About “The Compounding Tortoise”

“The Compounding Tortoise” is an investment research newsletter that focuses on high-quality companies and applying a practical framework to long-term shareholder value compounding.

Keen on learning more about our thorough research process and portfolio of quality compounders? Then consider becoming a premium member! Annual members have access to our private Discord.

In December 2024, we were hosted on The Capital Compounder Show to talk about Constellation Software and our deep dive.

If you’re looking for a sneak peek at how we research our steady winners, then there’s the deep dive on Harvia and O’Reilly Automotive.

Do you have any questions? We’re here to help - feel free to reach out to us: info@thecompoundingt.com. As a reader of and/or subscriber to our research, you’ve read and agreed to our disclaimer.

Our Professional Background

In April 2024, I left my role as a senior finance professional at a small-to-medium-sized company that I had acquired with my former business partner. My journey began in management consulting, focusing on financial analysis, before transitioning to helping clients - primarily entrepreneurial families - identify M&A targets.

Unlike private equity, which operates on structured frameworks and institutional mandates, working directly with individual business owners provided a unique perspective. These discussions taught me that, at the end of the day, everything comes down to people. No matter how strong the financials look on paper, long-term success is impossible without the right team - executives, middle managers, and employees all playing their part. That realization gave me a deep respect for the best serial acquirers, those who understand that sustainable value creation is about more than just numbers.

Ultimately, I started writing on Substack to gain more freedom outside the traditional corporate structure. Initially, we had no idea what to expect, but after four months, we’ve decided to go all in. Our goal is to share entrepreneurial experiences, provide educational content on fundamental analysis, and expand our deep-dive database - all while staying true to our investment philosophy. We won’t chase hype or shift toward active trading. Instead, we’ll continue focusing on what truly drives long-term compounding: great businesses, strong leadership, and smart capital allocation.

Boring Compounding Wins the Game

The "Compounding Tortoise" is a metaphor for the concept of slow, steady, and persistent growth that ultimately leads to substantial results, particularly in investing and personal finance. It draws inspiration from The Tortoise and the Hare, the fable where the slow but steady tortoise wins a race against a much faster, overconfident hare.

In finance and investing, the "Compounding Tortoise" represents an approach where investors prioritize long-term compounding returns over quick gains or speculative bets. It emphasizes:

Long-Term Vision: The tortoise's steady pace mirrors a long-term investment strategy, such as buying and holding quality assets, instead of chasing short-term market trends.

Power of Compounding: Small, consistent returns reinvested over time can lead to significant growth. Even modest growth rates, when compounded over decades, yield substantial wealth.

Avoiding Risky Behavior: The tortoise doesn't rush or chase after the Hare's accelerating pace, just as long-term investors may avoid high-risk, high-volatility assets in favor of steady, reliable growth.

We use this concept to manage our psychology, reminding themselves that wealth-building doesn’t need to be flashy or risky. By sticking to consistent, incremental progress, the “compounding tortoise” eventually surpasses the “hares” of the market who might burn out due to riskier, faster strategies.

What’s the difference between our approach and many others’ quality-investing strategy?

Contextualization of numbers vs. generalizing stock screener information. We’re looking beneath the surface when analyzing financials;

We are sometimes contrarian;

Detailed analysis that’s highly appreciated by our members

Our Services

On this Substack, we’ll provide you with the following information:

educational articles about fundamental analysis and general posts

bi-weekly webinars to address key concepts on fundamental analysis, shareholder value creation, M&A et cetera

quarterly letters on our portfolio strategy, holdings, performance

deep dives, follow-ups, earnings analyses and real-life stock portfolio

weekly news digest

reports on 10 diverse serial acquirers

Bonus: a private Discord where you can exchange views with other like-minded quality growth investors.

We treat our members as our Partners.

As the Linde management said in 2023: “Our job of management is not to predict what will happen, but instead, execute in a volatile world and deliver on our commitments.” That’s what you can expect from our substack as well: focused and objective research, and a transparently shared portfolio for the quality growth investor.

Keen on learning more about our thorough research process and portfolio of quality compounders? Then consider becoming a premium member! Annual members can access our Discord!

