🔎 Everything You Need to Know About Valuation vs. ROIIC and Durability

Why and when paying up for quality makes sense: one of our favorite companies

This blog has been on our minds for a while now, especially as more and more questions from premium members are keep coming in.

We’ll illustrate the valuation concept with one of our favorite companies.

This article is freely accessible to everyone. We’d be grateful if you could share it with your network!

Why and when does it make sense to pay up for quality, knowing that the impact from getting valuation wrong diminishes over time?

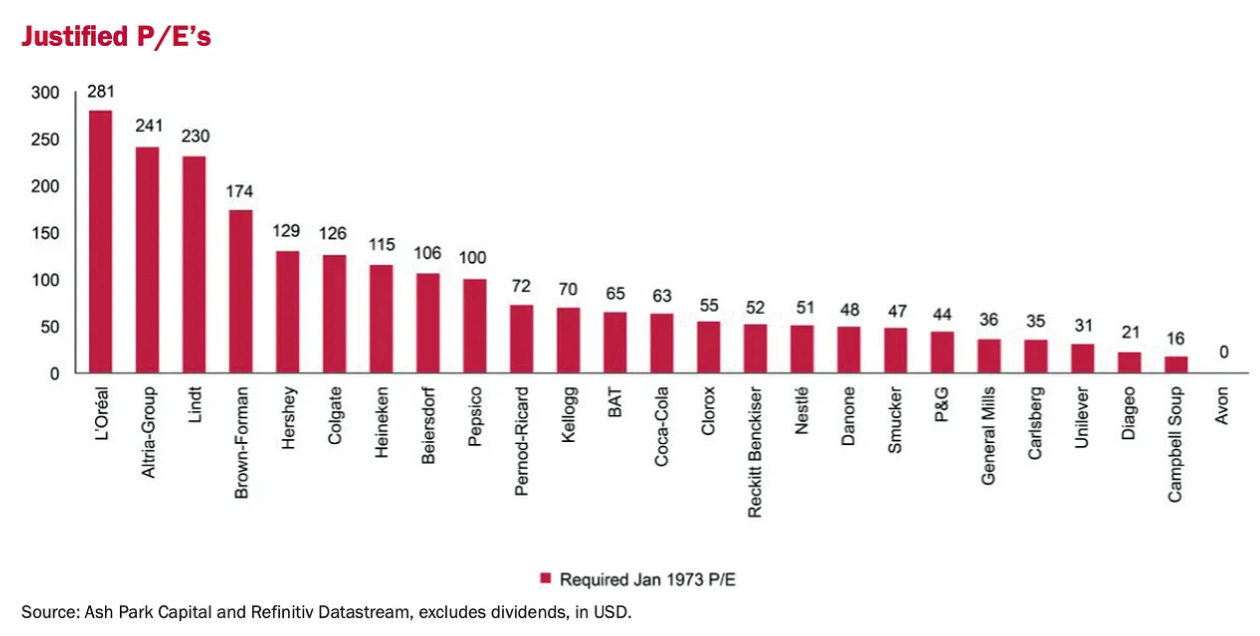

What this question refers to is that this graph in relation to Fundsmith’s do-nothing strategy demonstrates the power of compounding.

Nothing’s Constant

The issue around valuation and the above illustrated cherrypicking is six-fold:

In hindsight, you should have willingly paid up for this great company, and ultimately beaten the index. How could you know?

Present is the time of maximum uncertainty. The past is the past, and the competitive and operating environment to generate strong incremental returns on incremental investments is dynamic. Growth is essential to earning attractive stock market returns.

A company’s size evolves over time, impacting the reinvestment runway. L’Oréal in 1973 isn’t comparable to today.

ROIIC and reinvestment rate drive investor expectations, and ultimately total shareholder returns.

Stock-picking to beat the index is tough. Bessembinder's 2019 study expanded this analysis to 42 countries over the period from 1990 to 2018, revealing that global returns were even more concentrated. The best-performing 811 firms (1.33% of the total) accounted for all net global wealth creation. The extraordinary returns from a small number of high-growth businesses result in the market's return distribution being positively skewed, rather than following a normal bell curve. These extraordinary winners with high returns drive most stock market gains over the long term. For a long-term buy-and-hold investor to achieve excess returns, they must successfully identify and heavily weight future structural growth companies in their portfolio.

