Q3 FY24 AutoZone - Analysis

Strong profitability trends, but severe weather impact and tax refund volatility

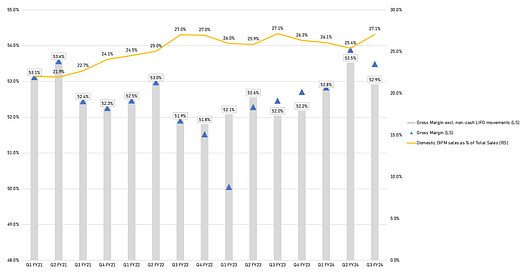

Following the earnings release of O’Reilly at the end of April, AutoZone was next in line. While the underlying sales performance was a little underwhelming due to tax refund volatility at the beginning and severe weather impacts at the end of the quarter, gross margin expansion stood out as a positive. Let’s dig deeper into the numbers. At the time of writing, AutoZone stock is down 3.8%.

Before we do that, let’s remind ourselves of the current macro backdrop for the retail industry: consumers are challenged on big ticket purchases, and all eyes are on the lower-end consumer. This narrative has pulled many retail stocks down, even LVMH which has some exposure to beauty retail through Sephora, a direct competitor of Ulta. To put things in perspective, the aggregate Consumer Discretionary ETF has yet to reach fresh all-time highs.

One of the retail bellwethers, Home Depot, is now close to entering bear market territory.