Testimonials

KISS and Concentrated

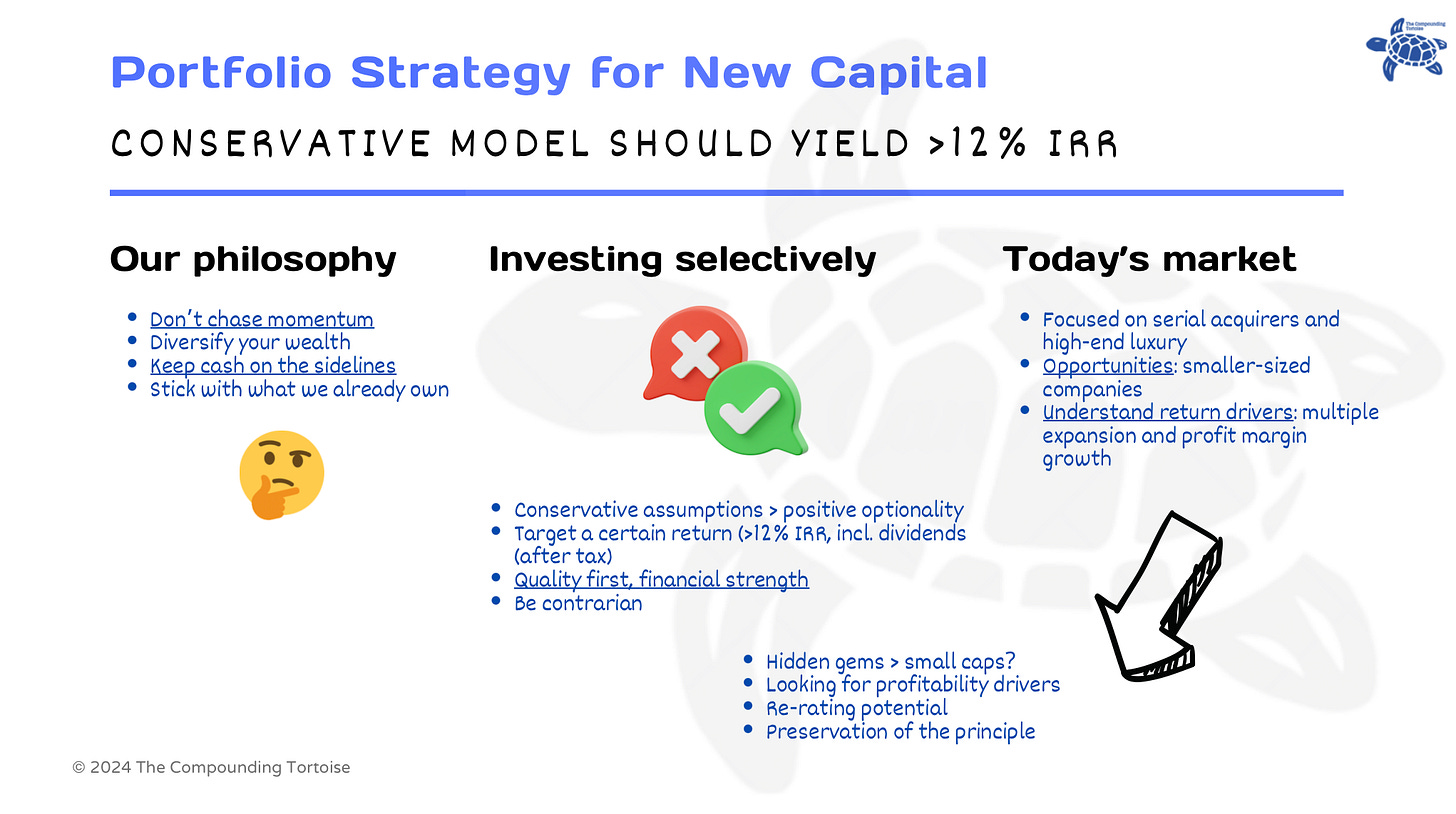

We’re fond of the KISS strategy: a selective set of parameters to determine whether a company is 1) capable of compounding total shareholder capital at a decent clip, whilst earning a high return on that capital and 2) whether or not it’s already priced in from a long-term perspective.

However, KISS does not mean superficial and fast decision-making. Our stock investment portfolio is concentrated on our highest-conviction ideas. It typically takes several weeks or even months before our rigorous research process on a potential new name is complete.

Before we got involved in private M&A-dealmaking, our stock watchlist and portfolio consisted of 30+ names. And for us, it was impractical to follow up on each of the screened stocks in great detail.