Past compounding isn’t indicative of future performance. Companies can grow too quickly with several hiccups and thus subsequently higher volatility in their share prices. High growth rates are like a honey jar: they attract competition, tend to lead to reduced returns for all parties looking to get a bigger piece of the pie. Plus, there’s plenty of empirical evidence that fast growers (or at least, investors expect them to meaningfully accelerate top line growth, i.e. the expectations treadmill) are prone to severe overvaluation. It’s not just about timing a reversal in sky-high growth rates but also factoring in the potentially devastating impact from substantial multiple contraction. Research conducted by McKinsey demonstrates why boring wins the race.

The sixth reason is precisely why we’ve published our series on “Sustainable Quality Compounding”.

The Big Picture

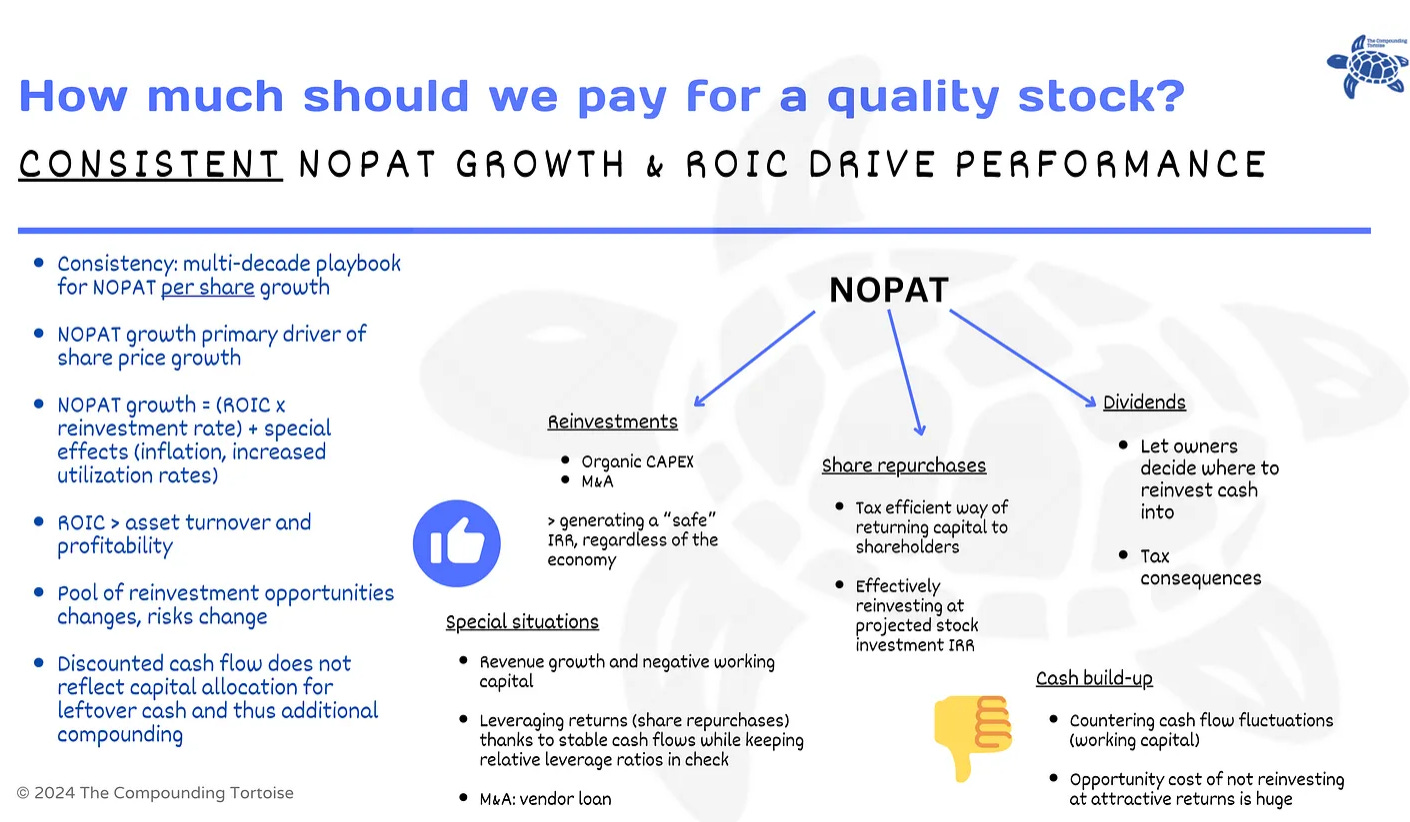

Earlier, we shared this “Big Picture” slide on what we’re looking for. It’s a straightforward framework around consistent NOPAT growth being driven ROIIC/ROIC, reinvestment rate, and cyclicality. As investors focused on sustained quality compounding, we simply can’t afford to own businesses that stand still for long periods.

