Overall Philosophy

Given that we already share our real-life portfolio and transactions with our community, elaborating more on our current three favorite buys should provide more insights into our personal allocation strategy over the next 12 months. As always, we don’t want to attach ourselves to a specific buy list or an opinion on a certain company. We’d better not become complacent about (short-term )return goals. But for now, we feel this list acts like a good starting point for new capital inflows.

As a reminder: as a long-term quality tortoise, we generally stick with what we own (even if the valuations of some of our holdings may have gotten ahead of themselves). Our strategy/substack isn’t about rotating in and out quality growth companies; instead we selectively invest in a group of companies we’ve analyzed thoroughly and which we intend to hold onto for a very long period of time.

Put another way, the following three names already sit in the portfolio but we would be very eager to buy more shares during the next dip.

As we wrote at the beginning of the year:

Talking about the fundamental profile of a “Compounding Tortoise”, it boils down to a company:

being transparant with its owners, as evidenced by a management team’s integrity and skin in the game;

posting positive organic growth;

investing in assets that generate secured cash flows (implies a high degree of economic resilience with little disruption risk);

looking for stable growth rates, based on a sustained return on capital;

having a large pool of potential investments, whether it be organic or acquisitive;

having a strong balance sheet to weather any economic downturn. You don’t want to see a declining ROIC being made up for by borrowing for future investments;

distributing all leftover cash to shareholders;

and lastly, with no dilution of existing shareholders through excessive share-based compensation. Share-based compensation is a very handy approach to artificially growing your cash flow from operations (and free cash flow, by its theoretical definition). SBC-adjusted earnings are a perfect indication of a shortsighted management team trying to persuade the market of its (“adjusted”) value creation.

This concise 8-point list will certainly keep you out of a lot of trouble. Why is it so simple? It’s based on common sense. When I’m researching a potential private M&A target, the only thing I care about is ROIC (i.e. capital intensity), earnings and cash flow visibility, and a relatively fast investment payback.

The latter is based on a discounted cash-flow method (based on our return hurdle rate) and/or discounting the terminal cash flow to the present (i.e. the exit-multiple method, especially useful for serial acquirers). It’s nothing more but nothing less.

Looking for Alpha

One of the most frequently highlighted sources of substantial short-term outperformance/alpha: stocks with re-rating potential. In essence, buying at a lower multiple and then exiting at a higher multiple. Most of the time, there are very good reasons as to why a stock has de-rated:

A doubtful growth strategy

Shrinking ROIC (higher capital intensity, margin contraction)

Shrinking pool of reinvestment opportunities

Financial distress

Higher interest rates (although their impact is oftentimes too overstated)

What if none of the above has occurred and yet the stock has de-rated? It’s what you’ll spot in the small and mid cap space from time to time. The lack of sufficiently traded volume, the fact that we’re dealing with lesser-known companies, the general trend towards passive investing/herding in bigger stocks, sector momentum. Also, the market valuation reflects currently known information.

If there are signs of positive optionality (entering adjacent markets to reinvest the excess cash flows into, share repurchases et cetera), you’ll get a chance to buy at very attractive multiples. If the optionality becomes reality, a re-rating is likely to take shape quite quickly. Again, figuring out what's already priced in versus prudently pencilling in optionality as margin of safety.

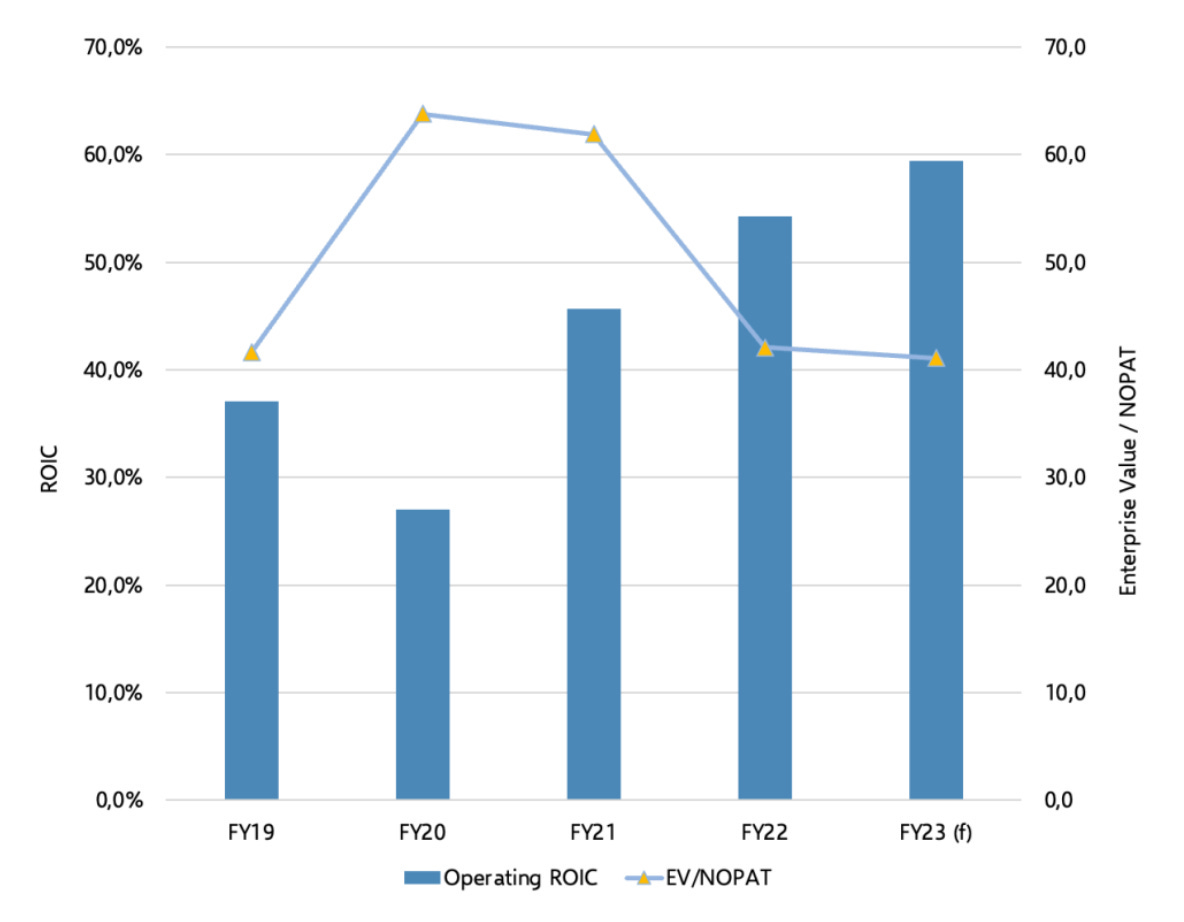

That’s precisely what we did with Hermès earlier this year. The below graph depicts the return on invested capital excluding cash and goodwill and Hermès’ valuation multiple (EV/NOPAT).

Return on capital has increased significantly compared to pre-COVID levels, yet the valuation multiple is roughly the same. Ceteris paribus, this makes us believe Hermès future total shareholder ROIC to be higher than in 2019, because of:

higher NOPAT growth per unit of newly invested capital

more leftover cash to be distributed to shareholders (currently a mere 0.7% dividend yield)

pricing power

Again, we should contextualize valuations and overall investor perception to make well-informed long-term investment decisions.

Without further ado, let’s look at our three favorite buys.

1/ Topicus.com

We wrote a deep dive on the “European CSI” last month. To demonstrate how volatile markets can be, shares have since already performed extremely well (+13.2%).