Strong Organic Growth

Yesterday, Topicus.com (or TOI) announced its Q1 2024 results. We wrote quite a bit on Topicus already, including the January deep dive, the FY23 results summary and the special dividend announcement.

Last Tuesday, we stated:

We expect a continuation of strong organic growth (though it’s up against a quite high bar set last year). Last week, Topicus announced the acquisition of the Belgian Rekencentra BV with an expected EBITA of 1m EUR this year. The target has been growing at >20% over the last three to four years.

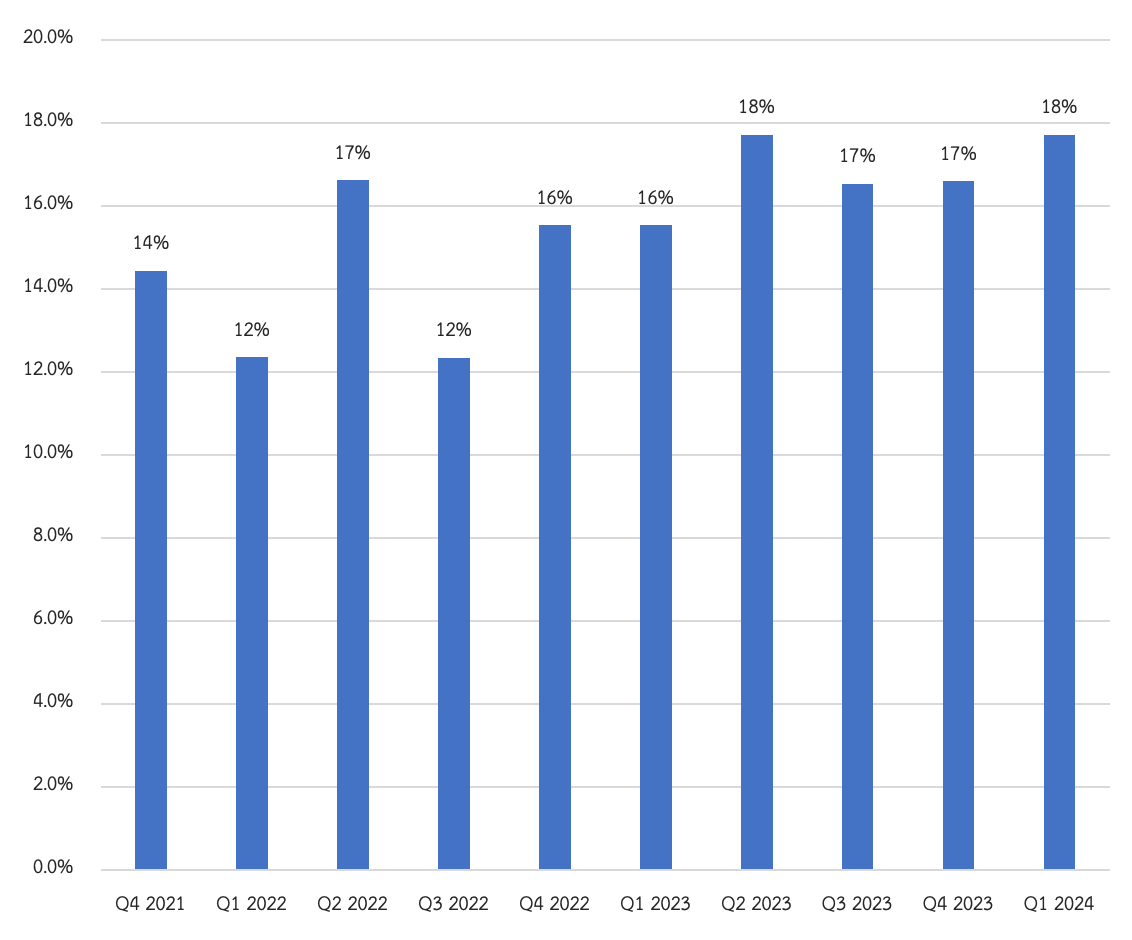

On the organic growth front, maintenance and other recurring revenues seem to be accelerating on a two-year stack basis, as shown in the below graph. With approximately 70% of TOI’s coming from this stable cash generator, we for sure like the substantially stable growth trend and view strong organic growth as a risk reductor to compensate for M&A growth volatility.

Headline Numbers

Turning to the headline numbers before we jump into some more details and our updated IRR model.

Revenue for the whole group increased by 16% year-over-year, driven by 5% organic growth and 8% organic growth in maintenance and other recurring revenues. Revenues for Topicus Coop excl. companies with minority shareholders rose 17%.

Completed acquisitions (incl. acquired cash) worth 54.0m EUR of which 17.5m EUR in deferred payments. Acquisitions yet to be finalized during or after Q2 for a total consideration of 23.4m EUR.