The Compounding Tortoise

In our previous blogs, we’ve touched on the concept of not all earnings growth being created equal. Returns on incremental invested capital should exceed a minimum target. Even then, ROIIC cannot be measured in isolation: cyclicality, competition, disruption… all these external factors impact growth and how investors will model that growth.

While we prefer high ROIICs, they also imply that the capital outlay required to grow the business by X percent isn’t significant, which could then also invite competition. Rather than saying: look for high-ROIC companies and you’ll be fine, we argue that there’s a lot of hidden value in picking those that have a strong ROIC and ROIIC and whose competition does not. “Moaty” sectors are not necessarily the best places to look for steady outperformance throughout the whole cycle (just look at tech in the 2022 bear market despite generally favorable margin characteristics, capital-light business models and growth prospects).

What we do believe and have seen work over and over again (private and public markets): it’s far easier to understand terminal value risk for companies that are earning high long-lasting incremental returns in tangible industries with low risk of disruption (good luck trying to replicate Linde’s industrial gases network).

Additionally, there’s room for returns to come down and still create a lot of shareholder value. It’s necessary to think about and value this level of margin of safety. High ROIIC companies that pursue growth will end up with a huge steady-state cash flow. As a result, the potential for large payouts (although we don’t invest for dividend income) becomes a compounding by-product.

One of the smaller private companies we’ve been tracking for a long time here in Belgium managed to grow its NOPAT from 650k EUR to 2 million EUR over the past 10 years, or a 12% CAGR. By itself, that 12% CAGR doesn’t tell much. Maybe, the company took on lots of debt, did many acquisitions. All growth was organic and the company earned a 65% ROIIC over that time… The owners were able to grow their business while paying out substantial and attractively growing dividends, on top of very generous management fees/salaries.

To increase the odds of owning truly great businesses, investors should focus on creating a limited investment universe by eliminating companies with dubious financials, products, management, or competitive advantages. This idea aligns with Charlie Munger’s "invert" principle, which suggests that solving complex problems starts by reversing your thinking process. Investors should focus on eliminating poor investments to optimize their investable universe.

This is precisely what we’ve outlined in the below article.

Seizing the Total Reinvestment Opportunity

Whether it’s about Harvia (see below) or Constellation Software, investing is ultimately about weighing opportunities that deliver a solid return relative to the uncertainty and risk around that their payoff. It’s not about maxing out ROIIC or IRR, it’s about redeploying as much capital as possible at rates of return that exceed a fairly ambitious hurdle rate.

As our companies’ cash flows and earnings have grown substantially, we’re becoming increasingly vigilant, maybe even a bit paranoid, about the day when reinvestment opportunities fail to generate the same level of annualized growth. While the VMS market is enormous, it’s not only about size; it’s about the pace at which CSI can execute on its M&A playbook.

Weighing Alternatives

This economic law isn’t unique to CSI it holds true for every company in our portfolio and the growth expectations priced in by the market. Therefore, as companies get bigger, they’ll become inherently more cyclical as the impact from timing new growth investments increases.

As growth becomes more cyclical or starts to slow down, and as more alternatives emerge that offer better growth, higher ROIIC, and superior excess cash management, investors will need to adapt to this new reality. This shift in expectations is then likely to be reflected in increased share price volatility and multiple contraction.

Steady Compounding

Therefore, our view on sustainable quality compounding and the degree to which we’re willing to pay up for a business relies on:

steady and structurally attractive ROIICs;

management team that understands the key pillars of sustainable quality compounding;

low risk of capital expenditures or other investments (reflected in the P&L) being wasted or yielding poor IRRs;

proactive excess cash management;

>10% annual growth in NOPAT per share throughout the whole cycle;

excellent balance sheets;

a stock price that allows for relatively steady compounding and/or frequent opportunities to get in at attractive forward returns.

