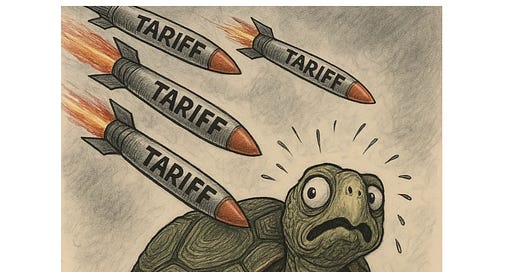

The Tortoise Approach to Tariff Turbulence

Why we shouldn't even try predicting short-term moves

Hi fellow Tortoise,

Welcome to another bi-weekly presentation. “Never a dull moment in the stock market”. That’s exactly what we saw this week following Donald Trump’s tariff announcement. We won’t be rehashing what’s been shared on other blogs or networks, but our approach to this turbulence and any other crisis is this: we keep on learning more about which businesses are truly remarkable and which ones are not (and which ones are very terrible at creating shareholder value).

During uncertain times like today, we feel more comfortable focusing on and understanding what we own, and allocating more capital to companies that are transparent about what’s happening. If you can provide clarity/guidance about your growth, cash flow, margins this time around, you’re likely to gain investors’ attention, simply because not many companies have the luxury of navigating today’s choppy waters.

While many would argue that the highest potential returns now lie in investment cases that are tough to model and appear to be cheap at face value (because of the tariffs, consumer backdrop), the reality is that over the long run high-quality stocks with below-average volatility outperform. We’ve studied this ourselves, and the degree of consistency (only for the patient investor, aka the Tortoise) is overwhelming.

Our sort of mission statement is to earn an attractive return with below-average risk if there’s a recession, crisis. We’re not talking about underperformance due to rotations out of defensive quality into high-beta, although they do happen from time to time (as we saw last year, and in 2021 and 2023). Year-to-date, our portfolio is now down 0.73% (in EUR), or +2.38% excl. FX as the USD and CAD weakened notably against the EUR.

That’s how it is, and there’s no need to celebrate recent relative outperformance as we’re still down money. We’re not pretending - even for a second - that we can predict the macro environment, tariff twists, or rebounds in battered stocks. When volatility runs high, there’s no need to play the hero. We’ll cover our portfolio performance in our upcoming Q1 Letter (scheduled to be out next week).

Let’s keep going with the presentation, which can be found below including the transcript and slide deck.