Welcome to another weekly digest to stay informed about everything that matters most to quality growth investors!

In case you’ve missed our previous posts:

If you haven’t yet, subscribe to get access to these posts, and every other post.

If you enjoyed reading this post, feel free to share it with friends! Or feel free to click the like button on this post so more people can discover it on Substack.

Next week, many of our companies will share their recent quarter’s performance, which we’ll be covering in great detail, and as fast as possible.

In this weekly digest, we’ll cover just one topic we’ve touched upon in the previous bi-weekly webinar: the Great Small Cap rotation.

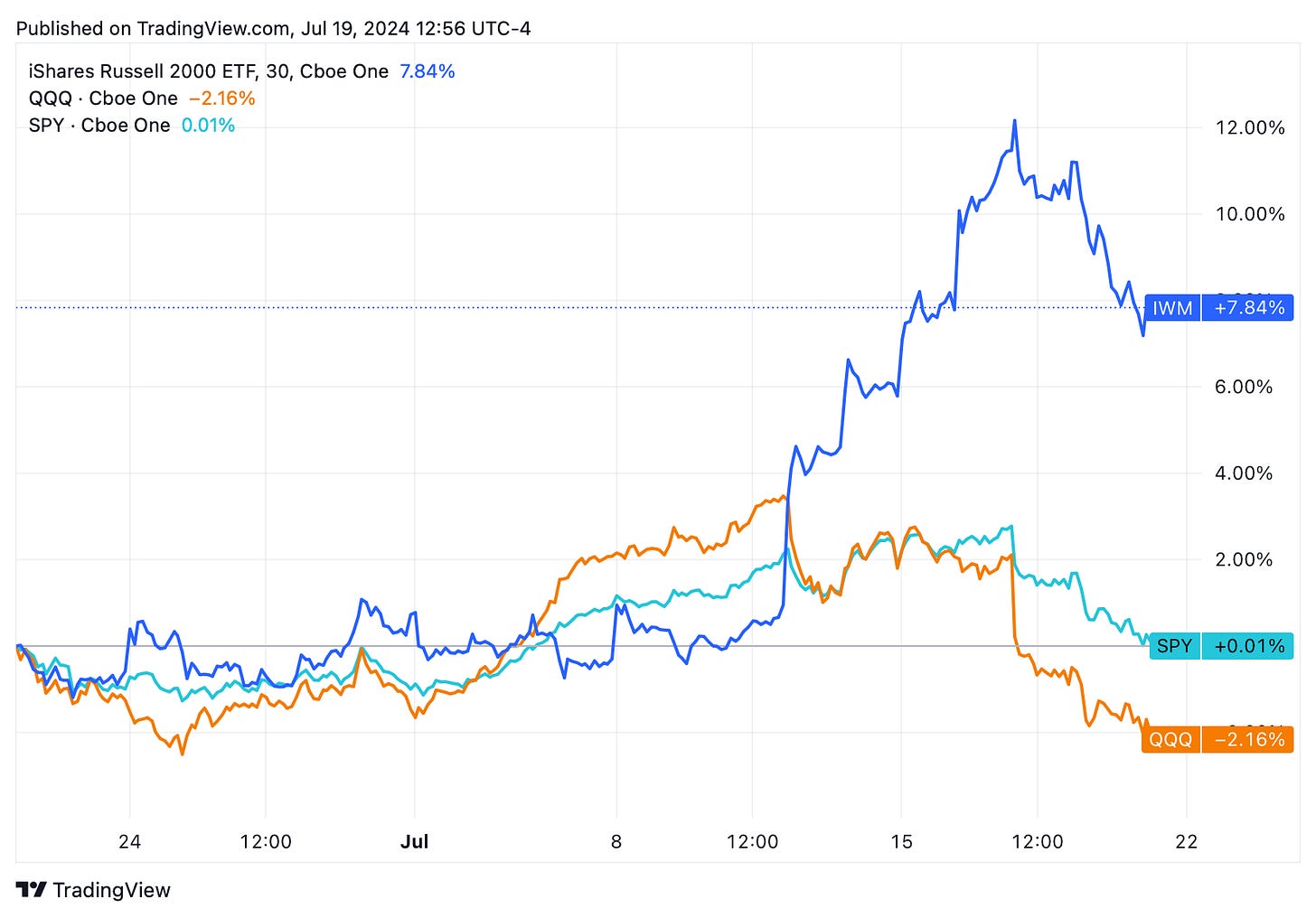

A recent surge in the Russell 2000 following the release of the US CPI report for June last week has sparked claims that we are entering the early phase of a secular rotation into US small-cap stocks, given their recent rally, as shown in the below graph.

We wouldn’t call this a cyclical value rally, rather a low-quality rally in long-term laggards driven by the unwinding of bullish (and sometimes leveraged) bets in overcrowded passively managed large-cap ETFs.