On the last point: investors should aim to buy as much as they can when the projected returns are appealing. If we don’t have many occasions to do so, compounding our own capital becomes much more challenging.

Harvia - a Terrific Business Worth Paying Up For

To wrap up this discussion, we’d like to share our thoughts on Harvia and the question from one of our premium members:

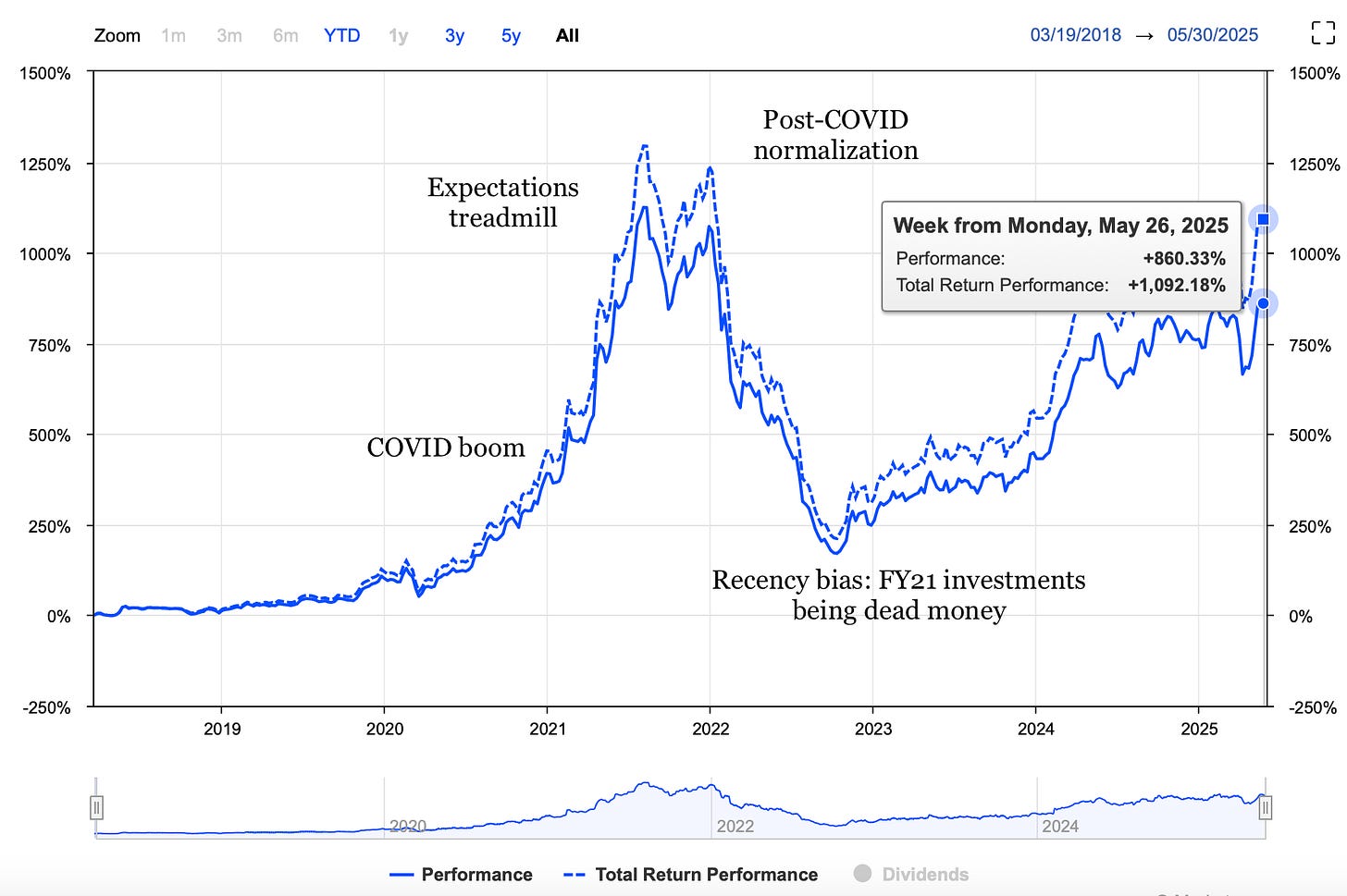

Why has the stock returned >40% annually since its IPO (excluding dividends)?