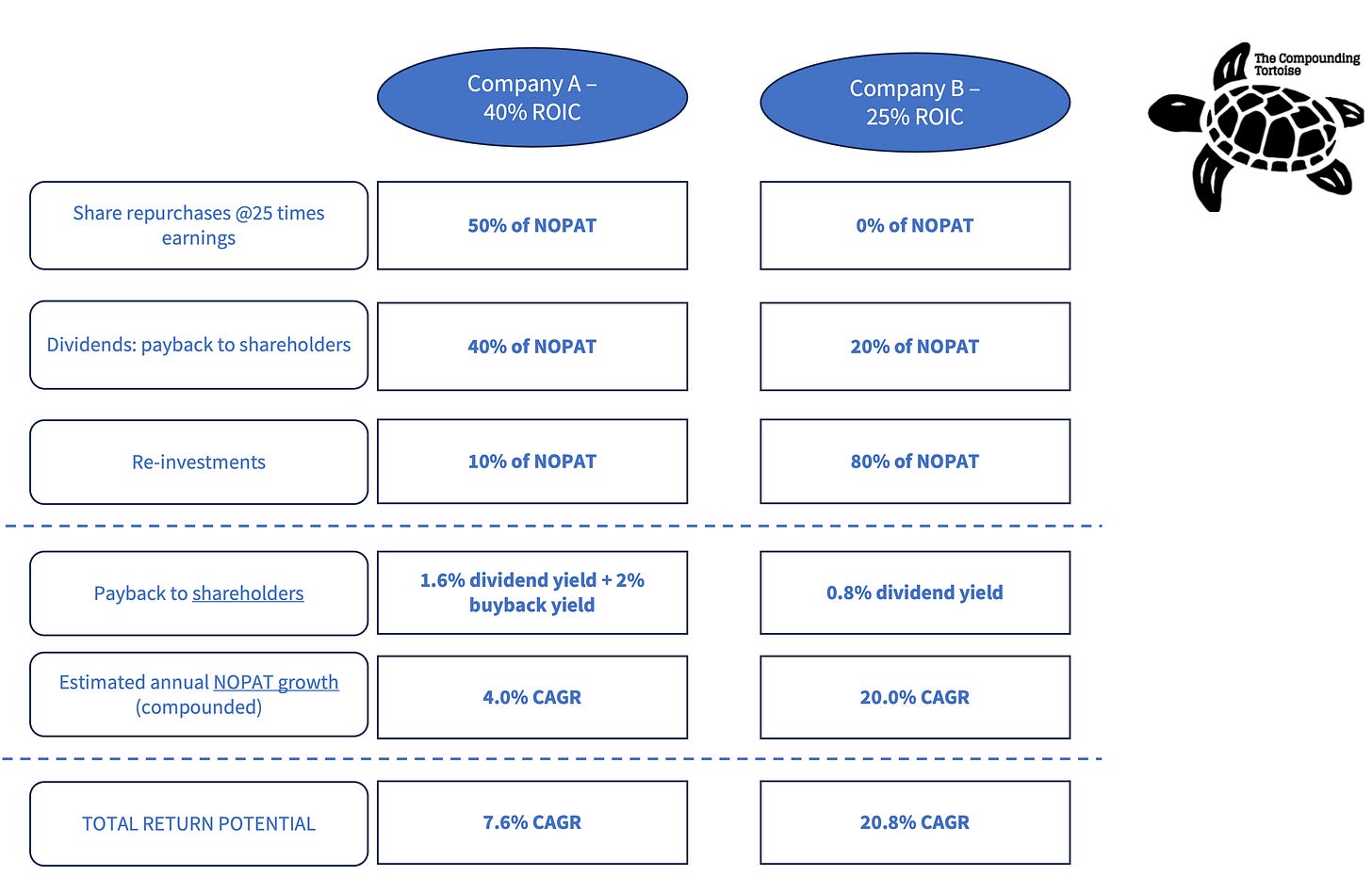

Past vs. Future Capital Allocation

While most quality investors will simply stick to the compounders that have already proven themselves, it’s more important to break down the company’s future capital allocation strategy. So it can happen that the highest ROIC company is not the best option, when a lower-ROIC alternative is able to reinvest more at still elevated returns. This is shown in the comparative tables below.

Stated differently, quality-investing and finding our lovely tortoise compounders is all about thinking about the capital allocation strategy of an already proven high-quality business model.

After that, it’s calculating a company’s terminal cash stream (adjusted for leasing and share-based compensation), applying a multiple to that figure and calculating the present IRR. The shorter your investment horizon, the less attractive quality stocks will be and the higher the perceived risk of multiple contraction.