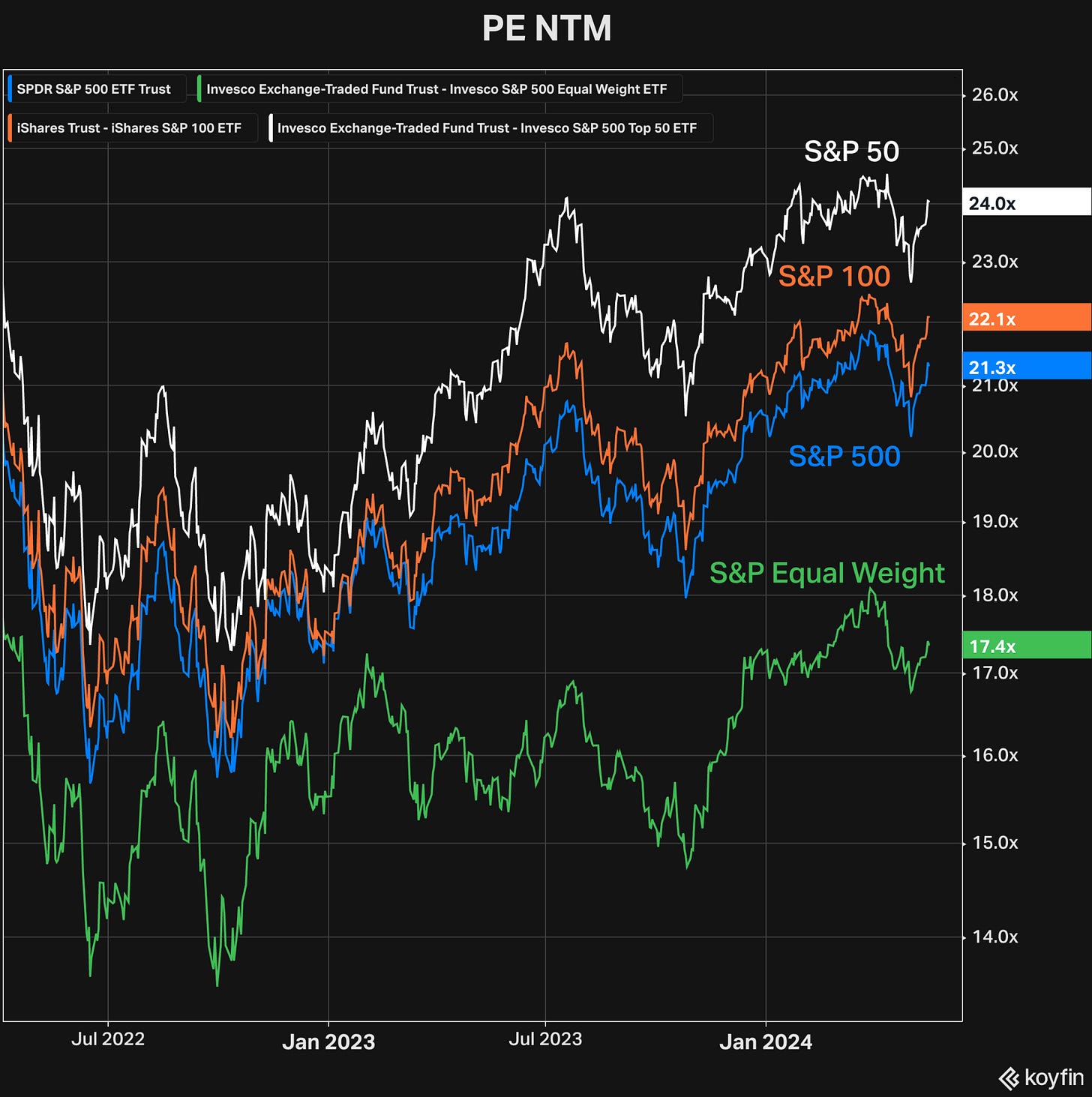

When financial conditions loosen, you don’t need a stock-picking strategy to earn satisfying returns: just buy the index and capture the mother of all risk premiums, the equity premium, which we believe won’t continue to deliver the strong risk-adjusted returns it’s enjoyed over the past 1.5 decades.

As per usual, we don’t let relative performance dictate our portfolio strategy, sector mix and trading activity. However, we do want to - once again - share a friendly reminder: during strong bull markets or V-shaped rebounds, we’d expect our portfolio to lag the market index.

Relative underperformance for a quality growth strategy is likely to come from the index constituents seeing their multiples expand faster than our companies. Keep this in mind, though:

A re-rating in a company's valuation multiple is a one-time event. Sustainable earnings growth is the only reliable source of perpetual compounding. - The Compounding Tortoise

Given that we expect our companies’ NOPAT per share growth, ROIIC, and earnings and cash flow quality to be materially ahead of the index’, short-term performance drivers or detractors related to changing multiples should be ignored as much as possible.

Just take a look at how fast the S&P-500 multiples have changed over the course of 2023: a +33% return stemming from multiple expansion (and 4% from earnings growth). Good luck trying to time those reversals.

As of today, we’re invested in the following themes and countries. There’s a strong emphasis on:

Negative working capital and organic revenue growth support cash conversion

High reinvestment rates and excess cash returns to shareholders

Very rational managers: shareholders know what to expect, leading to stabler valuation multiples over time (i.e. managers controlling for the expectations treadmill)

The Compounding Tortoise

We’ve talked about it already: why do quality stocks outperform over the long run? In fact, it’s one of the most read articles on our Substack.

Let’s now go further and zoom in on the low volatility (and high quality) anomaly, the persistence of high risk-adjusted returns, and a premium member’s question on portfolio concentration.

Low volatility anomaly

Questions

It’s a phenomenon that we’ve been researching since 2019 and even more so during 2020 and 2022. Whilst it is not watertight from a short-to-medium-term perspective, the long-term evidence cannot be denied: highly volatile stocks underperform their steady and less volatile counterparts. The following questions arise:

Why is this the case?

Will it continue to exist?

Should you look at relative or absolute volatility?

What’s the significance of this anomaly vs. other factors?