Looking at some key metrics, we note that free cash flow has grown from 7.4m EUR in FY18 to 22.7m EUR in FY24. The company has recently started to make some targeted capacity investments. Steady-state NOPAT has roughly quadrupled since.

To be fair, it hasn’t been an easy ride since late 2021 (i.e., expectations treadmill)… Let’s take a closer look.

MarketScreener

The “expectations treadmill” principle shows that a company’s share price is driven more by shifts in market expectations than by its actual performance, such as growth and returns on invested capital. Investors looking at the past years’ share price performance, the rolling ROIC, while ignoring changes in incremental returns and/or competitive landscape.

As expectations rise, the company must achieve increasingly better results just to maintain its position. While this doesn’t matter much in the long run, in the short term, especially if you’re managing others' money or can't stay invested for years, it can harm performance. Even the best, most prudently managed compounders can fall prey to irrational exuberance. This happened to Home Depot and Automatic Data Processing in the late 90s, when the market overestimated their future growth, despite these businesses being more like steady Tortoises than sprinting Hares. Their executives knew it was impossible to meet market expectations, but there was little they could do.

As such, we must be careful not to become euphoric about our companies’ prior outperformance or be swept up in others’ optimism. The future is uncertain, so it’s as important as ever to stay focused on what truly matters: ROIICs, reinvestment rates, longevity, and the opportunities and risks within each business segment and geography.

For Harvia, the impressive growth rates were fueled by the pandemic-era sauna boom. However, these levels of growth were unsustainable, despite initial optimism, as the company had reinvested a significant amount of cash into expanding capacity (see below).

When the 2022 inflation crisis, post-COVID normalization, and the war in Ukraine weighed on consumer discretionary stocks, investors grew skeptical about the appeal of Harvia’s incremental returns and the unfortunate timing of its recent capital expenditures. It’s true that most consumer discretionary stocks are still down more than 40% from their COVID-era highs.

Today, the stock’s rerated to higher valuations, leading to the follow-up question: does this rerating make sense?

Navigating the Post-COVID Backdrop

Compounding starts with preserving shareholder capital. A concise overview of Harvia’s recent performance, aimed at illustrating its nimble execution.

Cyclicality & normalization: Harvia’s sauna boom during COVID-19 has cooled off, and the company also lost its Russian business after the Ukraine invasion. We’ve now lapped these tough comps.

