Coffee Can

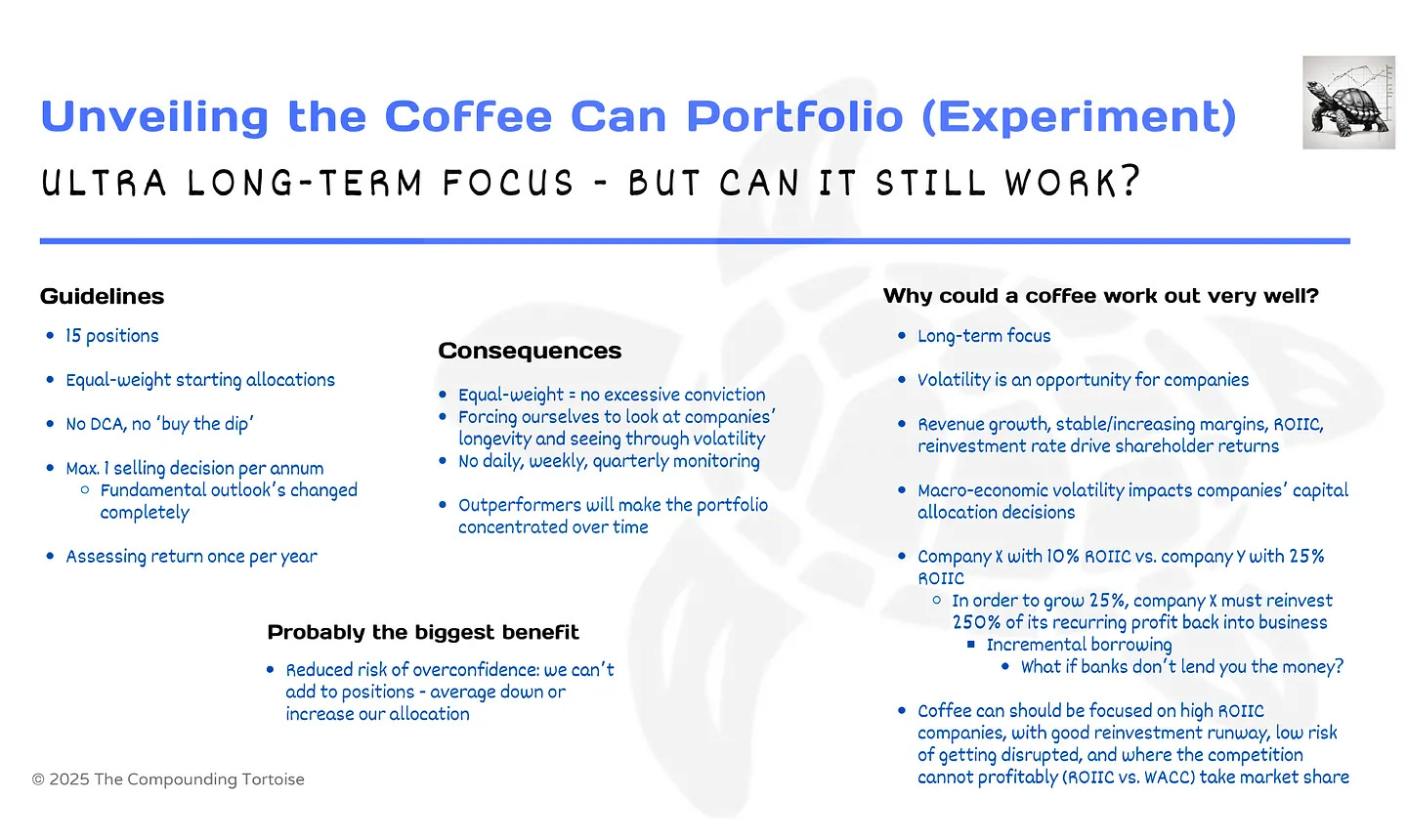

It's a question we receive often: If you were to invest a lump sum in stocks for the long run right now, what would they be? This hypothetical scenario differs significantly from our usual strategy of incrementally adding capital to our portfolio during periods of broad market fear or through periodic purchases.

To address this intriguing question, we've launched a new experiment - not a real-money portfolio - we call the "Coffee Can" portfolio. This portfolio consists of 15 stocks, each with an equal-weight starting allocation. The core tenets of this approach are no rebalancing or trimming, allowing winners to run and the power of compounding to take full effect. The only exception to this rule is one potential selling decision per year, based solely on fundamentally disappointing performance.

The portfolio can be found below. A very simple table with the positions, the purchase price, and the total return excluding dividends (many of these companies reinvest a significant portion of their generated free cash back into the business).