How We Implement the Dollar-Cost Averaging Strategy

Quality first, valuation, VIX, market breadth, and personal risk tolerance

Introduction

It’s been a topic on our Discord lately: when to buy more of great quality growth companies, can you give us a sense of where valuation stand today? Very topical questions we’re getting from our growing premium member community.

Dollar-cost averaging, i.e. buying more shares along the way, enables us to benefit from investors’ overreaction to bad (macroeconomic) news. But it’s highly subjective: when is a good time to buy? How do you balance “time the market” versus “time in the market”? Do you take profits?

Let’s present five concise pillars that we stick to and provide more context around their nuances:

Quality first - rock-solid companies that preserve shareholder capital

Valuation - stick to the script + research on CAPE ratio (cyclically-adjusted price earnings)

VIX - fear and greed as a guide

Market breadth - nuancing seemingly low volatility

Common-sense principles based on personal risk tolerance and temperament- cash level and buying discipline

1/ Quality first

As should be well-known by now, our strategy is built around quality growth companies. Steady compounders whose business model is easy to grasp. Some articles to help you better understand our philosophy:

In January of this year, we stated:

Talking about the fundamental profile of a “Compounding Tortoise”, it boils down to a company:

being transparant with its owners, as evidenced by a management team’s integrity and skin in the game;

posting positive organic growth;

investing in assets that generate secured cash flows (implies a high degree of economic resilience with little disruption risk);

looking for stable growth rates, based on a sustained return on capital;

having a large pool of potential investments, whether it be organic or acquisitive;

having a strong balance sheet to weather any economic downturn. You don’t want to see a declining ROIC being made up for by borrowing for future investments;

distributing all leftover cash to shareholders;

and lastly, with no dilution of existing shareholders through excessive share-based compensation. Share-based compensation is a very handy approach to artificially growing your cash flow from operations (and free cash flow, by its theoretical definition). SBC-adjusted earnings are a perfect indication of a shortsighted management team trying to persuade the market of its (“adjusted”) value creation.

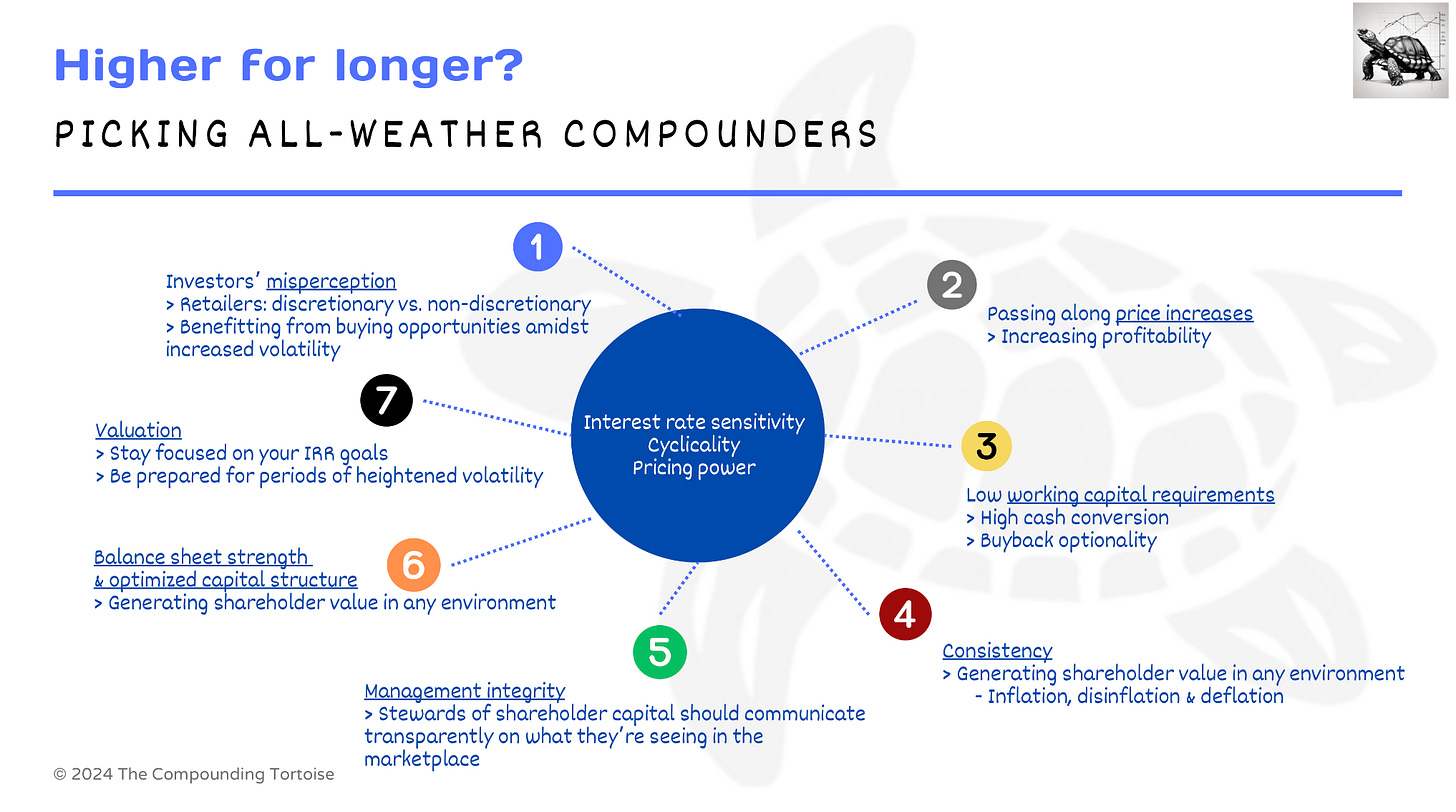

With interest rates higher for longer and/or inflation (wage inflation, and ultimately overall inflation) bottoming out, quality growth investors should become even more selective. Fortunately, there are quality companies that tend to outperform the index when inflation is on the rise.

2/ Valuation

But hey, aren’t quality companies trading at high multiples? It’s a fair question, and remember: valuation should be reflective of ROIIC, reinvestment rate and the ability to deliver uninterrupted compounding. There are stocks whose valuation is completely out of whack to earn a good risk-adjusted forward return, as there always are.

If one or more of our great companies were to see its/their multiple increase quite nicely, the best thing is likely to do nothing and just allocate more capital to other better risk-reward opportunities.

On balance, we believe our companies’ valuations are still in check for meeting our long-term return hurdle, though even better opportunities will present themselves over the next months, quarters, years… The point is that the IRRs on new purchases should make sense. Don’t become over-confident in your modeling: don’t increase your estimates to get to a return that’s worth the risk at first sight. Overstating the potential return and understating the risk of permanent loss of capital is killing.

Paying up for cyclicals or timing reversals in valuation is darn difficult and risky. As such, we don’t hold pure cyclicals, but acknowledge every company has some sort of cyclicality, especially relative cyclicality (growing faster or slower, there’s no such thing as a static growth rate). How much should we pay for an excellent business: it’s a topic we’ve talked about in the below webinar.

Let’s take a high-level view now on stock-market valuations, because money flows and investor sentiment could signify whether or not significant opportunities will show up rather sooner than later. In the end, almost every asset is correlated to what the broader market’s doing. Correlations aren’t static either.

One indicator to elaborate on this is the Shiller PE/CAPE ratio, which is the cyclically-adjusted price earnings ratio.