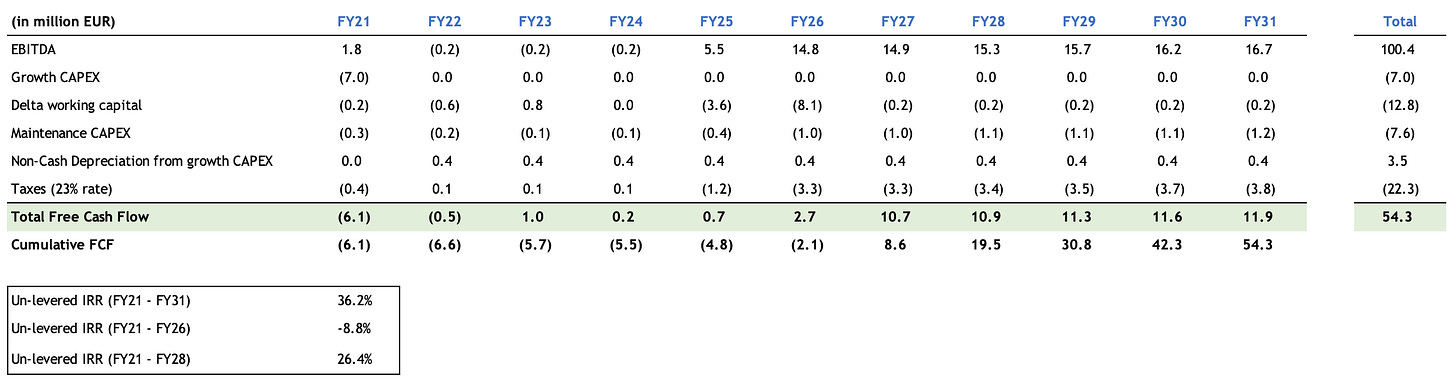

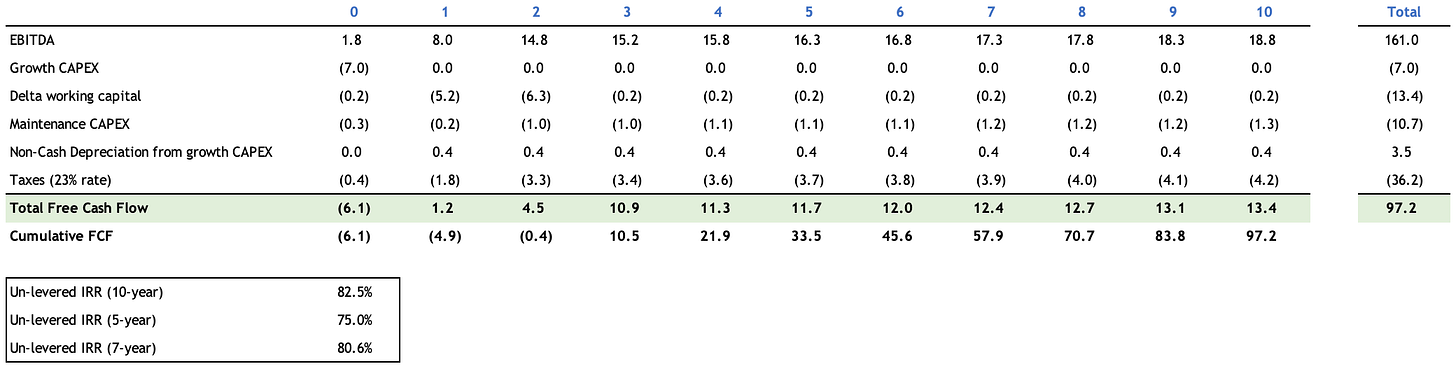

FY21 growth investments: The 2021 investments expanded capacity by ~25%, but sales didn’t recover to 2021 levels until late 2025. The IRR of these investments is expected to be negative until 2025, turning positive only after structural growth resumed.

IRR Model - The Compounding Tortoise

From the above, we can conclude three things:

IRR & ROIC: Despite a 4-year period of underutilized (frankly, not utilized) capacity, the 10-year un-levered cash IRR for the 2021 investments should eventually be 36%. It’s crucial to consider IRR, not just ROIC, for understanding the true payoff of investments. Harvia can quickly generate high IRRs, and the FY21 growth CAPEX ex. US represented 14% of its FY21 EBITDA. As such, cash flow risk by reinvesting for growth is low (they don’t have to take on external funding). Even if Harvia’s investments don’t yield their maximum output, the IRR is still attractive.

Pricing power: Harvia maintained strong margins despite macro pressures, supporting the thesis of sustained quality compounding.

Reinvestment runway: With a market share potential of 10% over the next 7-9 years and strong free cash flows, Harvia can keep reinvesting at high organic IRRs (>50-80%) to fuel future growth, underscoring why temporarily cyclical headwinds aren’t likely to derail the company’s shareholder value compounding.

The Compounding Tortoise

While it’s difficult to reconcile IRRs for all our companies’ growth investments, it does shed light on why a premium valuation isn’t so premium after all. Excellent companies simply find ways to surprise us positively, even if the macro outlook is uncertain/dynamic. Harvia’s growth outlook is now more easily attainable, thanks to growing exposure to fast-growing and immature sauna markets.

Combined with high returns on incremental invested capital (also relative to competitors), ongoing market share gains, new product launches, the explicit commitment to reinvesting back into business should support Harvia’s valuation.

It’s one of very few companies we've come across that’s able to pull out this kind of staggering organic IRRs, even when accounting for the poor timing of its FY21 growth investments.

Bringing it full circle to the graph we first shared: if you’d paid close to 50x NOPAT in FY18 for Harvia, you’d still have earned a 10% annualized return (excluding dividends). To put that into context, that’s 4x its actual forward FY19 NOPAT valuation at the time.

We’re not suggesting you should pay just any price, of course. But this does highlight how high ROIICs, high investment IRRs, and structural growth in your end market works wonders for shareholder returns. So, when there aren’t many alternatives with equally excellent recurring growth and longevity available, it could make sense to pay up for quality companies with sustainable growth tailwinds and high ROIICs.

For additional insights on Harvia, check out our library of earnings recaps and the in-depth September 2024 report. These resources will help you better understand this high-quality compounder.

Thanks! Interesting post!